PowerGrid Infrastructure Investment Trust’s IPO is all set to make its debut on the D-street on April 29th. The company is owned by state-run PowerGrid Corporation of India and has fixed the price band for its public offer at Rs 99-100 per unit.

- Know The Company

- Issue Details

- Offer Breakup

- IPO Timeline

- The Funds Will Be Utilised For

- How to apply for POWERGRID InvIT?

- Steps to apply IPO through HDFC bank

- Steps to apply IPO through ICICI bank

- Steps to apply IPO through State Bank of India

- Steps to apply IPO through Kotak Mahindra bank

- Steps to apply IPO through Axis bank

The issue for subscription will open up on April 29 and will go on till May 3, 2021. The anchor book for the same will open for bidding for a day on April 28.

The public issue for this company comprises a fresh issue of Rs 4,993.48 crore and an offer for sale of 2,741.51 crore by selling unitholders. KFintech Pvt Ltd is the registrar for the IPO.

Know The Company

PowerGrid InvIT is set up to own, construct, operate, maintain and invest as an infrastructure investment trust as permissible in terms of the InvIT Regulations, including in power transmission assets in India. Its sponsor, Power Grid Corporation of India, is also acting in the capacity of InvIT’s project manager.

The PowerGrid InvIT’s Initial Portfolio Assets comprise five power transmission projects located across five states of India. The projects comprise 11 transmission lines, including six 765 kV transmission lines and five 400 kV transmission lines, with a total circuit length of approximately 3,698.59 ckm, and three substations with 6,630 MVA of an aggregate transformation capacity and 1,955.66 km of optical ground wire.

As of December 31, 2020, their Sponsor owned the Sponsor Tariff based competitive bidding (“TBCB”) Projects. As of December 31, 2020, 8 of these Inter-state transmission system (“ISTS”) SPVs had commenced commercial operations, comprising 39 transmission lines (6,398 Circuit kilometres (“ckm”)), with a total power transformation capacity of 9,630 Megavolt-Ampere (“MVA”). The remaining Sponsor TBCB Projects are at different stages of development.

Issue Details

Total Issue Size: upto Rs 7,734.99 crores

Fresh Issue size upto Rs 4,993.48 crores + Offer for Sale size upto Rs 2,741.51 crores

Price Band: Rs 99 – Rs 100

No. of units: upto 773,499,100^ Units (^Based on Upper Price Band)

Bid Size: 1,100 Units and in multiples thereafter for Non-Institutional Investors

