‘Inside the Product’ with Ravi Ahlawat, Product Manager at Paytm Money

👋 Hey folks, Ravi here — Product Manager at Paytm Money.

Over the past few months, one question kept coming up from investors — new and seasoned alike:

“How do I make a confident call on whether to buy, hold, or sell a stock?”

Even for savvy investors, it’s easy to feel overwhelmed by conflicting headlines or gut instinct. Retail investors often lack access to the clear, research-driven signals that institutional traders rely on.

So we asked ourselves a big question:

How can we bring reliable, research-backed insights directly to everyday investors — inside Paytm Money — in a way that’s simple, actionable, and actually helpful?

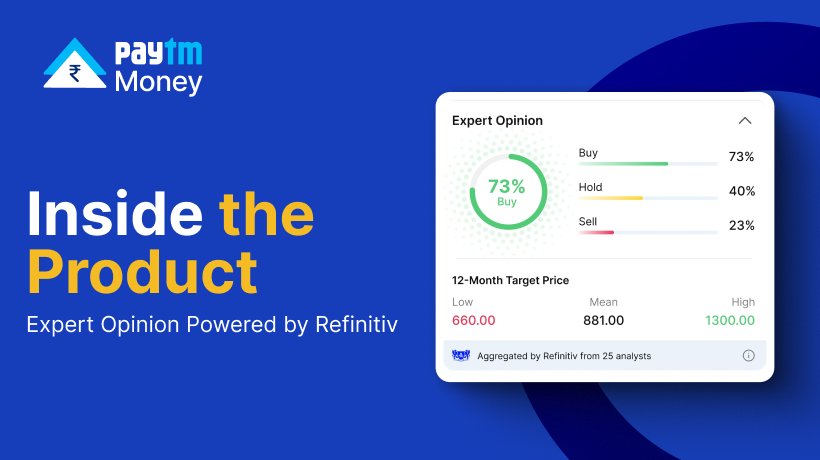

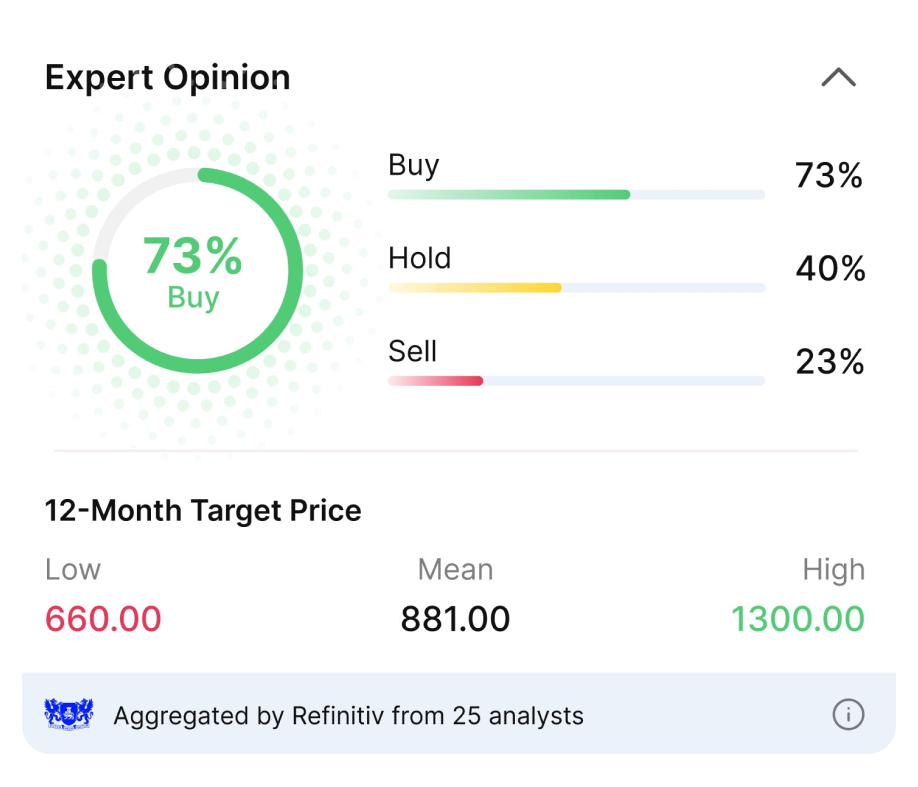

🔍 The Breakthrough: Expert Opinion, Powered by Refinitiv

After exploring several options, we decided to partner with Refinitiv, a global leader in financial data and analytics and part of the London Stock Exchange Group (LSEG).

This was a strategic choice. Refinitiv powers research for top brokerages and institutional desks worldwide. By integrating their equity research and consensus ratings directly into our app, we’ve made these insights available to everyone — right at the moment it matters.

