The Future of Investing Is Personal, Seamless, and AI-Powered

In the world of finance, change rarely makes noise, but it always leaves an impact. Over the past month, India’s financial landscape has shifted in ways that are subtle yet deeply significant. And if you’ve been investing, you’ve likely felt it.

As CEO of Paytm Money, I see this transformation not just in numbers, but in behavior. Investors are growing more confident, savvier, and increasingly selective about how and where they invest.

On June 6, the RBI made a surprising and bold move—cutting interest rates by 50 basis points and reducing the Cash Reserve Ratio. It was the biggest easing in five years. Inflation is now below 3%, the rupee is stable, and market confidence is rising. SIP contributions hit an all-time high of ₹26,688 crore in May.

Source: Reuters

For long-term investors, this opens a compelling case for rebalancing—possibly moving from fixed deposits into equities, or considering hybrid and goal-based investing. On our platform, we are enhancing tools that help users understand this macro shift and realign their financial journeys accordingly.

And yet, global risks remain real: slowing global capital flows, ongoing trade wars, rising crude oil prices, surging US bond yields, declining rupee, and geopolitical tensions all continue to weigh in. The message is clear—investing in this market requires better tools, deeper insights, and faster execution.

That’s exactly what we’ve been building at Paytm Money.

Here’s how we’re helping you stay ahead, smarter, and sharper.

