Contents

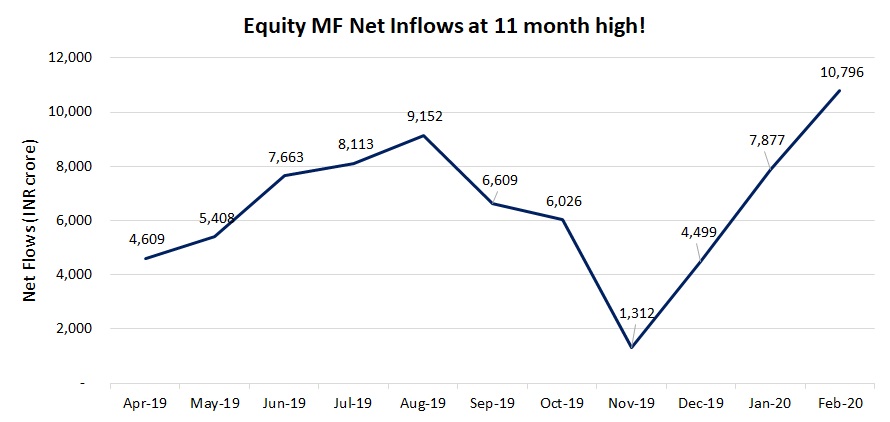

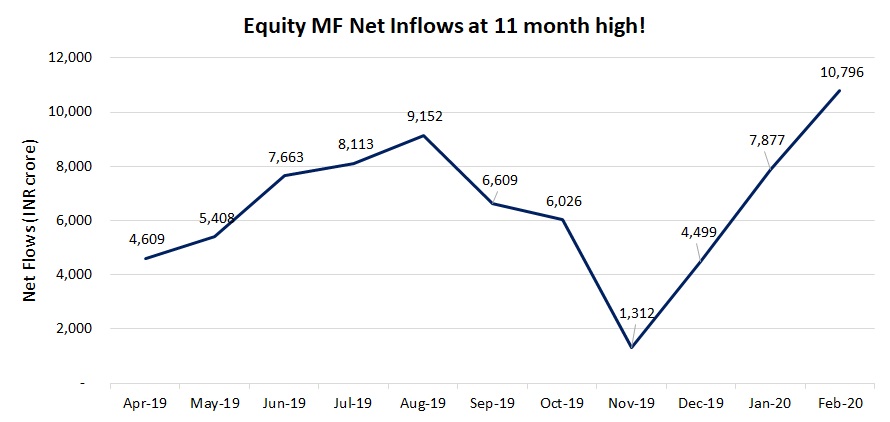

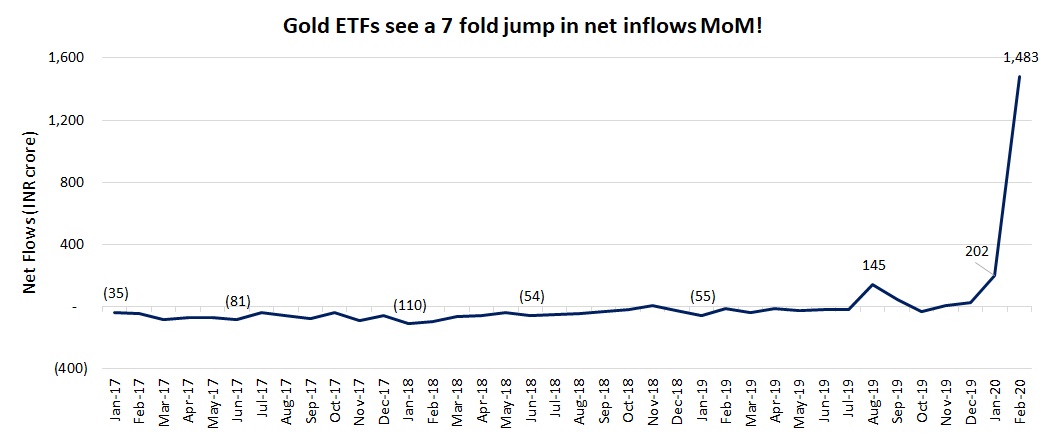

Net inflows into open ended equity category came in at 11-month high (as shown in the graph below) as investors continued to repose their faith in the equity mutual funds. Equity inflows which have been growing for 3 months in a row, witnessed a growth of 37% month-on-month (MoM) to INR 10,796 crore in February 2020. SIP inflows were almost flat relative to the previous month and were at a healthy INR 8,513 crore. Overall industry AUM witnessed a marginal drop of 2.3% MoM and was at INR 27.22 lakh crore in February 2020.