What You’ll See in the App:

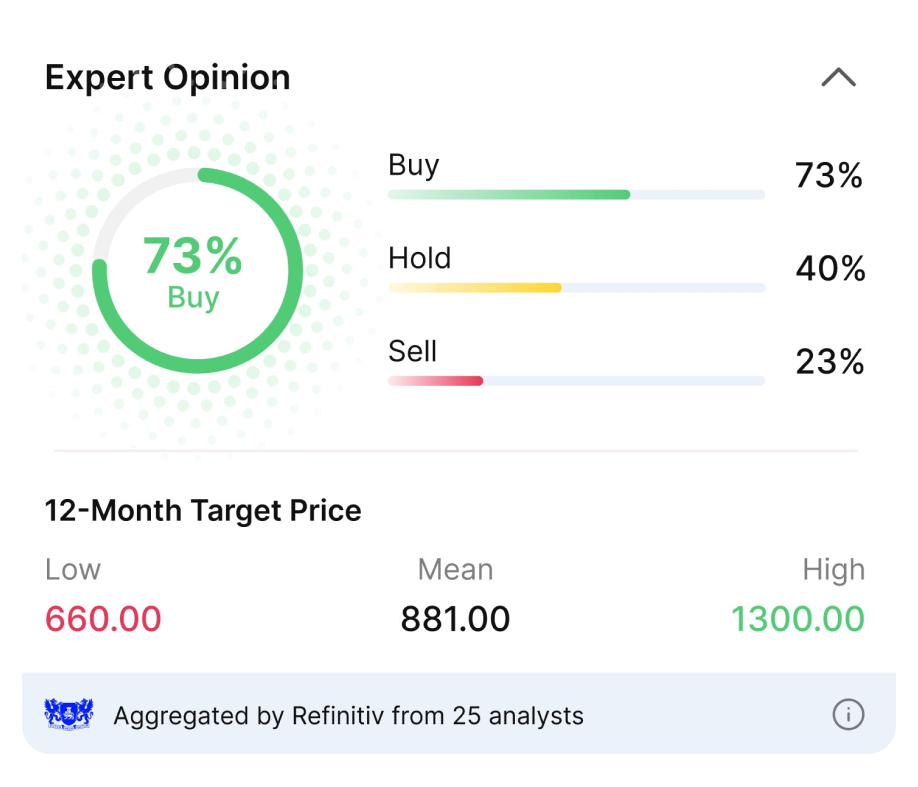

✅ Buy / Hold / Sell recommendations for 800+ listed companies

✅ 12-month target prices, aggregated across top brokerages like Goldman Sachs, JP Morgan, and Edelweiss

✅ Easy-to-read summaries in the Expert Opinion section across stock pages, watchlists, and portfolios

Why This Matters to You?

We built this because many investors told us:

- “I don’t know what analysts think about this stock.”

- “I want a second opinion before I invest.”

- “I keep Googling target prices or brokerage reports.”

We’ve now made it possible to get that institutional perspective without jargon, without noise, and without paywalls.

Let’s say you’re browsing a stock like TCS. You’ll now see a clear analyst consensus — whether most experts recommend a Buy, Hold, or Sell — and what the median price target is. This gives you confidence at the exact point of decision.

Behind the Build

Building this wasn’t a plug-and-play task.

The integration was led by Rani Rawat, our Senior Technical Lead, and involved deep backend work. Here’s what we focused on:

- Building a reliable API connection to fetch real-time analyst data

- Ensuring smooth and responsive load times on every stock page

- Designing a clean UI that simplifies complex data points into intuitive visuals

- Syncing insights across watchlists, portfolios, and alerts, so you’re always informed

This was a true cross-functional effort — from engineering to design, analytics to content — and reflects our broader goal: making Paytm Money a smarter, faster, more empowering experience for investors.

What’s Next: More Personal, More Powerful

We’re just getting started.

Here’s what’s coming soon:

- Expanding analyst coverage to more mid-cap and small-cap stocks

- Adding explainers that break down what each score (like “momentum” or “valuation”) really means

- Creating personalized insight feeds based on your investing preferences and portfolio behavior

We’re also listening closely. If you have thoughts — good, bad, or confusing — about how these insights show up, let us know. Your feedback directly shapes how we evolve this feature.

Ready to Explore?

The next time you visit a stock page on Paytm Money, look for the Expert Opinion section. It’s subtle, smart, and built to help you make decisions with clarity.

We hope this makes your investing journey a little more informed, a little more confident — and a lot more befikar.

Because smarter investing doesn’t need to be complicated — just well-designed.

#InvestKarBefikar

#BuiltForInvestors

#InsideTheProduct

Ravi Ahlawat

Product Manager, Paytm Money

💻 w/ Rani Rawat, Senior Technical Lead

🔜 This is the first post in our new series: #InsideTheProduct

We’ll be sharing the real stories behind the features you use — from ideas to impact.

Stay tuned.