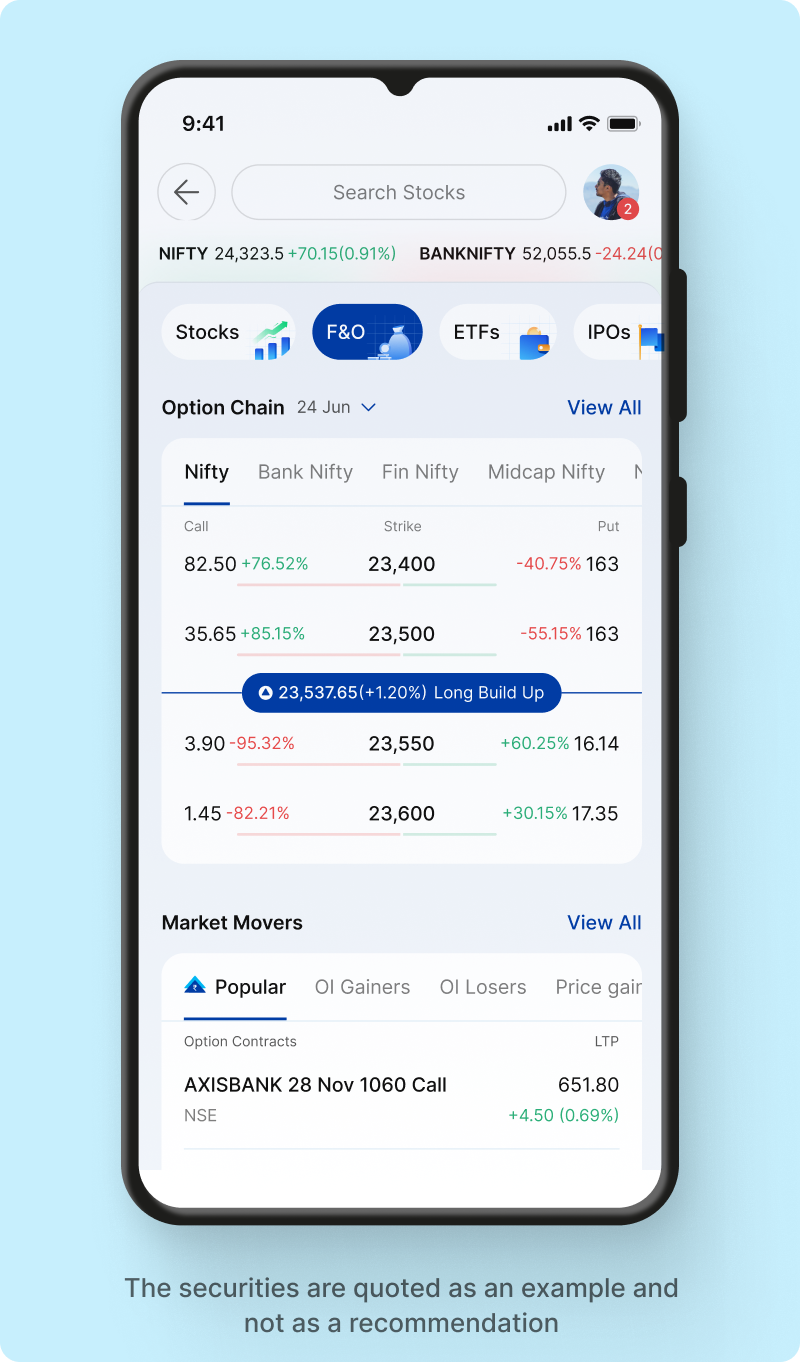

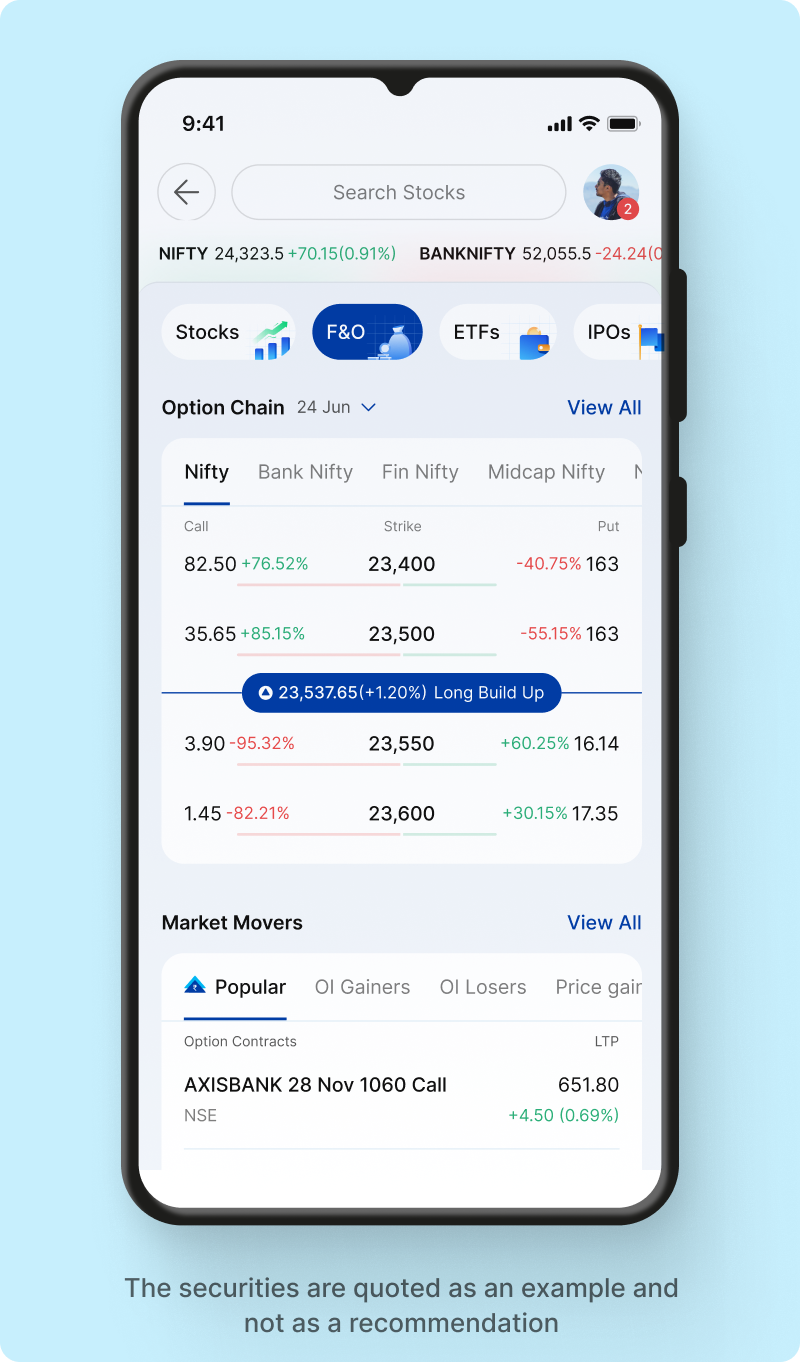

A Dedicated Space for F&O Traders

Traders, your space just got cleaner and quicker.

