Markets move in seconds—and sometimes that’s all the time you have to execute your strategy. But building multi-leg options strategies has traditionally been slow, clunky, and error-prone.

Until now. We heard you. And we fixed it.

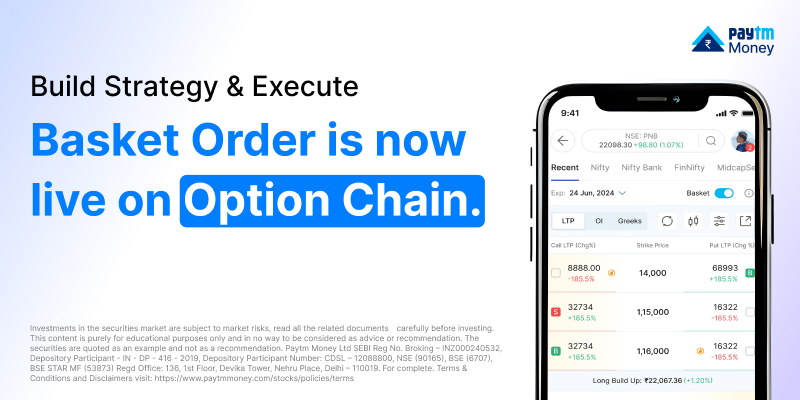

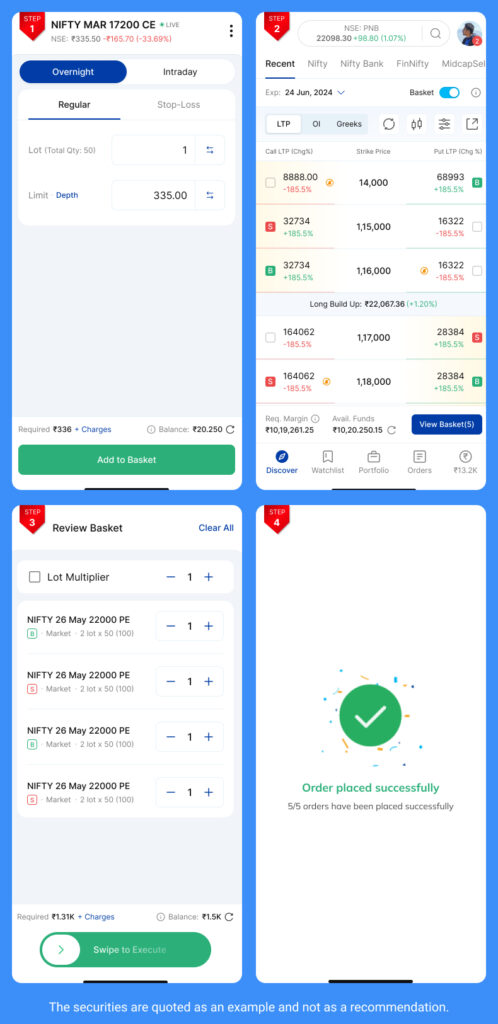

With our new basket order from the option chain feature, you can now build and place multi-leg option strategies without ever leaving the option chain screen. This not only saves time but also keeps your risk-return trade-off account aligned to the market and your strategies.

Why This Matters?

Let’s say you’re looking to set up a Bull Call Spread or an Iron Condor. You identify the strikes from the option chain, but by the time you finish building your strategy on a separate screen, prices have already moved, or a leg gets entered incorrectly, which affects your risk-return trade-off and demands modifying the orders. Frustrating, right?

This feature cuts all that out.

What You Can Now Do?