Minimum Bid Amount: Rs. 1,10,000

Issue opens on: Thursday, Apr 29th 2021 Issue closes on: Monday May 3rd 2021

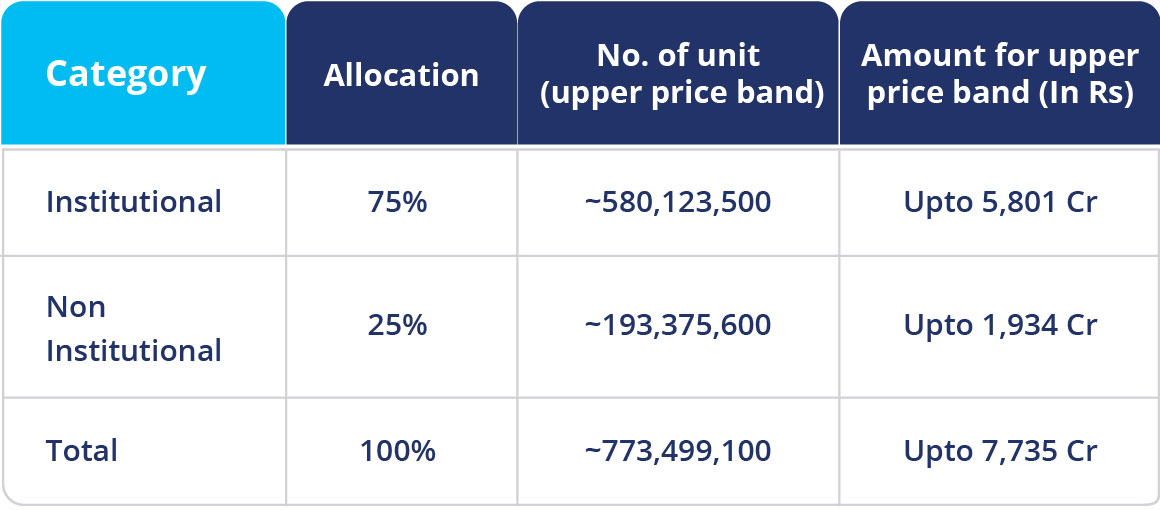

Offer Breakup

Source – BRLM

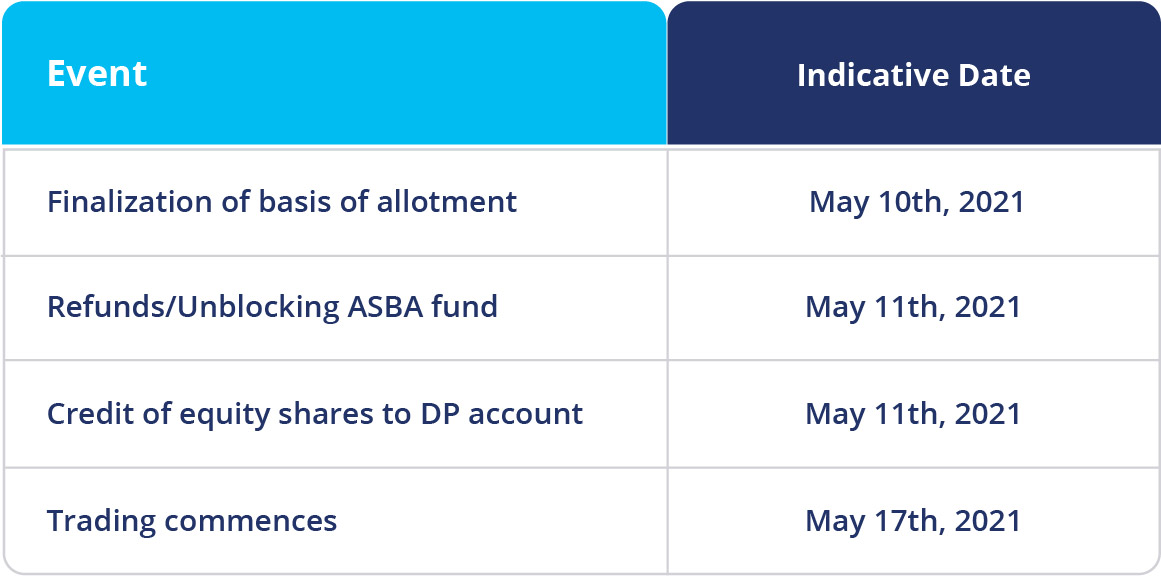

IPO Timeline

Source – BRLM

The Funds Will Be Utilised For

The company will use the funds raised through the fresh issue to provide loans to the Initial Portfolio Assets for repayment or pre-payment of debt, including any accrued interest, availed by the initial portfolio assets. Among the five initial assets, PowerGrid Warora Transmission Limited has the highest outstanding amount of Rs 1,540 crore.

The same will also be utilised repayment or pre-payment of debt and general corporate purposes.

How to apply for POWERGRID InvIT?

For Non Anchor and Non Institutional investors online applications using ASBA is the only method possible. Most of the syndicate banks (SCSB) provide access to apply via ASBA process. You must have your net banking access, BO ID information to apply via ASBA

ASBA: Applications Supported by Blocked Amount (ASBA) is a process developed by the India’s Stock Market Regulator SEBI for applying to IPO. ASBA is an application containing an authorization to block the application money in the bank account, for subscribing to an issue. If an investor is applying through ASBA, his application money shall be debited from the bank account only if his/her application is selected for allotment after the basis of allotment is finalized, or the issue is withdrawn/failed.

Self Certified Syndicate Bank (SCSB): SCSB is a bank which offers the facility of applying through the ASBA process. Please click the below link to see if your bank is eligible for ASBA.

https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=35

BO ID or Demat Account Number: BO ID is Beneficial Owner Identification Number or Demat Account Number which is of 16 digits consisting of 08 digits DP ID and 08 digits Client ID.

To identify your BO ID or Demat Account number and depository in Paytm money please follow below steps.

- In main dashboard please select stocks option

- In the bottom right corner, please select Account

- And select the top tab where your name appears

- The page will open which will show your Demat account number and DP ID as well as depository services used. Depository for Paytm Money is CDSL

The process to apply using some of the bigger banks like HDFC, ICICI, SBI, Kotak Mahindra and Axis bank have been shown briefly below

Steps to apply IPO through HDFC bank

Please login to your HDFC Bank net banking account. (https://www.hdfcbank.com/personal/invest/ipo-application-through-asba)

- Click on the link named “IPO Application” under Request on the left side menu as shown in image

- Select one of the IPOs you want to apply for and mention up to 3 bids.

- Enter your depository details.

- Place and confirm your Order.

- You would then be required to accept the “Terms & Conditions” before submitting the bid.

Steps to apply IPO through ICICI bank

Login to your ICICI NetBanking Account. (https://www.icicibank.com/Personal-Banking/investments/ASBA/ASBA.page)

Click on “Investments & Insurance” tab on the top menu. Then click on the Invest Online on the dropdown menu.

Go to IPO “online box” and click on “Invest in IPO”.

- Select your account number from the dropdown and click “submit”.

- Enter and confirm your personal details and authorize your transaction.

- Select the IPO you wish to apply from the list and click “GO”.

- Enter IPO details and click on “Submit”.

- Verify and Confirm the details.

Steps to apply IPO through State Bank of India

Login to SBI Bank NetBanking – (https://www.onlinesbi.com/)

First IPO applicant needs to be added. After logging in please select profile in the left tab. Select “Manage IPO applicant”. Validate the same with your profile password and fill in necessary details and add IPO applicant.

Then proceed with POWERGRID InvIT IPO application as per below process

- Click on eServices Tab

- Click on Demat & ASBA Services

- Click on IPO Equity

- Select IPO

- Enter Details in the Form like DP ID, BID, Name, Pan Card and more

- Verify & Confirm Your Order

Steps to apply IPO through Kotak Mahindra bank

Login to your Kotak Net Banking

(https://www.kotak.com/en/personal-banking/investments/asba-facility.html)

Go to Investments IPO ASBA Beneficiary registration Select Depository Name CDSL and register your 16 digit Demat A/c no

- To Apply follow the below steps.

- Once you register your Demat as beneficiary click on apply now

- Select your Demat from the drop down

- Select IPO you wish to Apply (POWERGRID InvIT)

- Select Investment Category and apply in the multiple of 1100

- Enter other details to apply

Steps to apply IPO through Axis bank

Login your Axis Net Banking (https://www.axisbank.com/retail/investment/iposmart/apply-for-iposmart)

Go to Investments / Online IPO

- Click on Register ASBA and fill in your Paytm Money Demat ID Details

- Once registered apply using below steps

- Investments / Online IPO

- Select Demat account you want to use and click on Apply for Equity IPO

- Select Ipo from the list and click Initiate payment

- Select Investor Category as NII and proceed to select the bid details and confirm

Disclaimer – This content is purely for informational purpose and in no way advice or a recommendation.