Investing in mutual funds is only one part of the investment process; tracking and analysing portfolio performance is equally important. Many investors invest systematically but may not consistently track asset allocation, fund contribution, or changes in portfolio risk over time. Portfolio analysis helps investors gain clarity on these aspects and supports more informed investment monitoring.

- What Is Portfolio Analysis?

- Advantages of Portfolio Analysis

- Features of Portfolio Analysis on Paytm Money

- Unified Portfolio View Across Mutual Funds

- Portfolio Insights by AMC and Fund Type

- Clear Visibility Into Allocation and Returns

- Asset Allocation Breakdown

- Sector-Wise Exposure Analysis

- Top Holdings Transparency

- Easy Navigation and Clean Interface

- Steps to Analyse Your Mutual Fund Portfolio on the Paytm Money App

- Conclusion

- FAQs

The Paytm Money App simplifies portfolio analysis by presenting investment data through clear dashboards and structured insights. It allows investors to view their mutual fund holdings in one place and assess portfolio composition, performance trends, and diversification more effectively.

Whether you are a beginner or an experienced investor, knowing how to analyse your mutual fund portfolio on the Paytm Money App can improve clarity and confidence in long-term investing decisions. Mutual fund portfolio analysis helps investors review asset allocation, diversification, and performance trends over time.

What Is Portfolio Analysis?

Portfolio analysis is a structured, quantitative method used to evaluate the performance, risk, and structure of an investment portfolio. It examines how different assets work together and whether the portfolio is aligned with its intended financial objectives.

The process involves reviewing performance metrics, analysing risk and risk-adjusted returns, understanding asset positioning, and identifying areas that can be optimised. The objective of portfolio analysis is to assess alignment with stated financial goals and identify areas that may require review or adjustment, based on available data.

Regular portfolio analysis helps investors stay aligned with their goals while adapting to changing market conditions.

(Source: Financial Edge)

Advantages of Portfolio Analysis

- Performance visibility: Offers clear insight into the performance of individual assets, schemes, and fund categories.

- Asset allocation alignment: Helps determine whether the portfolio remains aligned with its intended asset allocation and investment objectives.

- Risk and diversification assessment: Enables identification of relatively stronger and weaker investments while assessing overall portfolio risk and diversification.

- Cost and expense awareness: Highlights cost-related factors such as expense ratios, exit loads, and transaction charges that impact net returns.

- Periodic strategy review: Supports regular review and refinement of investment strategies as financial goals and market conditions evolve.

(Source: HDFC Bank)

Features of Portfolio Analysis on Paytm Money

Unified Portfolio View Across Mutual Funds

One of the key features of portfolio analysis on the Paytm Money App is the consolidated view of all mutual fund investments. Instead of tracking multiple funds separately, investors can see their entire portfolio at a glance.

The dashboard displays:

- Total value of investments

- Allocation percentage across fund houses

- Absolute and percentage returns for each AMC or fund category

This unified view saves time and allows investors to assess overall portfolio health instantly.

Portfolio Insights by AMC and Fund Type

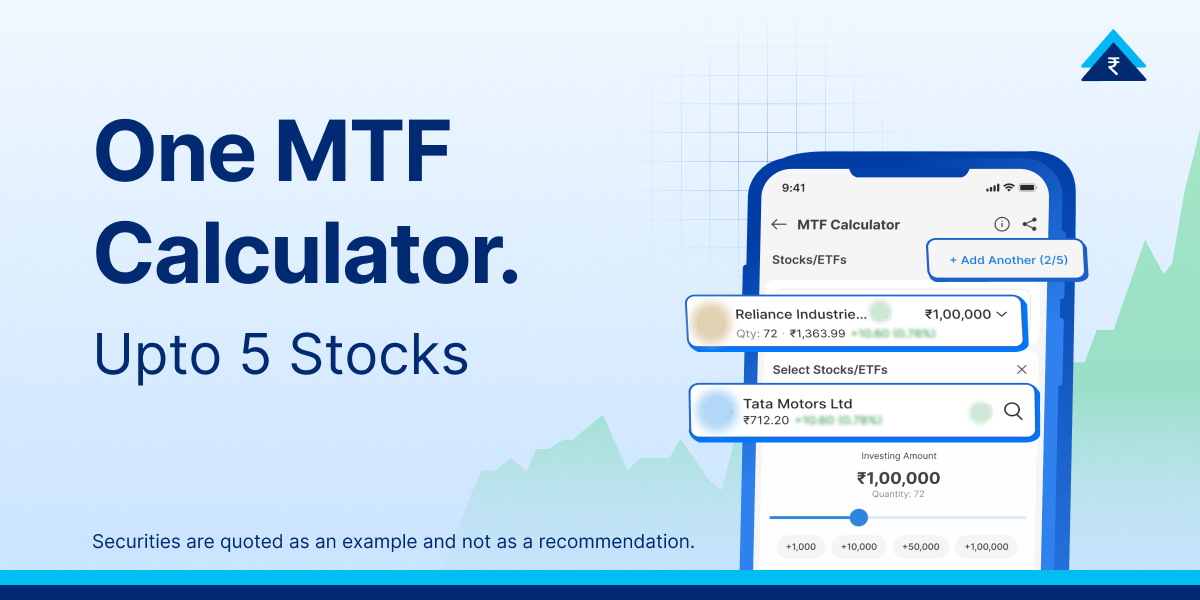

Paytm Money allows portfolio analysis in two structured ways.

