Often, when traders spot a great opportunity, they face a dilemma: they want to hold a stock for a few days to let the price rise, but they don’t want to lock up 100% of their capital in a “Delivery” trade. On the other hand, “Intraday” trading offers high leverage (buying power) but forces you to sell your position before the market closes, regardless of profit or loss.

- What is T+5 Pay Later?

- How Does T+5 Pay Later Work?

- Step-by-Step Guide to Using T+5 Pay Later

- Real-World Example: How the Numbers Work

- Where to Find T+5 in the App

- Why Should You Choose T+5 Pay Later?

- Who is This For?

- Eligible Stocks

- Risks and Safety Measures

- Comparison: T+5 vs. Intraday vs. Delivery

- Tips for Success

- FAQs

What if there was a middle ground?

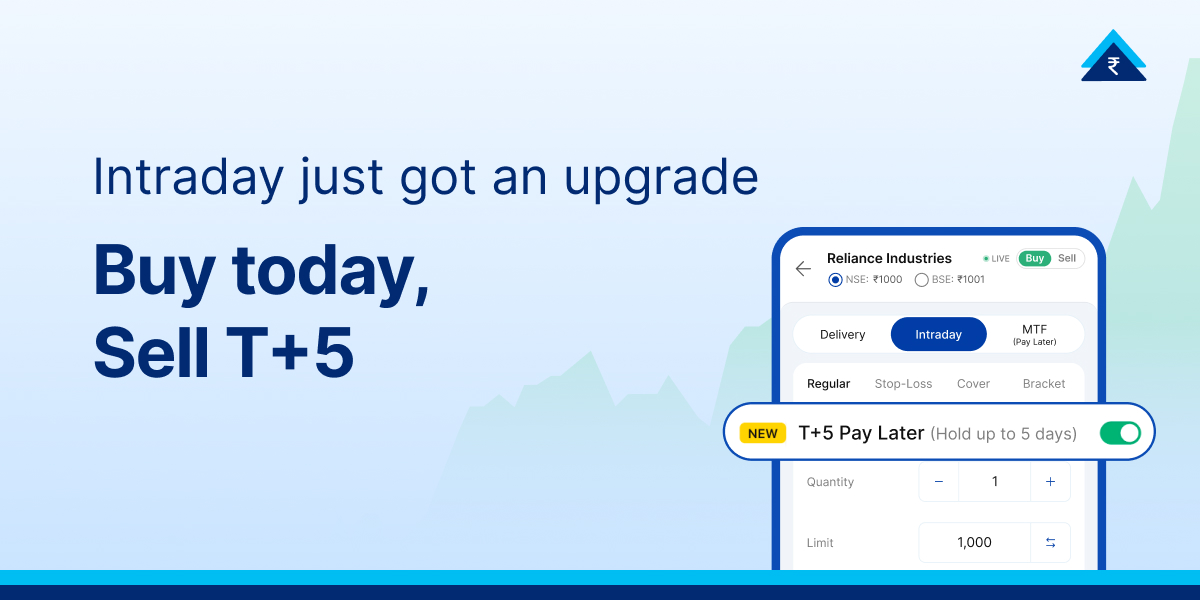

Paytm Money bridges this gap with a feature designed for the modern trader: T+5 Pay Later. This facility allows you to break free from the strict deadlines of intraday trading. It gives you the power to buy stocks with limited capital and the flexibility to hold them for nearly a week. Whether you are looking to capture a short-term trend or simply need a few extra days to fund your account, T+5 Pay Later puts the control back in your hands.

Here is how this feature can transform the way you trade.

What is T+5 Pay Later?

T+5 Pay Later is a feature on Paytm Money that upgrades the traditional Intraday trading experience. While standard Intraday trading requires you to sell your shares (square-off) on the same day you buy them, T+5 Pay Later gives you a longer window. You can hold your positions for up to 5 trading days.

This facility allows you to act on your trading convictions without the pressure of a single-day deadline. It combines the benefits of short-term trading with the flexibility of a longer holding period.

Key Features

- Extended Time: You don’t have to sell on Day 1. You can hold your position for up to 5 days.

- Leverage (Buying Power): You can trade with up to 4X leverage. This means if you have ₹25,000, you might be able to buy shares worth ₹1,00,000. Leverage is essentially using borrowed capital to increase the potential return of an investment.