We’ve introduced a separate F&O tab on the home screen. This one-click entry takes you directly into the F&O dashboard—no more digging or toggling. Whether you want to check open positions, place a quick order, or watch the market live, it’s now faster than ever. Explore the F&O Dashboard

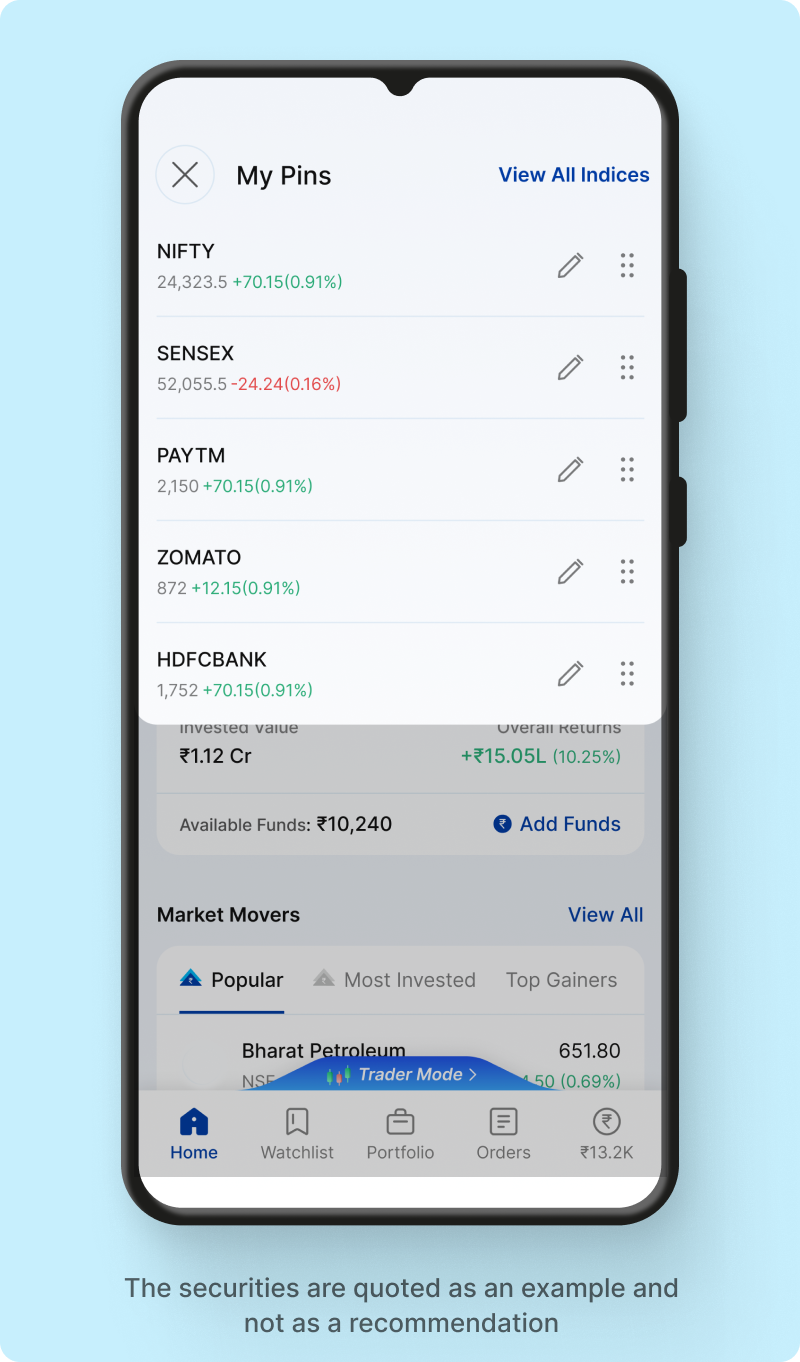

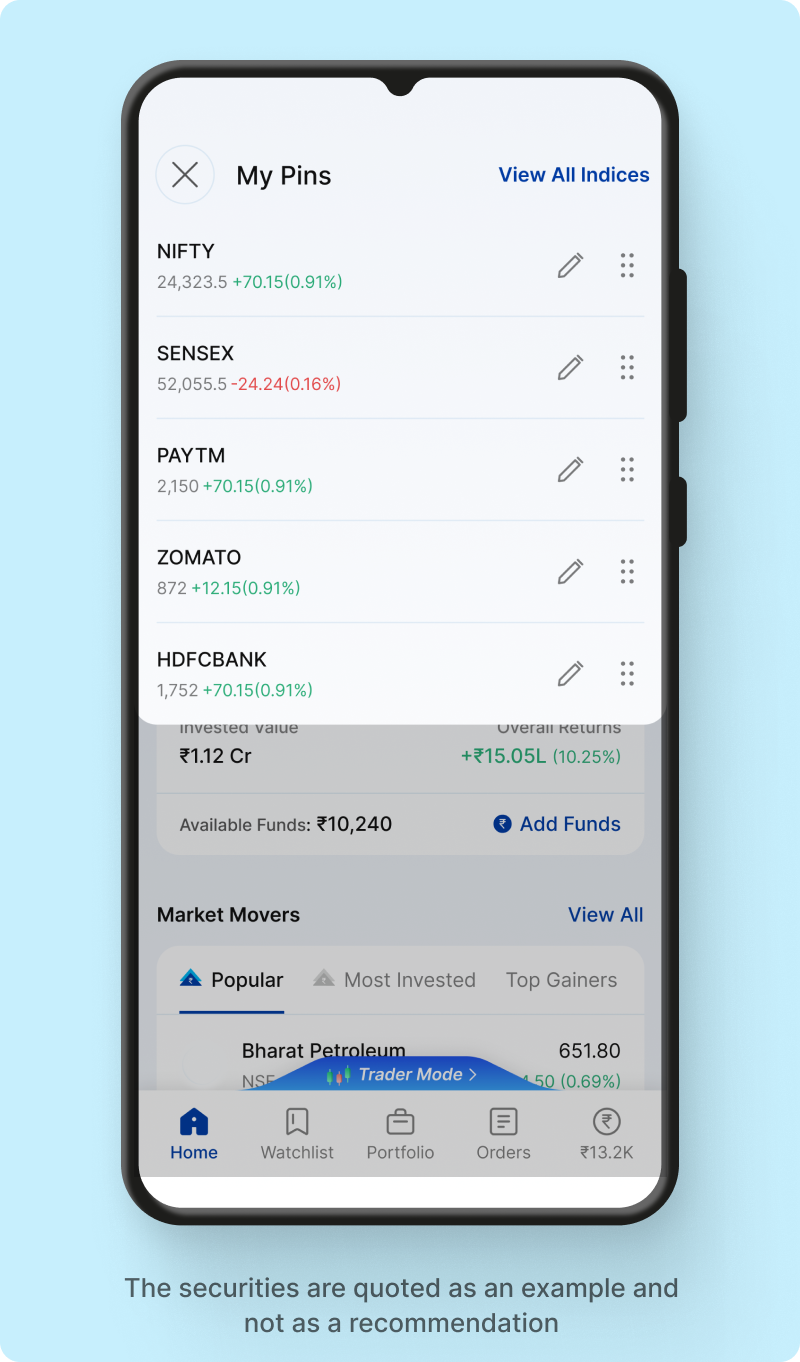

Pin & Personalize Indices

Market moves matter more when they’re your moves.

