It’s 3:10 PM on a Tuesday. The market closes in twenty minutes. You are staring at a stock you bought this morning. It is currently down 1%, but every technical indicator you trust suggests it’s going to bounce back tomorrow morning.

If you are an intraday trader, you have no choice. The clock is your enemy. You must sell right now, accept the loss, and walk away or convert the position to delivery by adding the required funds to your trading balance.

But what if you could hit a “snooze button” on that trade? What if you could carry that leveraged position into tomorrow, or even the day after, to let the setup play out?

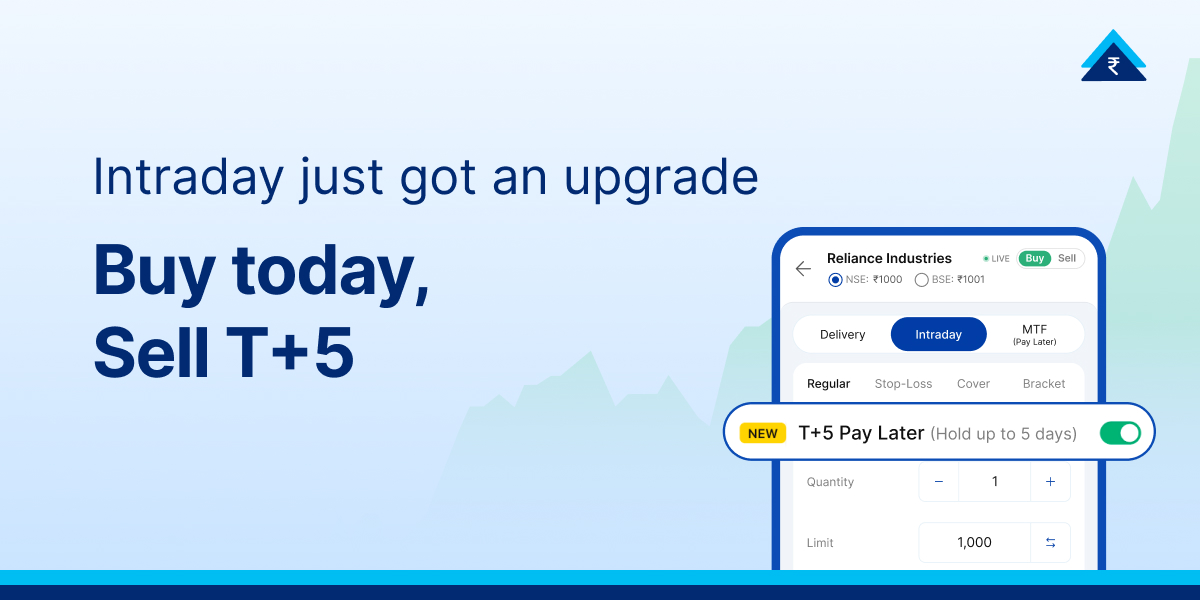

This is exactly the problem that T+5 Pay Later solves. It sits right in the middle of the trading spectrum, offering the leverage of intraday with the breathing room of delivery. The debate of Intraday vs T+5 Pay Later comes down to time, flexibility, and cost.

If you are trying to decide between the adrenaline rush of day trading and the flexibility of T+5, here is a clear breakdown of Intraday vs T+5 Pay Later, and which strategy fits your trading style and wallet.

What Is Intraday Trading?

Intraday trading is like a sprint. You enter and exit the market within a single trading session (9:15 AM to 3:30 PM). The primary appeal here is leverage—brokers often let you trade with 5x your actual capital because they know you aren’t holding the stock overnight. However, the golden rule of Intraday is the Square-off Deadline. Whether you are in profit or loss, your position must be closed before the broker’s cut-off time (usually around 3:15 PM). If you forget, the system does it for you automatically.

What Is Paytm Money’s T+5 Pay Later?

Paytm Money’s T+5 Pay Later is essentially “Swing Trading on Margin.” It allows you to buy more stocks with limited capital (upto leverage) but gives you a holding window of Trade Date + 5 Days.

Unlike Intraday, the clock doesn’t run out when the market closes today. You can hold the position overnight and across the week. It allows you to capture price movements that take a few days to mature, without requiring you to pay the full delivery value of the shares upfront.

Why Traders Choose T+5 Pay Later

- Extended Holding Period: Unlike Intraday trading where you must square off by 3:15 PM, T+5 Pay Later gives you up to 5 trading days to hold your position. This allows you to ride short-term trends without the pressure of a daily deadline.

- Higher Buying Power: Get up to 4X leverage, meaning you can take a position worth ₹1,00,000 with just ₹25,000 of your own capital.

- Interest Flexibility: You are charged interest (at 0.05% per day) only on the borrowed amount and strictly for the number of days you hold the position. If you exit early, your costs reduce.

