Everything you need to manage your trades, investments, and documents—beautifully organised in one place

- 1. Main Account Dashboard: Your Investment Cockpit

- 2. My Account: Manage Your Personal Details

- 3. Manage Investments: Tools That Put You in Charge

- 4. Statements: Downloadable Records for Tax & Review

- 5. Transaction History: Real-Time Tracking, Sorted by Category

- 6. Call Support: Instant Help Without the Wait

- Why the Account Section Matters?

- Start Exploring Now

The Account Section on the Paytm Money app is more than just a place to check your details. It’s the control centre for your entire investing journey. From reports and documents to margin usage and support, everything you need is now grouped together and simplified.

This blog takes you through each part of the Account Section so you can make the most of your experience on Paytm Money.

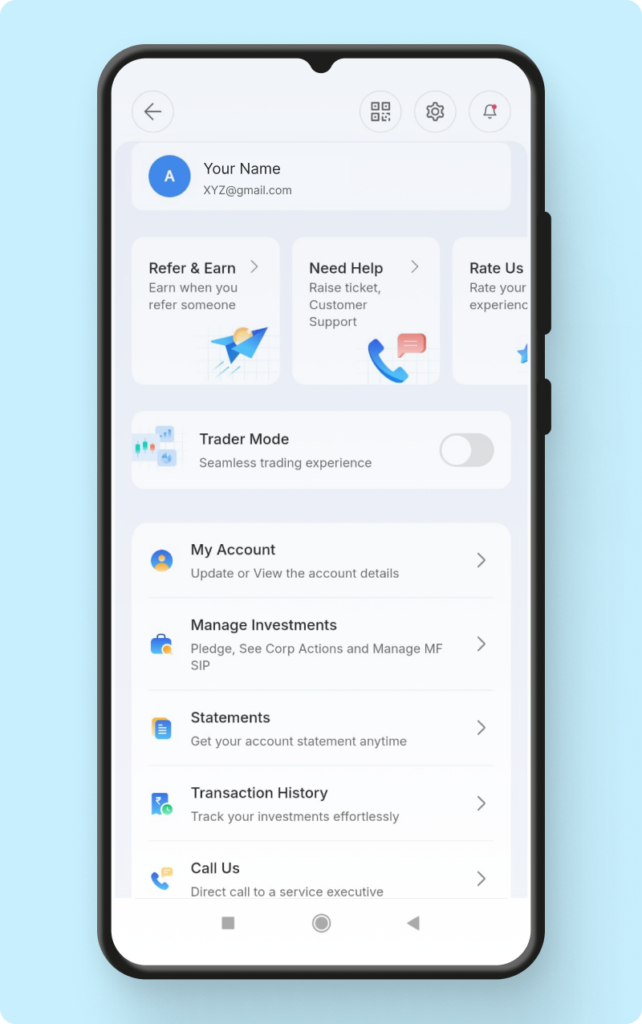