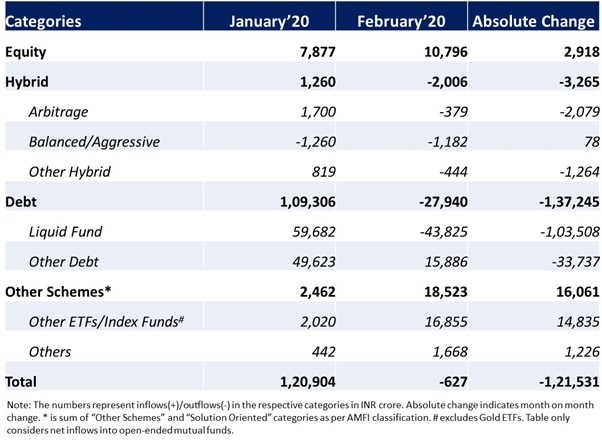

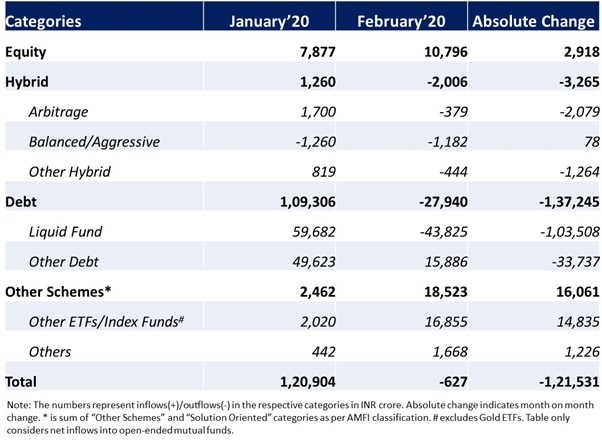

The following table shows the net inflows into various mutual fund categories in Jan and Feb 2020:

For simplicity of understanding let’s focus on the flows of open ended mutual fund categories only and highlight some salient points.

Equity

• Net inflows into large cap and small cap categories grew 39% and 40% respectively MoM to INR 1,607 and INR 1,498 crore in February 2020

• Small cap category witnessed two NFOs during the month, IDFC Emerging Businesses Fund and ITI Small Cap Fund which garnered INR 699 crore combined

• NFO of Axis ESG Equity Fund in the thematic category ended up raising INR 1,715 crore during the month

Debt

• Liquid category witnessed significant outflows to the tune of INR 43,825 crore in February 2020 as institutional investors redeemed their investments for advance tax payment commitments. Overnight and ultra short category saw outflows while net inflows into low duration & money market categories fell relative to the previous month. Inflows into short duration, corporate bond, banking & PSU debt and floater fund categories remained robust

Hybrid

• Arbitrage category witnessed outflows while net inflows into dynamic asset allocation category witnessed a steep fall during the month of February

Other Schemes & Solution Oriented

• Follow on Fund offering of the 6th tranche of CPSE ETF ended up raising INR 16,500 crore in February

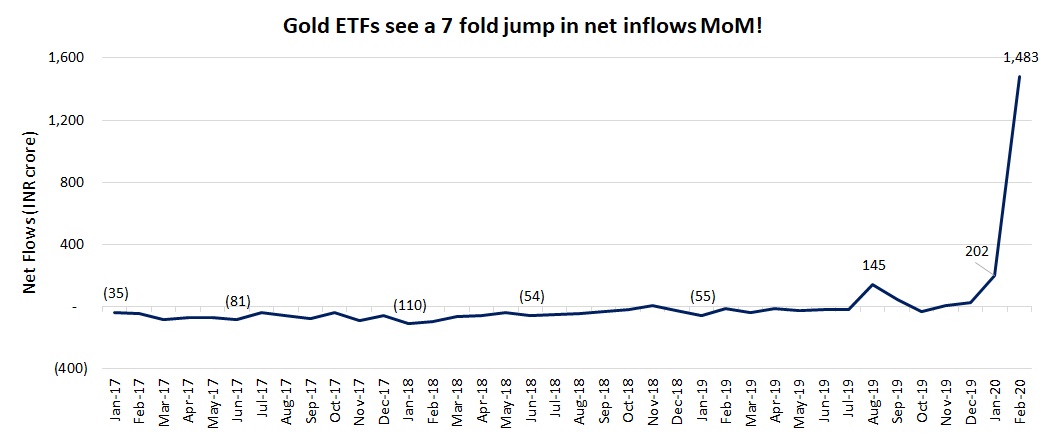

• Net inflows into Gold ETFs witnessed a massive spike during the month and came in at INR 1,483 crore, a 7 fold jump over the previous month (as shown in graph below)

It is not advisable to take investment decisions based on inflows/outflows as these can be volatile. Your investment decisions should be based on your investment objective, investment horizon and risk profile. Consider investing for long term through SIP as it ensures rupee cost averaging.

Go ahead and start investing through SIP on Paytm Money. It was never simpler! Managing SIPs is seamless. Invest with as low as Rs 100 through SIP on Paytm Money!