In a market that moves every second, timing is everything.

Whether you’re investing for the long haul or making quick intraday trades, your ability to act at the right moment — and with the right tool — can define your success. That’s why Paytm Money offers a powerful suite of trading features designed to help you react quickly, manage risk smartly, and execute your strategies with confidence.

Let’s explore 5 powerful order types available on Paytm Money that can make your trading faster, smarter, and more efficient.

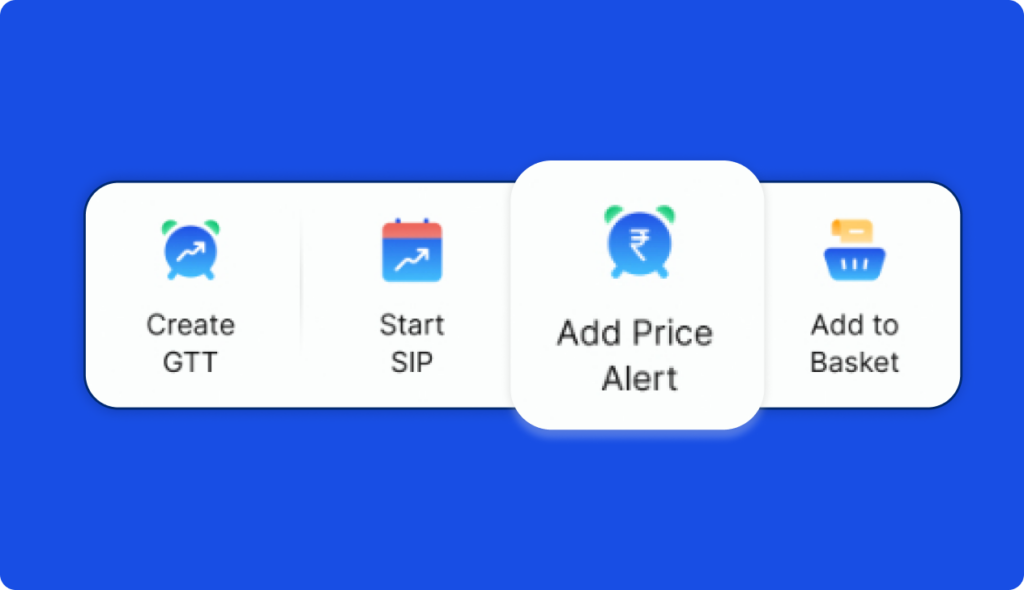

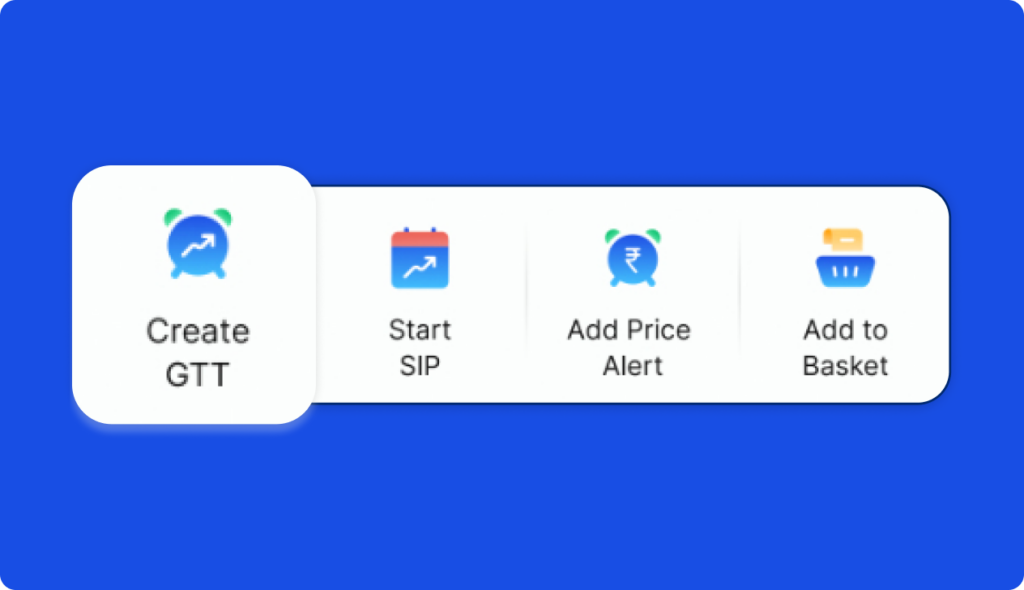

1. Price Alerts

Stay updated, not glued to your screen

Have a specific price in mind before you want to buy or sell a stock? You don’t need to keep checking charts all day. With Price Alerts, you can get notified the moment your stock hits your target price.

Why use it?

- Set your custom entry or exit price.

- Get real-time alerts via the app.

- Perfect for users who prefer manual execution after confirmation.

Example: Want to buy TCS when it dips to ₹3,500? Set a Price Alert and relax. We’ll notify you when it happens.

2. Basket Orders

Plan once. Execute multiple orders together

If you trade multiple stocks or options frequently, Basket Orders are your new best friend. They let you add multiple trades to a single basket and execute them all with one click.

Now also available on the Options Chain, this feature helps you manage complex trades like spreads or straddles with ease.

Why use it?

- Save time by grouping multiple trades.

- Ensure consistent execution across strategies.

- Reduce manual errors in placing multiple orders.

Example: Planning to buy 5 different stocks for your long-term portfolio? Create a basket, set quantities and prices, and place the order in one go.

3. GTT (Good Till Triggered) Orders

Automate your entries and exits

Don’t want to track the markets all day? GTT Orders are for you. With this feature, you can place a buy or sell order that remains active until your trigger condition is met — even if it takes days or weeks.

Why use it?