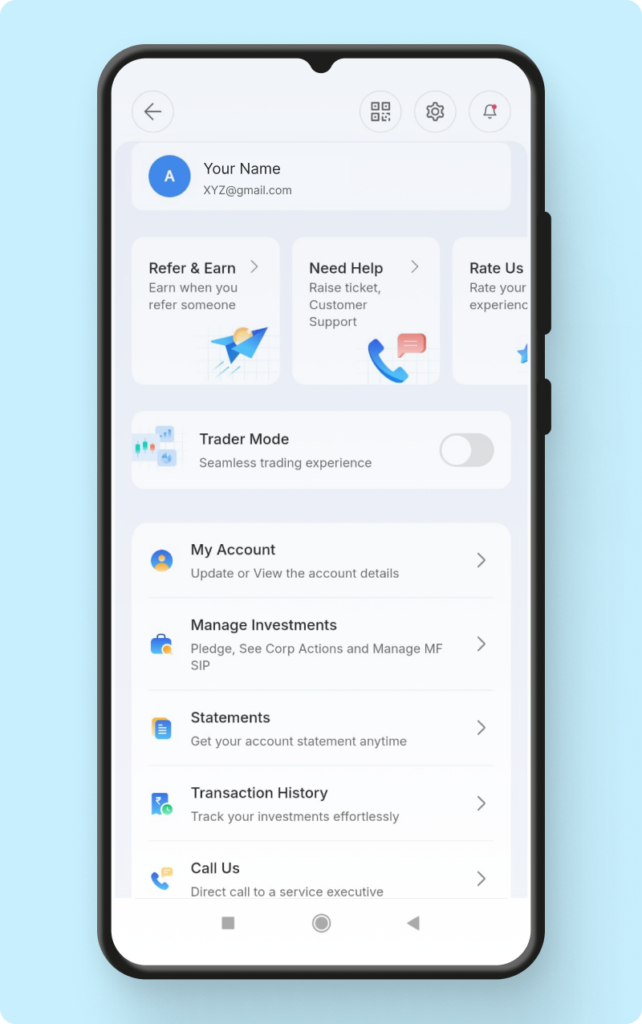

1. Main Account Dashboard: Your Investment Cockpit

When you tap on your profile icon in the app, you land on the Account Dashboard. This is the one place from where you can control your app experience, view key information, and access support.

Here’s what you can do from the dashboard:

- QR Scanner: Log in to Paytm Money on your desktop using the QR code scanner.

- Settings: Switch between dark and light mode, choose notification preferences, or log out.

- Notification Centre: Tap the bell icon to view all app alerts and messages.

- Refer & Earn: Invite friends and earn rewards when they open a Demat account.

- Support Access: Raise support tickets or give feedback quickly.

- Trader Mode Toggle: Get a cleaner, focused interface designed for fast-paced trading.

The dashboard brings all essential functions together for faster decision-making and easier navigation.