- Simple Pricing: You pay a flat brokerage fee of ₹20 per trade.

- Interest Only on Usage: You are charged interest (approx. 0.05% per day) only for the days you actually hold the borrowed funds.

- Flexibility: You can convert your trade into a long-term holding (Delivery) anytime by adding the necessary funds.

- Risk Control: If you don’t take action by Day 5, the system automatically closes (squares off) your position.

How Does T+5 Pay Later Work?

The name “T+5” represents the timeline of your trade. “T” stands for the Trade Day (the day you buy the stock), and “+5” refers to the five days you have to settle the position.

- T (Trade Day): You buy a stock using the “Intraday” option but select the “T+5 Pay Later” option.

- T+1 to T+4 (Holding Period): During these days, you monitor the stock’s performance. You can choose to sell, hold, or convert the trade to delivery.

- T+5 (Final Day): This is the deadline. If you haven’t sold the stock or paid the full amount to keep it, the system will automatically sell it for you.

Step-by-Step Guide to Using T+5 Pay Later

Step 1: Placing Your Order

- Open the Paytm Money app and select a stock that is eligible for this feature.

- In the order pad, select “Buy” and choose “Intraday”.

- Look for the “Enable T+5 Pay Later” toggle or checkbox and switch it on.

- Review the details: check how much money you need to pay (your margin) and how much is being funded.

- Place the order. You will be charged the standard flat brokerage of ₹20.

Step 2: Monitoring Your Position

- Once active, your position remains open for up to 5 days.

- Keep an eye on the market. Since you are using leverage, small price changes can have a larger impact on your profit or loss.

- Remember, interest is accumulating daily at roughly 0.05% on the borrowed amount.

Step 3: Exiting or Converting

You have three choices before the 5 days are up:

- Square Off (Sell): Sell the stock anytime between Day 1 and Day 5 to book your profit or loss.

- Convert to Delivery: If you decide you want to keep the stock for the long term, simply add the remaining funds to your account. The trade will convert to a standard “Delivery” trade, meaning you now own the shares fully.

- Auto Square-Off: If you do nothing, the system will automatically sell the shares on the 5th day to recover the borrowed funds.

Real-World Example: How the Numbers Work

Imagine you want to buy shares worth ₹1,00,000 on a Monday using T+5 Pay Later.

- Your Cash (Margin): ₹25,000 (You pay this)

- Borrowed Amount: ₹75,000 (Paytm Money provides this)

- Brokerage Fee: ₹20

- Daily Interest: ~₹50 (calculated as 0.05% of the total value ₹1,00,000)

Here is how different scenarios might play out:

Scenario A: You Sell on Day 3

- Time Held: 3 Days

- Interest Cost: ₹150 (₹50 x 3 days)

- Outcome: You sell the stock, the borrowed ₹75,000 is returned, and you keep the remaining profit (or pay the loss) minus interest and charges.

Scenario B: You Convert to Delivery on Day 2

- Action: You decide to keep the stock. You add ₹75,000 to your account.

- Interest Cost: ₹100 (₹50 x 2 days).

- Outcome: The “loan” is paid off. The shares are moved to your Demat account as a long-term holding.

Scenario C: You Do Nothing (Day 5 Reached)

- Action: The deadline arrives.

- Outcome: The system automatically sells the shares at the current market price.

- Cost: You pay interest for all 5 days.

Where to Find T+5 in the App

You don’t need to activate a special setting; it is integrated into the buying process.

- Login to your Paytm Money app.

- Select a Stock that is eligible (not all stocks allow this).

- Tap Buy.

- Select Intraday (NSE tab).

- You will see the T+5 Pay Later option. Enable it.

- Select your leverage (if adjustable) and confirm the order.

Why Should You Choose T+5 Pay Later?

- More Time to Decide: Unlike standard intraday trading, where you must exit by 3:15 PM, you have a week (5 trading days) to let your trade play out. This reduces the stress of daily volatility.

- Higher Buying Power (Leverage): You can take larger positions with less capital. The app clearly shows you how much leverage you are getting before you trade.

- Path to Ownership: It serves as a bridge between trading and investing. If a short-term trade looks promising for the long term, you can pay the difference and own the stock (Convert to Delivery).

- Transparent Costs: There are no hidden fees. You know exactly what you are paying: ₹20 brokerage and ~0.05% daily interest.

