If you’ve ever traded with Margin Trading Facility (MTF), you know the excitement of amplifying your buying power but also the confusion that comes with it. How much margin do I need? What will my interest cost be? Can I really afford to hold this position for 6 Months?

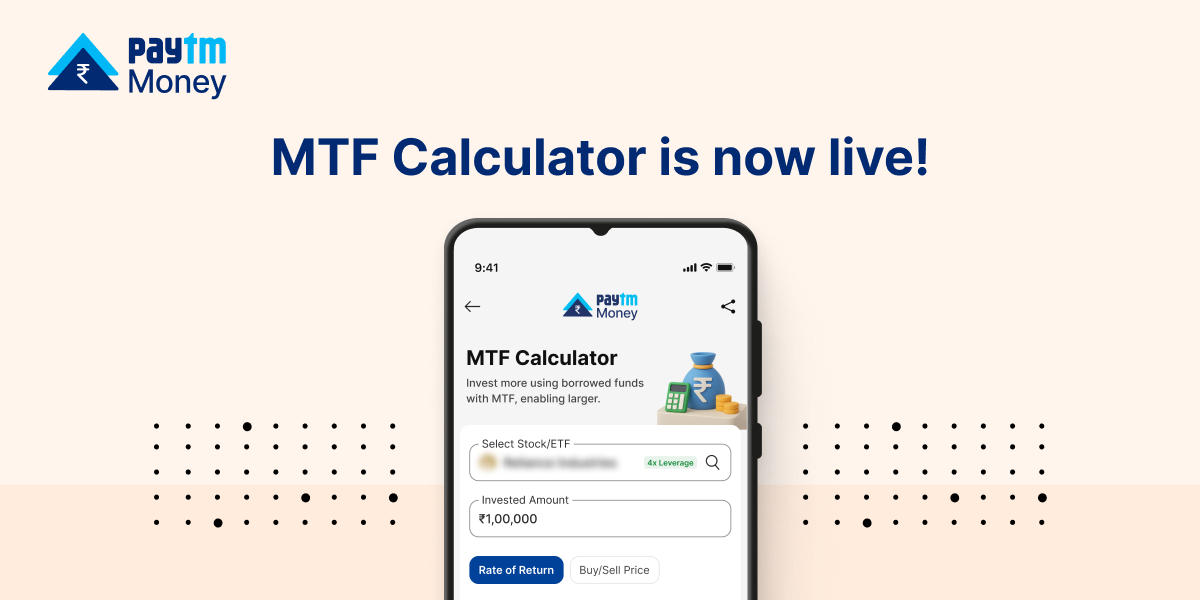

That’s where the MTF Calculator steps in. Think of it as your personal trading clarity tool — giving you instant answers about margin requirements, costs, leverage, brokerage charges and even your potential P&L, all before you hit the buy button.

What is an MTF Calculator?

An MTF Calculator is a self-service tool designed to help traders and investors instantly calculate margin requirements, interest costs, and buying power while using Margin Trading Facility.

Instead of second-guessing or manually crunching numbers, you get clear, accurate, real-time calculations that empower you to make confident trading decisions.

With the Paytm Money MTF Calculator, you can:

- See exactly how much margin is required for any stock.

- Estimate interest & brokerage costs for different holding periods.

- View your buying power like how much extra you can purchase with leverage.

- Compare scenarios of trading with vs. without MTF.

In short, it takes away ambiguity and replaces it with clarity and confidence.

How It Works

Using the MTF Calculator is as simple as 1-2-3:

- Select a Stock & Enter Investment Amount

Choose the stock you want to buy and enter the trade value. - Add Holding Period

Decide how long you want to hold the position. - Get Instant Results

The calculator shows:

- Margin required

- Leverage available

- Interest & brokerage charges

- Total cost of holding

- Scenario analysis (with vs. without MTF)

And the best part? You can tweak the numbers like increase trade size, change duration, or compare outcomes before placing your order directly.

Watch the video to know more – https://www.youtube.com/shorts/gokToEK3pUI

Why You Need It (Risks of Trading Without Calculator)

Trading with leverage can be powerful, but without clarity, it can quickly become risky. Here’s what happens when you don’t use an MTF Calculator:

- Unclear Margin Requirement – You may underestimate or overestimate the funds needed.

- Hidden Costs – Interest charges can eat into profits if you don’t calculate upfront.

- Missed Opportunities – Manual calculations slow you down while markets move fast.

- Errors in Estimation – A small mistake in math can turn profitable trades into losses.

- Lack of Scenario Analysis – Without a tool, you can’t compare how your P&L looks with vs. without leverage.

The MTF Calculator eliminates these risks by showing everything upfront — so you trade smarter, not riskier.

Who Should Use It

The MTF Calculator is designed for anyone exploring or actively using Margin Trading Facility:

- Active Traders & Power Users – Who frequently buy and sell with leverage and want quick cost clarity.

- Young Investors – New to margin trading, curious about exposure, and seeking transparency.

- Mid-to-High Net Worth Users – Managing larger trades and needing precision on interest and margin.

If you fall into any of these groups, this tool helps you save time, reduce errors, and trade with confidence.

Quick Example

Let’s break this down with a practical scenario.

Imagine you want to buy ₹2,00,000 worth of stock using Margin Trading Facility (MTF). Without MTF, you’d need the full amount in your account to execute the trade. But with MTF, it works differently.

- Step 1: Margin Requirement

The MTF Calculator instantly shows that you only need ₹50,000 as upfront margin, while the remaining ₹1,50,000 is financed through MTF. This means you get exposure to a ₹2,00,000 position with just one-fourth of the capital. - Step 2: Interest Cost

Next, you enter the expected holding period — say, 5 days. The calculator immediately displays the interest cost you’ll incur for financing the leveraged amount. This helps you decide whether the potential returns justify the borrowing cost. - Step 3: Scenario Analysis The tool then compares two outcomes side by side:

- Without MTF: You’d only be able to buy stocks worth ₹50,000, limiting your profit potential.

- With MTF: You control stocks worth ₹2,00,000. If the stock price rises 5%, your gains are magnified. Of course, the calculator also shows the associated interest charges so you can see the net benefit clearly.

This kind of transparent calculation ensures that before you take a leveraged trade, you already know:

✔ How much margin you need

✔ What your costs will be

✔ How your profit/loss changes with MTF vs. without MTF

No surprises. Just clarity.

Conclusion

The MTF Calculator isn’t just a feature. It’s a safeguard for smarter trading. By laying out margin requirements, leverage, and costs upfront, it ensures you never walk into a trade blind.

In fact, one of the most common questions traders have is: “Can an MTF Calculator help reduce risk?” The answer is yes. By giving you a clear view of costs and P&L scenarios in advance, it reduces uncertainty, prevents costly mistakes, and builds confidence in your trading decisions.

So whether you’re an active trader, a young investor exploring leverage, or managing larger portfolios, the MTF Calculator is a must-have in your trading toolkit.

👉 Use the MTF Calculator on Paytm Money today and experience the clarity before your next trade.