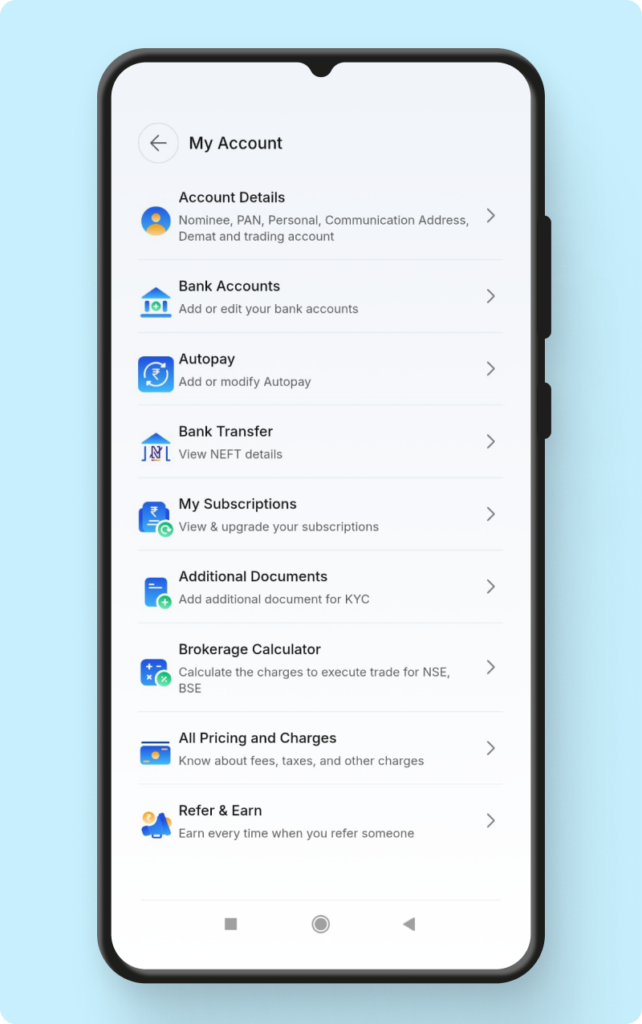

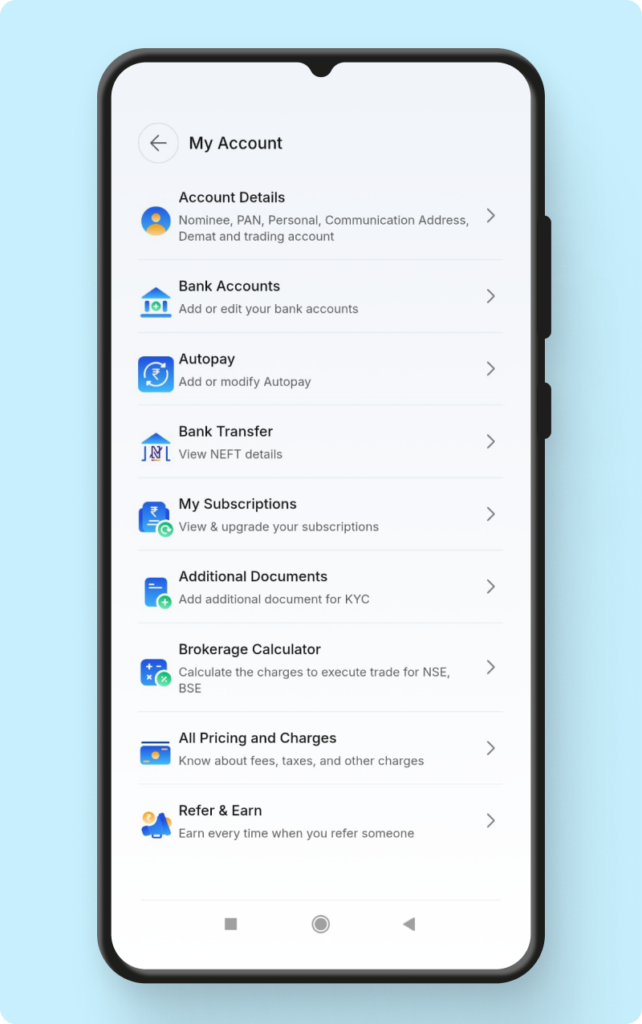

2. My Account: Manage Your Personal Details

This section stores and lets you update all your personal and banking details.

- Account Details: View and update your PAN, nominee, and address.

- Bank Accounts & Autopay: Add or edit bank accounts and enable autopay in a few steps.

- My Subscriptions: Check what plans or products you’re subscribed to, and upgrade if needed.

- Additional Docs: Upload any pending documents for KYC or compliance.

This section also gives you full clarity on charges and calculations:

- Brokerage Calculator: Helps you estimate how much you’ll pay per trade.

- Pricing & Charges: Transparent view of all fees, taxes, and charges.

Everything here is built to give you control and flexibility, without requiring you to contact support or hunt for settings.