You can now customize which indices appear on your home screen. Whether you’re tracking Nifty Bank, Midcaps, or international benchmarks, bring your relevant market data front and center—in just a tap. Set Your Indices

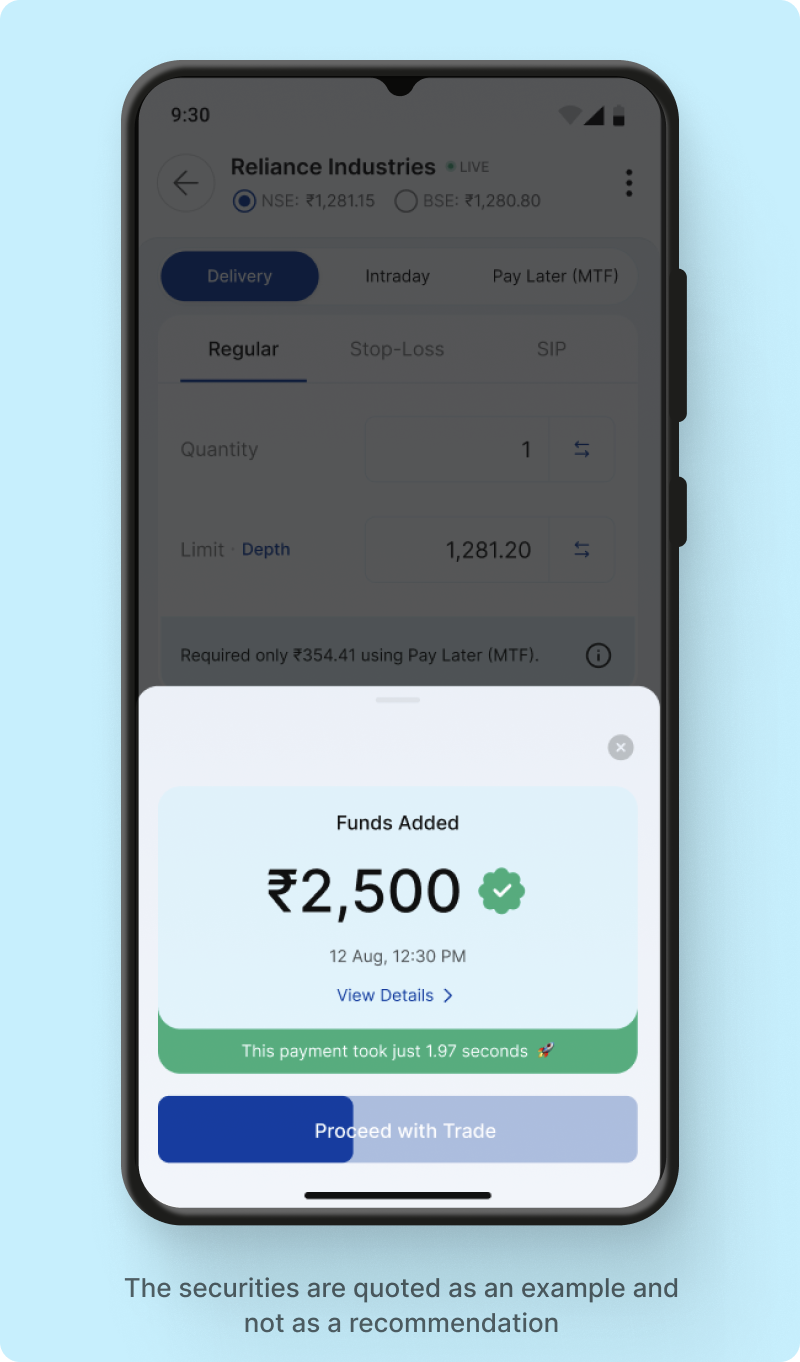

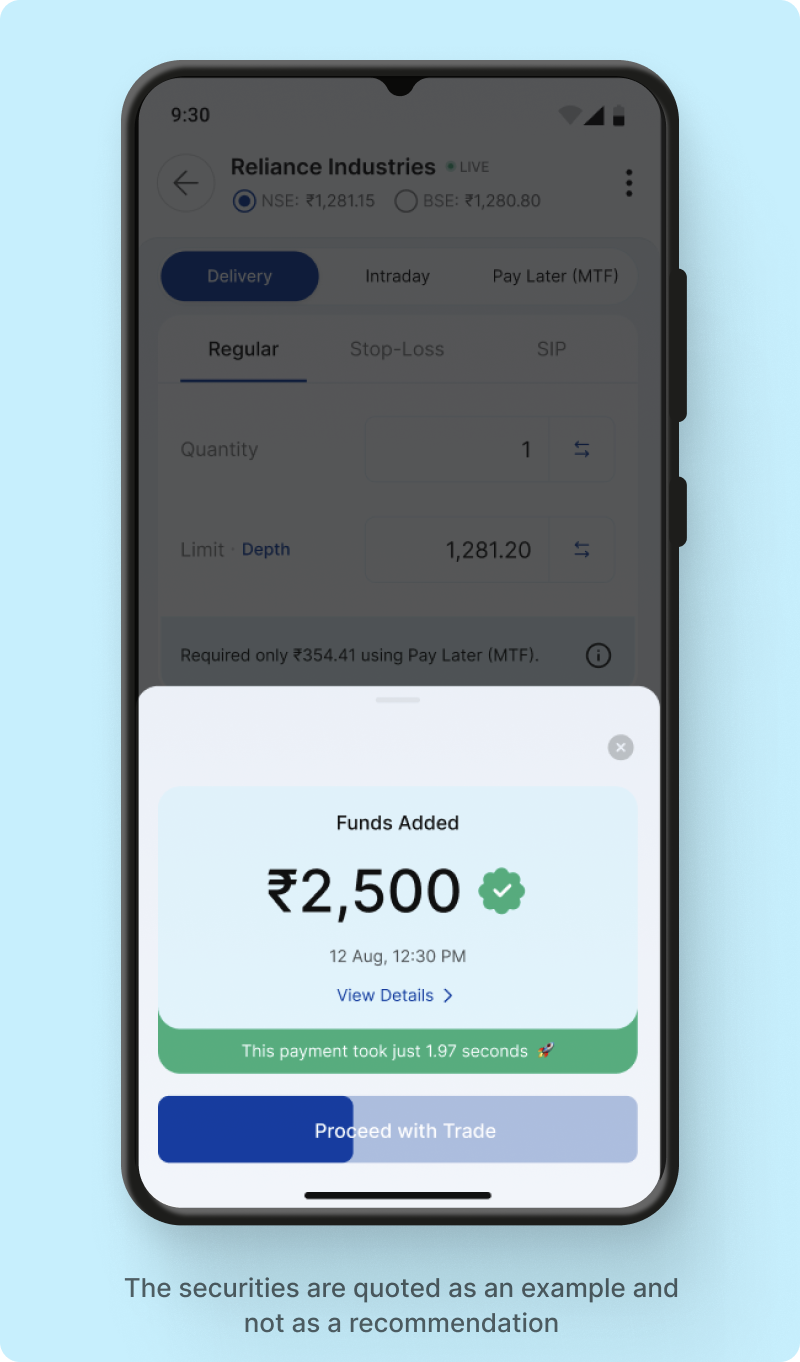

Add Funds from the Order Pad

Intent to execution—without interruption.

