ICICI Prudential Mutual Fund has announced the launch of a Flexi-cap fund which is an open-ended equity scheme that aims to provide capital appreciation by investing in equity and equity-related securities across market capitalization.

The new fund offer (NFO) will open today i.e on 28 June and close on 12 July.

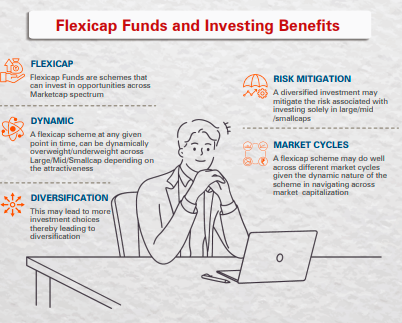

In November, the Securities and Exchange Board of India had launched a flexi-cap category for mutual funds, requiring funds under this category to invest at least 65% of their corpus in equity, but without any restrictions on whether they can invest in large-, mid- or small-cap stocks.

This circular came after the markets regulator in September had introduced new norms for asset allocation rules for multi-cap funds, mandating a minimum 25% allocation each in large-, mid- and small-cap stocks.

Following the changes in rules, most funds moved to the flexi-cap category.

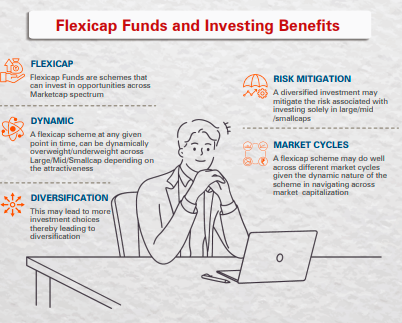

Why Flexicap?

The flexi-cap scheme will invest 65-100% in equity and equity-related instruments of large-cap, mid-cap and small-cap companies; 0-35% in other equity and equity-related instruments; 0-35% in debt instruments, units of debt mutual fund schemes and money market instruments and 0-10% each in preference shares and units issued by real estate investment trusts (Reits) and infrastructure investment trusts (InvITs).

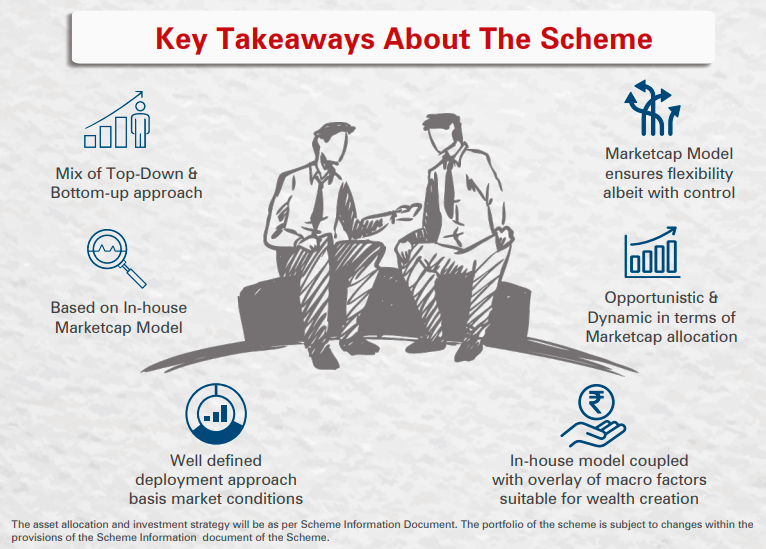

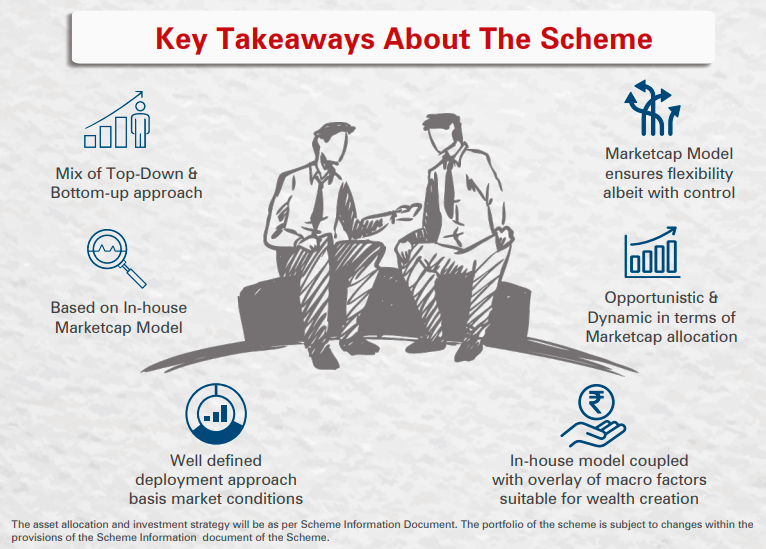

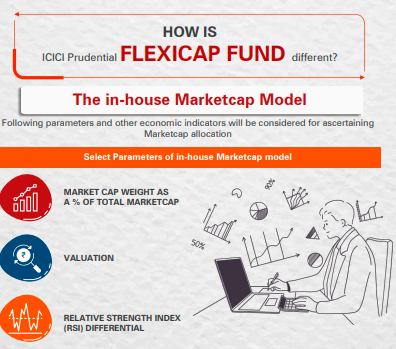

The large, mid, and small-cap allocation will be assessed and re-balanced on a periodic basis, based on an in-house model and in line with the asset allocation of the scheme.

This model comprises parameters such as valuation, Relative Strength Index Differential and market cap weight as a percentage of total market cap.

Conclusion

FlexiCap funds provide an opportunity for investors to invest across market caps and mitigate the risk of concentration. With this philosophy, ICICI Prudential Mutual Fund is launching its Flexicap Fund.

Apply on Paytm Money Now!

Disclaimer – Paytm Money Ltd (SEBI Reg No: INA100009859) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. The New Fund Offer (NFO) is non Exchange traded products and Paytm Money Ltd (PML) is acting as an agent for distributing the same. Please note all disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.