- Convert to Delivery: If a trade is working in your favour and you want to hold it longer than 5 days, you can easily convert it to a Delivery order by adding the remaining funds before Day 5.

- No Pledging Hassle: The stock holdings are not pledged. The broker keeps your holdings safe until the position is converted to delivery or squared off.

Intraday vs T+5 Pay Later: Key Differences

While both options allow you to take bigger trade positions, the mechanics are vastly different.

1. Holding Period

- Intraday: You have roughly 6 hours. The timeframe is rigid. You cannot carry a position overnight, no matter how confident you are about tomorrow’s opening.

- T+5 Pay Later: You have 5 trading days. This extended runway allows you to ride out minor intraday volatility or wait for a specific news event to trigger a price jump later in the week.

2. Costs

- Intraday: It is generally cheaper. You pay the standard brokerage fee, as per your brokerage plan, of upto ₹20 per order. Since you aren’t borrowing money overnight, there is no interest charged.

- T+5 Pay Later: There is a price for the extra time. Because you are borrowing funds to hold the stock overnight, you are charged small daily interest on the borrowed amount over and above the standard brokerage of ₹20. While the rate is low (only 0.05% per day), it accumulates the longer you hold.

3. Risk Exposure

- Intraday: Your risk is limited to market hours. You are immune to “gap openings.” For example, if bad news breaks in the US markets overnight, your intraday trade from yesterday is already closed, so you are safe.

- T+5 Pay Later: You carry overnight risk. If you hold a stock overnight, your stock is open to risks caused by after-hours news, or geopolitical events, leading to price gaps, high volatility at the open, and limited liquidity. Since you are using leverage, this can lead to losses exceeding your initial capital.

4. User Control

- Intraday: The broker has the final say at 3:15 PM. If you haven’t sold, they will auto-square off your position at whatever price is available, good or bad.

- T+5 Pay Later: You are in the driver’s seat for five days. You can choose to sell on Day 2 to book a quick profit, or wait until Day 5. If you really like the stock, you even have the control to convert the position to “Delivery” by paying the remaining funds, effectively turning a trade into a long-term investment.

Comparison Table

| Feature | Intraday Trading | T+5 Pay Later |

|---|---|---|

| Holding Period | ~6 Hours. Strictly within market hours (9:15 AM – 3:30 PM). No overnight holding allowed. | 5 Days. Allows holding positions overnight and across the week to ride out volatility or wait for trends. |

| Costs | Brokerage Only. Standard fee (max ₹20/order). No interest charges since there is no borrowing. | Brokerage + Interest. Standard fee (max ₹20/order) plus daily interest (~0.05%) on the borrowed amount. |

| Risk Exposure | Intraday Only. Immune to overnight “gap” risks caused by global news or events after market close. | Overnight Risk. Exposed to after-hours news and gap openings which can amplify losses due to leverage. |

| User Control | Auto-Square Off. Must sell by ~3:15 PM. If you forget, the broker sells it automatically. | Flexible. Sell anytime within 5 days or convert to “Delivery” (long-term) by paying the full amount. |

Common Misconceptions About T+5 Pay Later

Before you jump into T+5, let’s clear up a few myths:

-

“It’s just extended intraday.” — False

T+5 works like a loan. In intraday trading, the broker usually provides margin at no cost. In T+5, you pay interest for the privilege of holding positions overnight. -

“I can hold it forever as long as I pay interest.” — False

The “5” in T+5 is a hard limit. If no action is taken by the end of the fifth day, the system will auto-sell your shares at 8:00 PM on the last day to recover the funded amount. -

“I can use it for penny stocks.” — False

Brokers typically restrict T+5 or MTF facilities to stable, high-liquidity stocks to manage risk. On Paytm Money, T+5 Pay Later is available on 1,300+ approved stocks.

The Verdict: Which One Should You Choose?

- Stick to Intraday if: You enjoy the fast pace, have time to monitor the screen constantly, and want to sleep peacefully without worrying about overnight market news.

- Switch to T+5 Pay Later if: You are a swing trader who spots multi-day trends, you have a busy job that prevents you from watching the market every minute, and you are willing to pay a small interest fee for the luxury of time.

(Source: NSE)

Disclaimer: Investment in the securities market is subject to market risks. Read all the related documents carefully before investing. This content is purely for information purpose only and in no way is to be considered as an advice or recommendation. The securities are quoted as an example and not as a recommendation. Investors are requested to do their own due diligence before investing.

SEBI Reg No.: Broking – INZ000240532, Research Analyst – INH000020086, Depository Participant – IN-DP-416-2019, Depository Participant Number: CDSL – 12088800, NSE (90165), BSE (6707), MCX (57525), NCDEX (1315), MSEI (85300).

Registered Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019.

For complete Terms & Conditions and Disclaimers, visit https://www.paytmmoney.com.