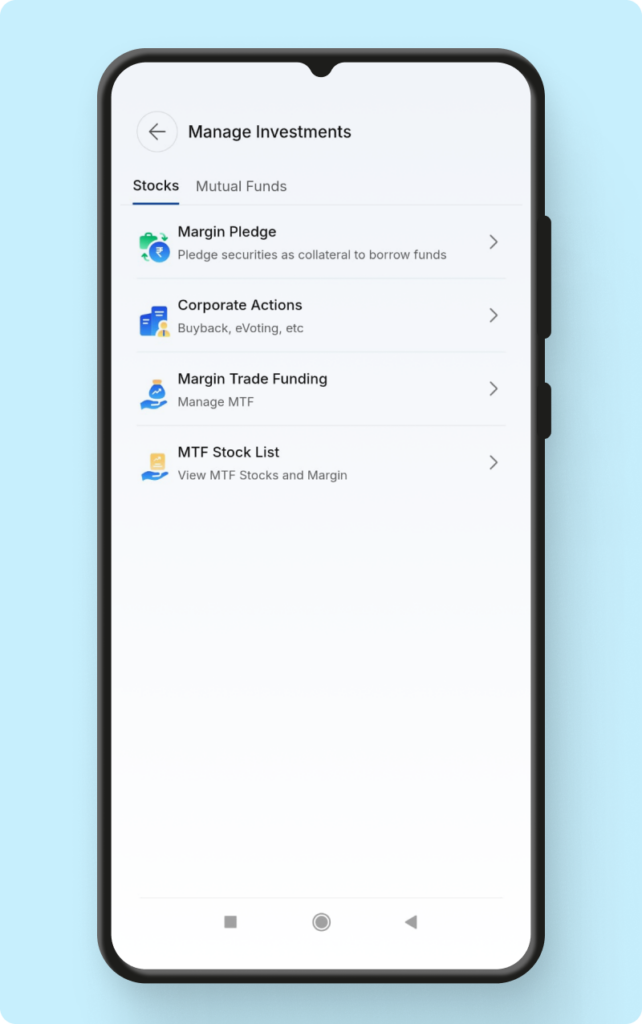

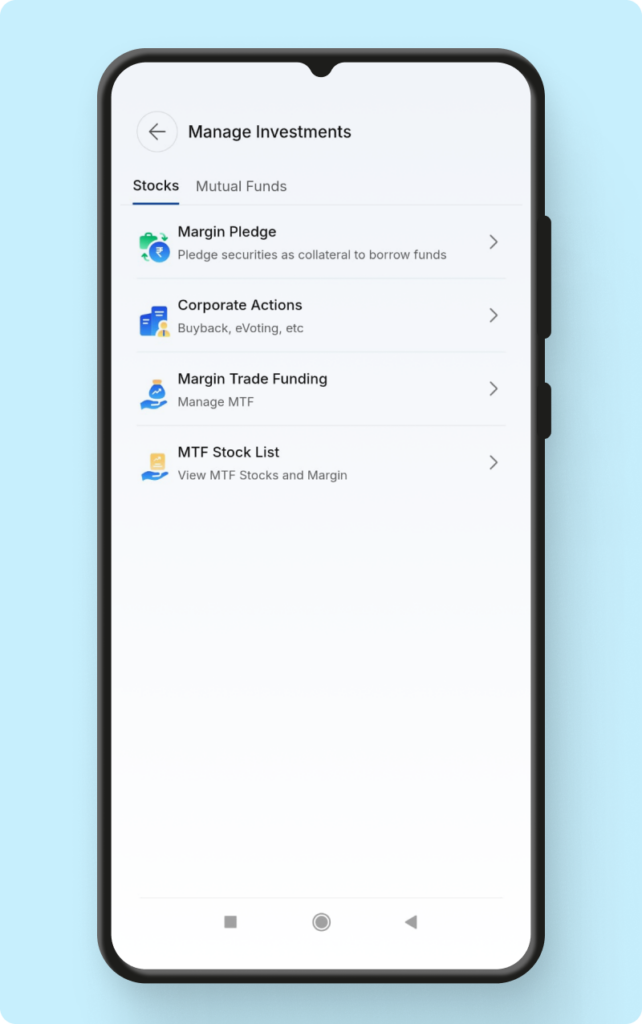

3. Manage Investments: Tools That Put You in Charge

The Manage Investments tab is your go-to place for actions related to stocks and mutual funds. It covers key tools for active investors and long-term planners.

- Margin Pledge: Raise funds by pledging your current stock holdings.

- Corporate Actions: Stay updated with dividends, buybacks, bonus issues, and e-voting.

- MTF (Margin Trade Funding): View your MTF usage, available margin, and limits.

- MTF Stock List: See which stocks are eligible under MTF and track margin availability.