We’ve added a simple yet powerful enhancement: you can now add funds directly from the Order Pad. No detours, no back-and-forth. Just one seamless path from placing an order to making it happen. Try It While Placing an Order

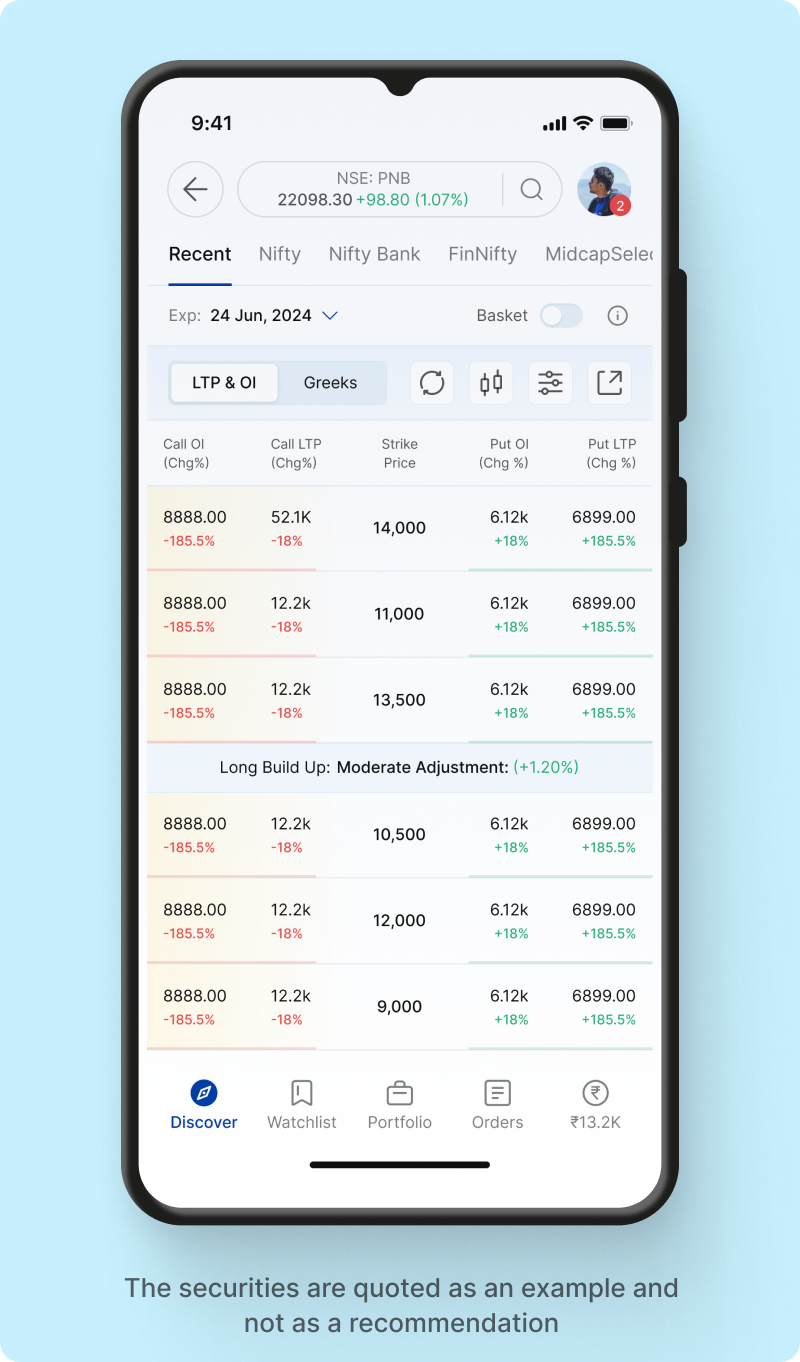

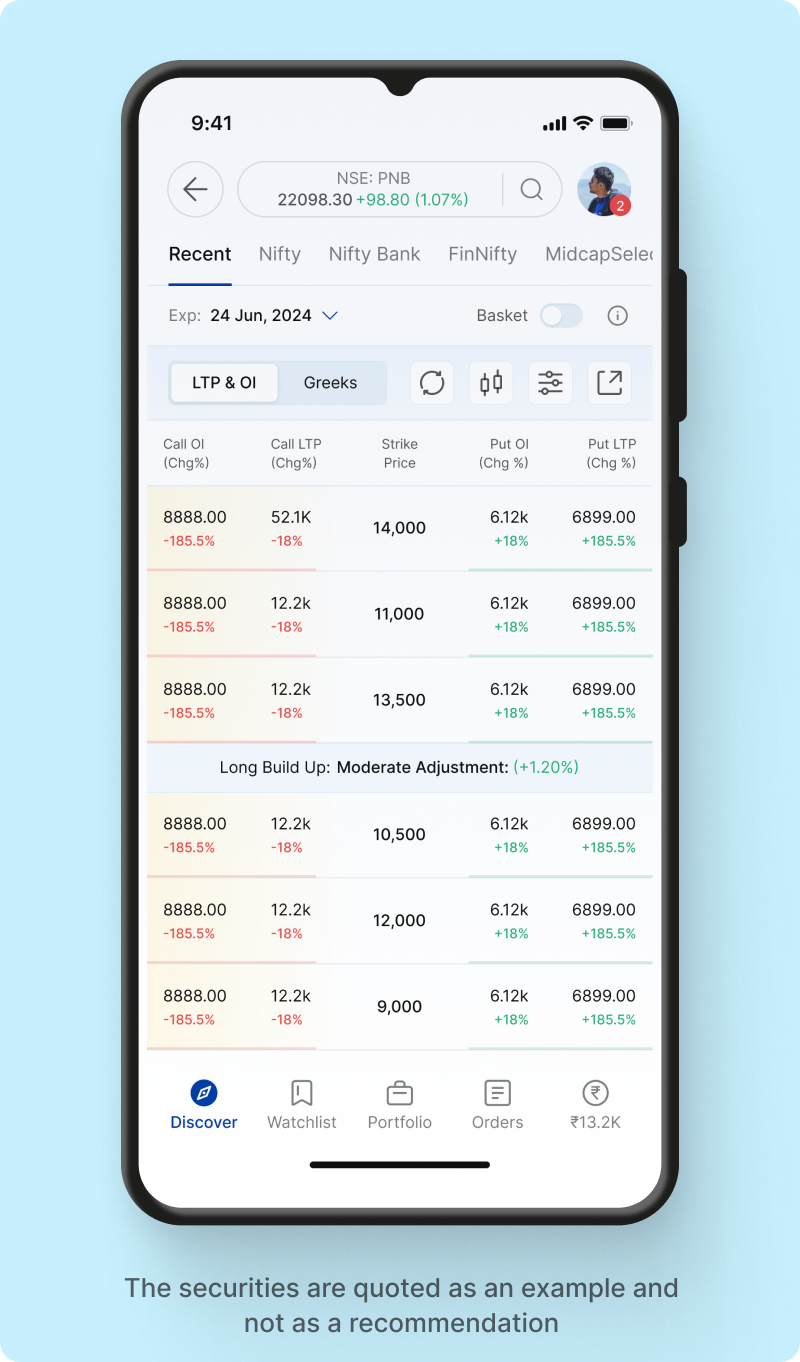

Enhanced Option Chain with OI + LTP

Options traders, we’ve made your core screen smarter.

Our updated Option Chain now displays Open Interest and Last Traded Price together, with color-coded visuals that make market sentiment instantly visible. It’s cleaner, more intuitive, and designed for sharp decisions. Check the Option Chain

Conclusion

Investing with Context, Confidence & Clarity

At Paytm Money, we believe investing shouldn’t be a maze; it should be a mirror that reflects your goals and adapts with your journey. As markets evolve, our mission remains the same: to empower you with tools that are fast, intelligent, and intuitive.

These new updates are more than features; they’re a part of a larger shift toward smarter, more holistic investing. One that keeps up with you—and the world.

Thank you for placing your trust in us.

Warm regards,

Rakesh Singh

Director & CEO, Paytm Money

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. This content is purely for educational purposes only and in no way to be considered as advice or recommendation. The securities are quoted as an example and not as a recommendation. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532, Depository Participant – IN – DP – 416 – 2019, Depository Participant Number: CDSL – 12088800, NSE (90165), BSE (6707), BSE STAR MF (53873) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. For complete. Terms & Conditions and Disclaimers visit: https://www.paytmmoney.com/stocks/policies/terms.