- By AMC

- By Fund Type

The AMC view shows how investments are distributed across fund houses such as Tata Mutual Fund, HDFC Mutual Fund, or ICICI Prudential Mutual Fund. It helps identify concentration risk if too much money is invested with a single AMC.

The Fund Type view categorises investments into segments like Tax Saver, Equity, and Hybrid funds. This makes it easier to understand how different fund categories contribute to overall performance.

(Source: Paytm Money App)

Clear Visibility Into Allocation and Returns

Each fund or category displays three critical data points.

- Allocation percentage

- Current value of investment

- Absolute and percentage returns

This transparency allows investors to quickly spot strong performers and underperforming funds. Gains are shown in green, while losses appear in red, making performance evaluation intuitive.

(Note: Returns displayed in the application are indicative, subject to market movements, and may change over time)

(Source: Paytm Money App)

Asset Allocation Breakdown

The Asset Allocation section shows how investments are distributed across major asset classes.

| Asset Class | Purpose |

|---|---|

| Equity | Long-term capital growth |

| Debt | Stability, predictable income, and lower volatility |

| Cash and Cash Equivalents | Liquidity and emergency needs |

| Gold | Hedge against inflation and market uncertainty |

| Real Estate | Long-term capital appreciation and rental income |

| REITs | Regular income and exposure to commercial real estate |

| International Equity | Global diversification and currency hedging |

| Hybrid Assets | Balanced growth with controlled risk |

| Commodities | Protection against inflation and supply shocks |

This breakdown helps investors understand whether their portfolio is balanced or overly tilted towards one asset class. It is especially useful during volatile markets or when financial goals are approaching.

(Source: Paytm Money App)

Sector-Wise Exposure Analysis

Sector allocation offers a clear view of your investments across key industries, including financial services, energy, technology, automobiles, capital goods, healthcare, consumer staples, telecom, metals and mining, and more. Each sector’s percentage allocation is clearly displayed. This helps identify concentration risks and supports informed rebalancing decisions.

(Source: Paytm Money App)

Top Holdings Transparency

The Top Holdings section shows the largest underlying stocks across all mutual fund investments. Major companies such as leading banks or telecom firms are listed along with their contribution percentages.

This feature helps investors understand indirect exposure to individual stocks, even when investments are spread across multiple funds.

(Source: Paytm Money App)

Easy Navigation and Clean Interface

The Paytm Money App is designed for simplicity. Tabs such as Portfolio Insights, Portfolio Allocation, Sectors, Top Holdings, and Asset Allocation are neatly organised. Navigation between sections is smooth, making portfolio analysis accessible even for first-time investors.

Steps to Analyse Your Mutual Fund Portfolio on the Paytm Money App

- Step 1: Open the Paytm Money application and go to the Mutual Funds section.

- Step 2: Tap on the Portfolio tab located among the bottom navigation options.

- Step 3: On the Portfolio screen, click on the Analysis tab positioned at the top, next to the Filter option.

- Step 4: Begin reviewing your portfolio using two views: “By AMC” and “By Fund Type”, to understand how your investments are distributed.

- Step 5: For each fund or category, review the key details displayed, including allocation percentage, current investment value, and absolute and percentage returns.

(Source: Paytm Money App)

Conclusion

Portfolio analysis on the Paytm Money App offers a structured view of mutual fund investments through AMC-wise insights, fund type classification, asset allocation, sector exposure, and holdings visibility.

The feature is designed to support both new and experienced investors by presenting portfolio data in a clear and organised manner. Regular portfolio reviews can help investors stay informed about asset allocation, diversification, and long-term performance trends without reacting to short-term market movements.

Disclaimer: Investment in the securities market is subject to market risks. Read all the related documents carefully before investing. This content is purely for information purpose only and in no way is to be considered as an advice or recommendation. The securities are quoted as an example and not as a recommendation. Investors are requested to do their own due diligence before investing.

SEBI Reg No.: Broking – INZ000240532, Research Analyst – INH000020086, Depository Participant – IN-DP-416-2019, Depository Participant Number: CDSL – 12088800, NSE (90165), BSE (6707), MCX (57525), NCDEX (1315), MSEI (85300).

Registered Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019.

For complete Terms & Conditions and Disclaimers, visit https://www.paytmmoney.com.