- SIP Schedule: Track and manage your mutual fund SIPs easily.

This section enables you to act quickly and keep your investment plans on track without leaving the app.

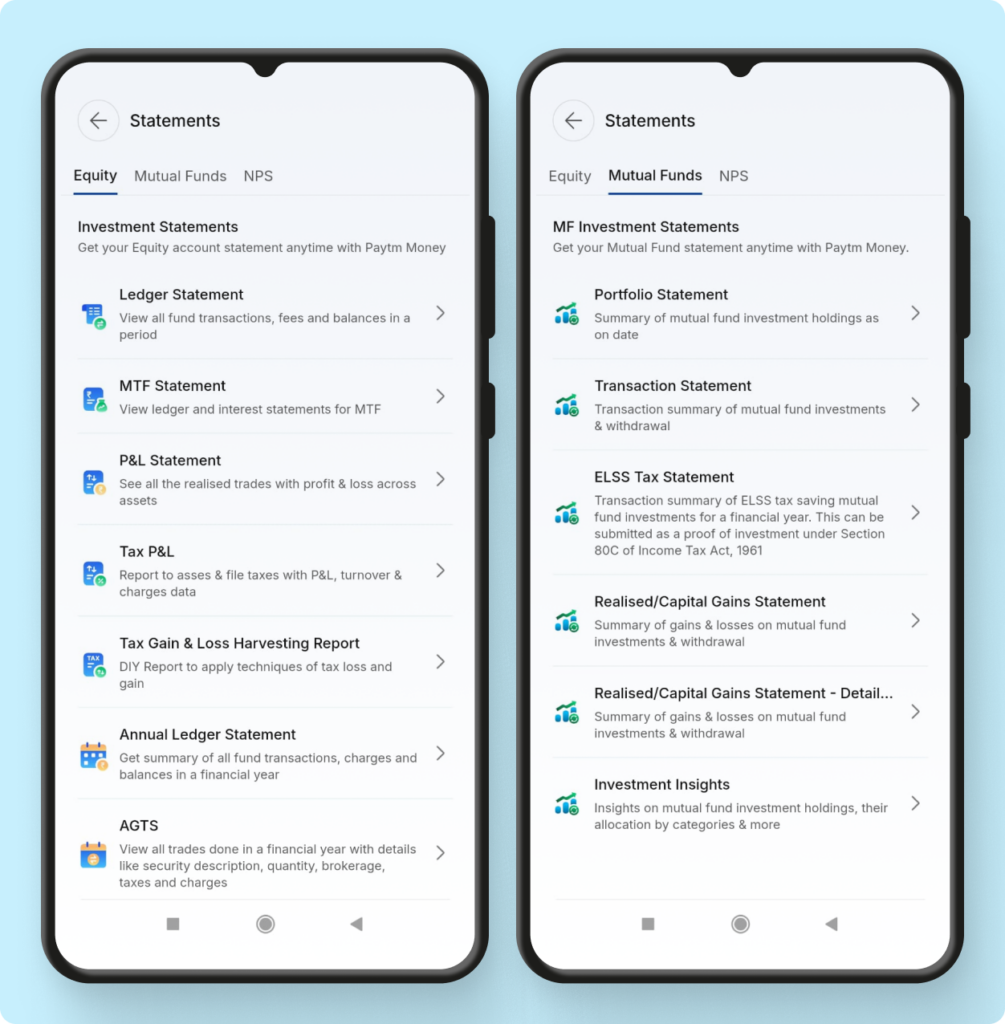

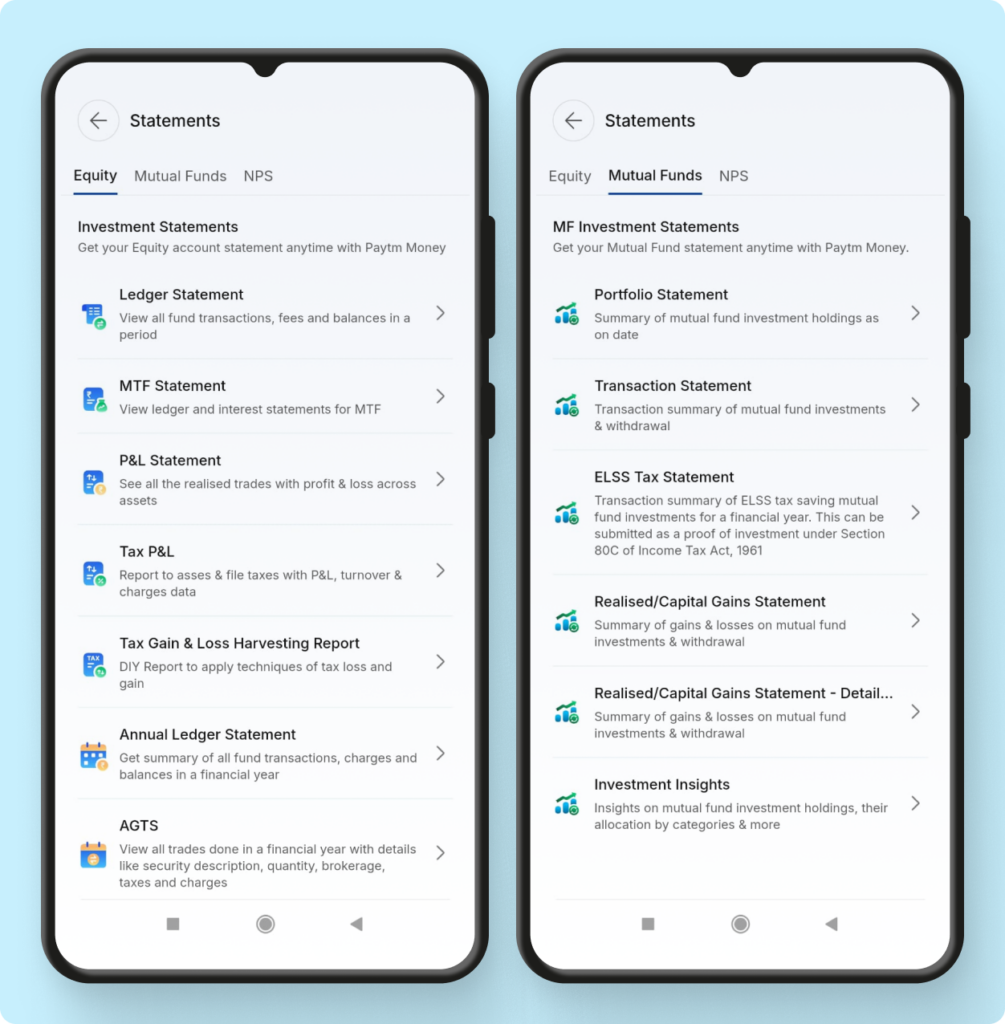

4. Statements: Downloadable Records for Tax & Review

One of the most powerful features of the Account Section is access to comprehensive statements. These reports help with review, planning, and compliance.

Here’s what you can download:

- Ledger Statement: Summary of all fund credits, debits, and balances.

- MTF Statement: Full history of your MTF transactions and interest charged.

- P&L Statement: Realised profits and losses from your trades.

- Tax P&L: Optimised for income tax filing, includes turnover, charges, and gains/losses.

- Tax Harvesting Report: Plan exits to optimise tax impact using historical data.

- Annual Ledger: A year-long summary of your investments.

- AGTS: Detailed trade-wise summary including taxes and transaction charges.

No need for spreadsheets or manual tracking—your reports are now accessible with just a few taps.