- Automated Management: The system handles the “pledging” (using shares as collateral) automatically, so you don’t have to do it manually.

Who is This For?

Ideal For:

- Swing Traders: People who like to hold stocks for a few days to catch a short-term trend.

- Momentum Traders: Traders looking to profit from specific news or earnings reports over a few days.

- Traders with Limited Capital: Those who want to trade larger volumes than their cash balance would normally allow.

- Flexible Investors: Those who want the option to turn a quick trade into a long-term investment.

Not Suitable For:

- Strict Day Traders: If you never hold positions overnight, standard Intraday is cheaper (no interest).

- Risk-Averse Investors: Leverage works both ways; it amplifies losses just as much as profits.

- Long-Term Investors: If you plan to hold for months, you should buy with full cash (Delivery) to avoid daily interest charges.

Eligible Stocks

Not every stock supports T+5 Pay Later. It is generally available for stocks that are:

- Approved for the Margin Trading Facility (MTF).

- High in liquidity (easy to buy/sell) and volume.

- Permitted by regulators for margin funding.

Always check the order pad to see if the T+5 option appears for the specific stock you are viewing.

Risks and Safety Measures

Using leverage involves risk. Paytm Money has built-in safeguards, but you must understand them.

- Auto Square-Off Risk

The 5-day limit is hard and fast. If you forget to sell or add funds by Day 5, the system will sell your shares. This might happen at a price you don’t like, potentially locking in a loss.

- Market Risk

Since you are trading with borrowed money (leverage), a small drop in the stock price results in a larger percentage loss of your own capital.

- Interest Costs

Interest is charged every single day the position is open, including weekends and holidays. This adds to your “break-even” point—the stock must rise enough to cover both the brokerage and the interest.

- Fund Utilization

If you add money to your account while you have an open T+5 position, that money is automatically used to convert your T+5 position into a Delivery trade. You cannot use those specific funds to open new Intraday trades until the conversion is settled.

Comparison: T+5 vs. Intraday vs. Delivery

| Feature | T+5 Pay Later | Intraday | Delivery |

|---|---|---|---|

| Holding Period | Up to 5 Days | Same Day Only | Unlimited |

| Leverage | Up to 4X | Higher | None (1X) |

| Interest | ~0.05% per day | None | None |

| Auto Square-Off | Yes (Day 5) | Yes (End of Day) | No |

| Conversion | Can convert to Delivery | Cannot convert | N/A |

| Best For | Swing Trading | Day Trading | Long-term Investing |

Tips for Success

- Have an Exit Plan: Know your target profit and “stop-loss” (the price at which you will sell to limit losses) before you buy. Don’t just hope for the best until Day 5.

- Watch the Interest: Calculate if holding the position for another day is worth the extra interest cost. Sometimes taking a small profit early is better.

- Use Alerts: Set price alerts in the app so you don’t have to watch the screen all day.

- Exit Early: Waiting until the final hours of Day 5 can be risky if the market moves against you. Try to close your position by Day 3 or 4.

- Volatility: Be careful with highly volatile stocks. They can swing wildly, potentially triggering margin calls (requests for more money) or hitting circuit limits.

Disclaimer: Investment in the securities market is subject to market risks. Read all the related documents carefully before investing. This content is purely for information purpose only and in no way is to be considered as an advice or recommendation. The securities are quoted as an example and not as a recommendation. Investors are requested to do their own due diligence before investing.

SEBI Reg No.: Broking – INZ000240532, Research Analyst – INH000020086, Depository Participant – IN-DP-416-2019, Depository Participant Number: CDSL – 12088800, NSE (90165), BSE (6707), MCX (57525), NCDEX (1315), MSEI (85300).

Registered Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019.

For complete Terms & Conditions and Disclaimers, visit https://www.paytmmoney.com.

FAQs

Can I convert my T+5 trade to Delivery (long-term) at any time?

+

What happens if I don’t have the funds by Day 5?

+

Is interest charged on weekends?

+

What happens when I add funds to my account?

+

What happens if the stock hits a Lower Circuit?

+

A “Lower Circuit” is a limit set by the exchange below which a stock cannot trade for the day because there are only sellers and no buyers. If your stock hits a lower circuit on Day 5, the system (and you) will be unable to sell the shares. In this situation, you may be forced to add funds to take delivery of the shares, or the position may be auctioned off later, which can result in significant losses.