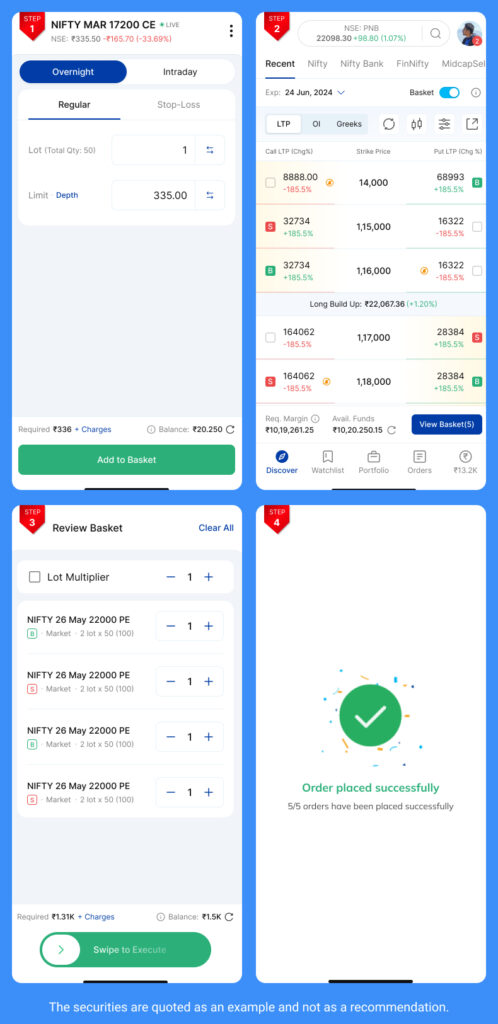

- Select Multiple Strikes Directly from the Option Chain

You can now choose all the legs of your strategy, whether it’s a spread, straddle, or condor, without leaving the option chain screen. This saves time and lets you stay focused on where the data is. - Add Legs to a Basket Instantly

As you select your strikes, just tap “Add to Basket” right there on the screen. No more switching tools or losing track of what you picked. - Preview Strategy with Margin and Greeks

Before you place the trade, see the margin required and key risk metrics like Delta, Theta, and Vega. This helps you remain informed and avoid surprises. - Save and Reuse Baskets

Got a favorite strategy setup? Save it as a template. You can easily reload, tweak, and reuse it whenever a similar market setup appears. - Execute All Legs in One Click

Once you’re ready, execute your complete strategy in a single tap. No need to punch in each leg separately—this cuts down on both time and errors.

How This Solves Common Trading Friction?

- No More Manual Entry

Earlier, traders had to manually type in each strike, expiry, and lot size, leaving room for errors. Now you can build the entire strategy on one screen, more accurately and effortlessly. - Maintains Context from Analysis to Execution

You’re no longer jumping from option chains to order screens. You analyze and act in the same place, which keeps your flow intact and speeds up execution. - Avoid Errors in Strike or Expiry Selection

Since you’re adding legs directly from the live option chain, the chances of selecting the wrong strike or expiry drop drastically. - Faster Execution in Volatile Markets

When markets move fast, every second matters. This feature reduces the time taken to place a strategy, helping you lock in better prices. - Built for Serious Strategy Traders

If you’re using spreads, straddles, condors, or any multi-leg strategy, this feature gives you the ease and accuracy needed for professional-grade execution.

How to Use Basket Orders from Option Chain?

Here’s the flow: Click on Select → Add to Basket → Preview → Save → Execute

Conclusion

Good trades begin with great execution. With Basket Order from Option Chain, we’re giving you a tool that’s not only faster but also far more reliable. It’s one less thing to worry about when you’re already juggling market movements, entry points, and technical setups.

Start using it today and see how much smoother your strategy game can get.

Recap

- Place multi-leg options strategies straight from the Option Chain

- Build, preview, save, and execute—all from one place

- Designed to help you trade faster and smarter with fewer errors

- Best suited for active derivatives traders and strategy users

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. This content is purely for educational purposes only and in no way to be considered as advice or recommendation. The securities are quoted as an example and not as a recommendation. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532, Depository Participant – IN – DP – 416 – 2019, Depository Participant Number: CDSL – 12088800, NSE (90165), BSE (6707), BSE STAR MF (53873) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. For complete. Terms & Conditions and Disclaimers visit: https://www.paytmmoney.com/stocks/policies/terms.