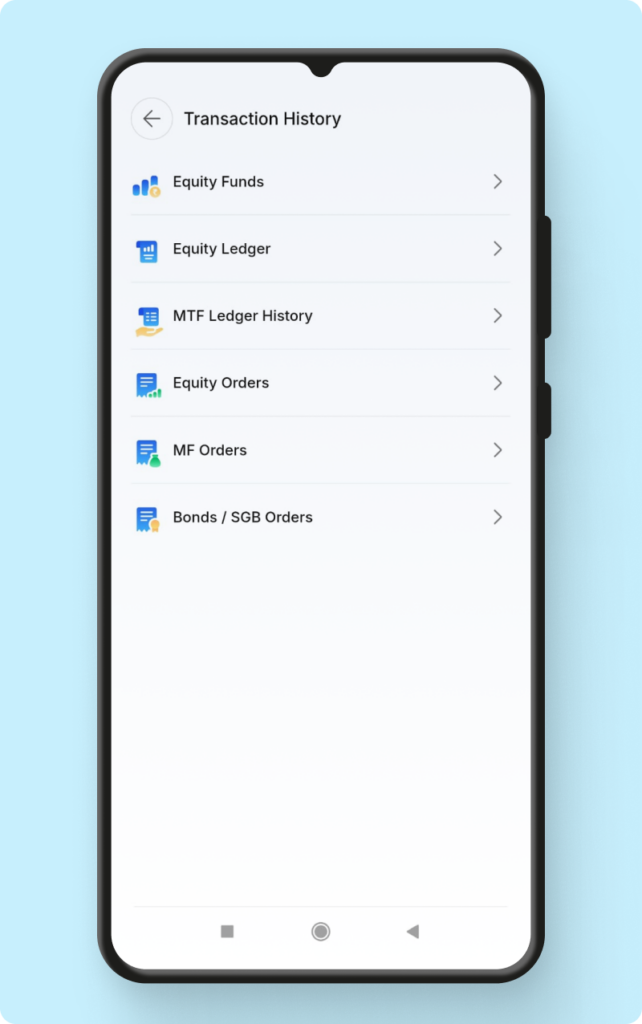

5. Transaction History: Real-Time Tracking, Sorted by Category

This section gives you a timeline of all your investment activity—broken down by segment so you can find the right info faster.

What you’ll find:

- Equity, Mutual Fund & Bond Orders: Track order status and execution.

- Funds Movement: View deposits, withdrawals, and transfers.

- MTF Ledger History: Separate tab to track margin trades and related entries.

Clear labels and filters help you locate transactions without needing to go through multiple menus.