- Great for swing traders or long-term investors.

- No need to re-enter orders every day.

- Automatically executes at your target price.

Example: Want to buy HDFC Bank at ₹1,400 but it’s trading at ₹1,600? Just set a GTT order and let the system handle the rest.

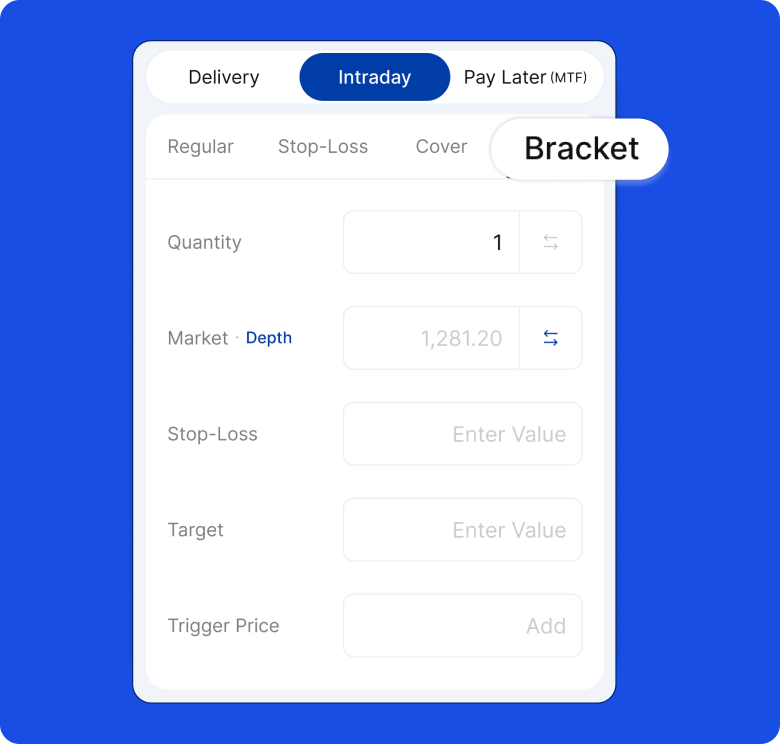

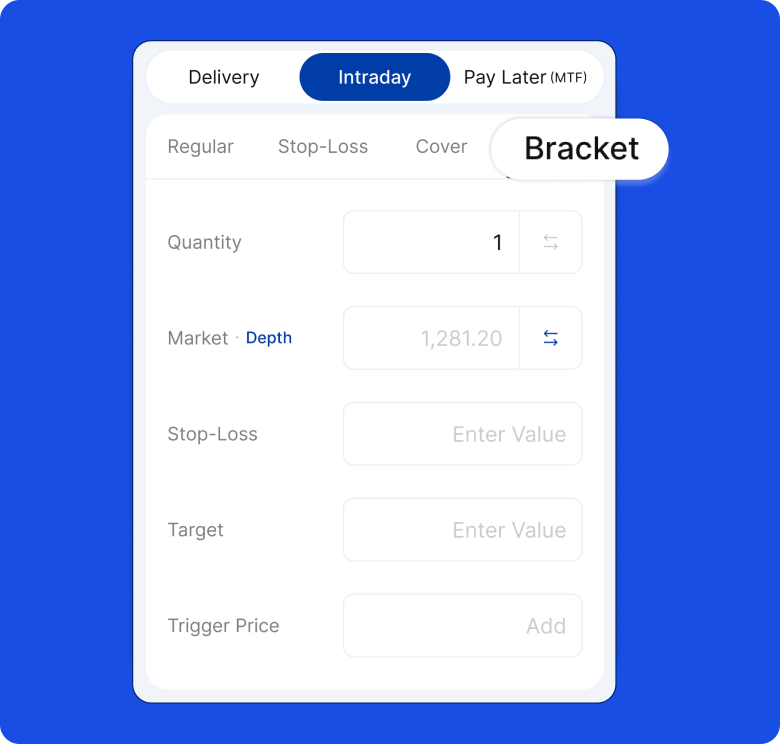

4. Bracket Orders

Control your risk and reward in a single trade

A Bracket Order includes three parts: the main order, a stop-loss order, and a target order. You ‘bracket’ your trade to manage both potential loss and expected gain in one go.

Ideal for intraday traders who want tight control over risk and reward.

Why use it?

- Automatically exits trades at your stop-loss or target.

- Helps avoid emotional decision-making.

- Executes all orders simultaneously for speed.

Example: Buy a stock at ₹100, set a stop-loss at ₹98 and a target at ₹105 — all in one click.

5. Cover Orders

Protect your trade with a mandatory stop-loss

A Cover Order combines a market/limit order with a compulsory stop-loss order. This helps you manage risk instantly, especially when trading in volatile markets.

Like Bracket Orders, Cover Orders are best suited for intraday traders who want to limit downside from the moment they place a trade.

Why use it?

- Reduces chances of heavy loss.

- Comes with lower margin requirements.

- Ideal for short-term and high-speed trading.

Example: Buying a stock at ₹150? With a Cover Order, you must set a stop-loss (say ₹145) — so your risk is controlled right from the start.

Ready to Trade Smarter?

These tools are designed to give you more control, more speed, and more confidence in your trades. Whether you’re new to the markets or an experienced trader, using the right order type can help you stay ahead and trade strategically.

Try these features today on the Paytm Money app.

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. This content is purely for information purpose only and in no way to be considered as an advice or recommendation. The securities are quoted as an example and not as a recommendation. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532, Depository Participant – IN – DP – 416 – 2019, Depository Participant Number: CDSL – 12088800, NSE (90165), BSE (6707), Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. For complete Terms & Conditions and Disclaimers visit: https://www.paytmmoney.com/stocks/policies/terms.