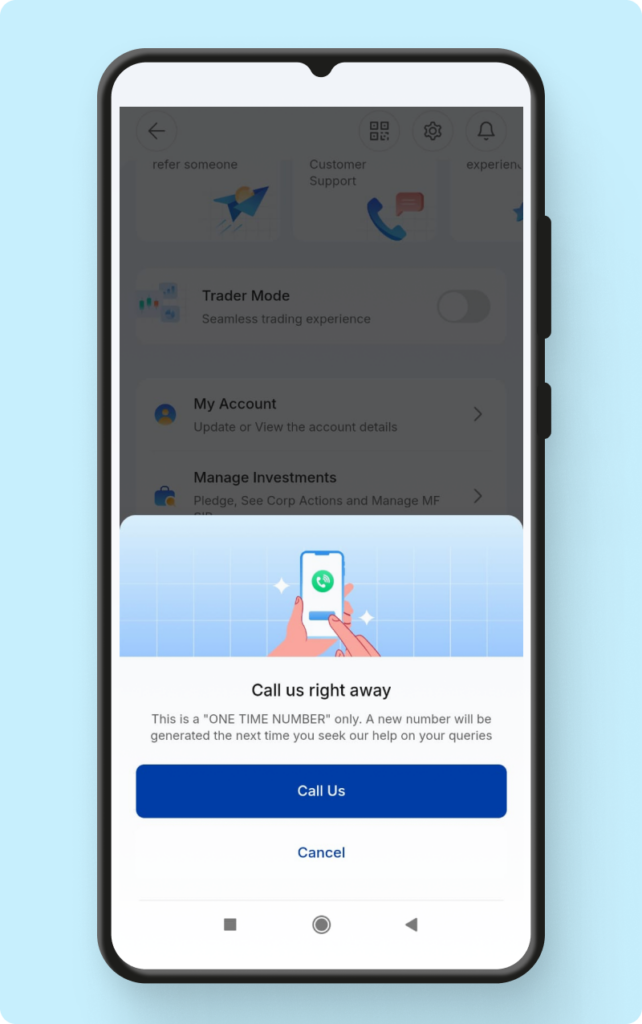

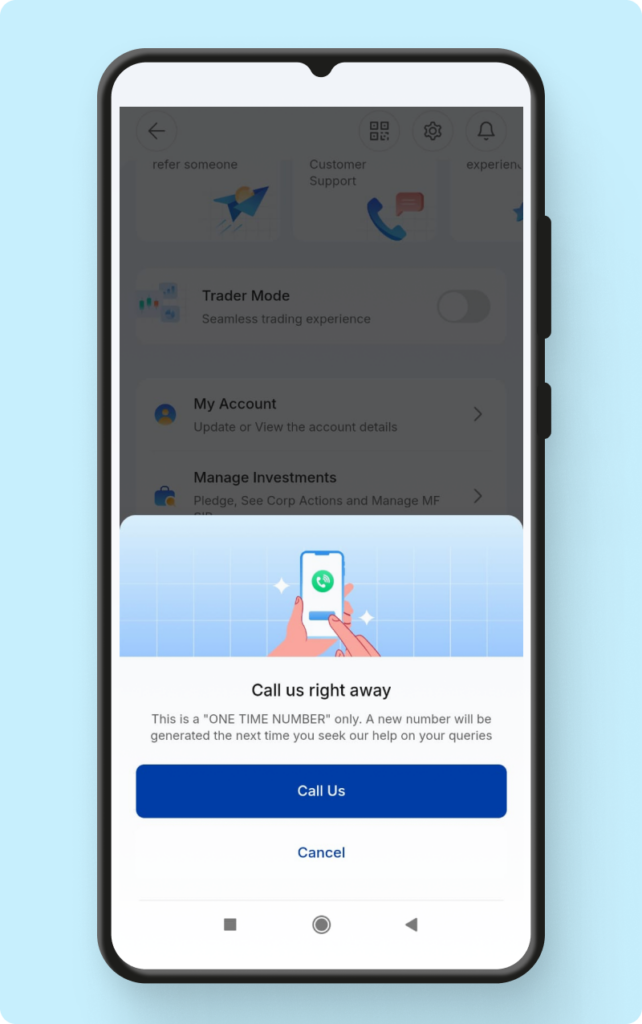

6. Call Support: Instant Help Without the Wait

Support should be easy to access, not hidden behind layers of menus. With the Call Support feature, you can:

- Tap once to get a One-Time Support Number

- Speak to our team without going through long IVR menus

If you’re stuck or need clarity on something, this feature ensures you get answers quickly.

Why the Account Section Matters?

It brings structure to everything you do as an investor. Instead of jumping across tabs or getting lost in reports, the Account Section gives you one powerful destination for:

- Managing your identity, KYC, and bank accounts

- Tracking your orders, SIPs, and margins

- Downloading any report you may need

- Staying in touch with support

- Switching to a trading interface with Trader Mode

It saves time, builds confidence, and offers a more seamless investing experience.

Start Exploring Now

If you’re using Paytm Money, go ahead and tap your profile icon to enter the Account Section. Take a few minutes to explore each tab—you’ll likely discover tools and reports you didn’t know were already available to you.

Disclaimer: Investments in the securities market are subject to market risks. Read all related documents carefully before investing. This blog is for informational purposes only and does not constitute investment advice.