Yesterday, the Reserve Bank of India (RBI) in consultation with the government imposed a moratorium on Yes Bank till 3rd April, 2020. During this period, normal withdrawals by depositors in the bank have been capped at INR 50,000 per depositor. More importantly, RBI has also superseded the Board of Directors of Yes Bank for a period of 30 days. This has been done to quickly restore depositors’ confidence and take further measures towards the same. RBI has also assured the depositors that their interest will be fully protected and there is no need to panic.

Due to these developments, debt and hybrid mutual funds having exposure to bonds of Yes Bank, saw drop in their NAVs yesterday. Across AMCs, Yes Bank bonds were mostly marked down as per the valuation agencies. However, Nippon Life AMC has completely marked down perpetual bonds of Yes Bank to Zero in all its schemes. In the affected schemes it has also capped fresh inflows to INR 2 lakh per day per scheme per investor.

Exposure of Yes Bank stock in equity mutual fund schemes are largely confined to index funds and ETFs as Yes Bank is part of Nifty 50 index. However, the exposure here is much lesser, the highest being 1.6%.

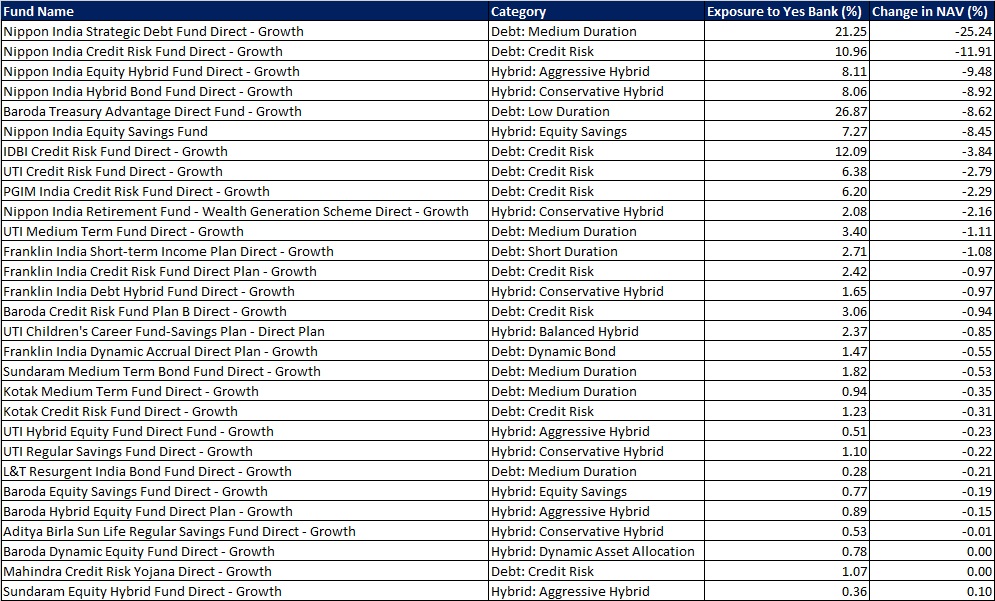

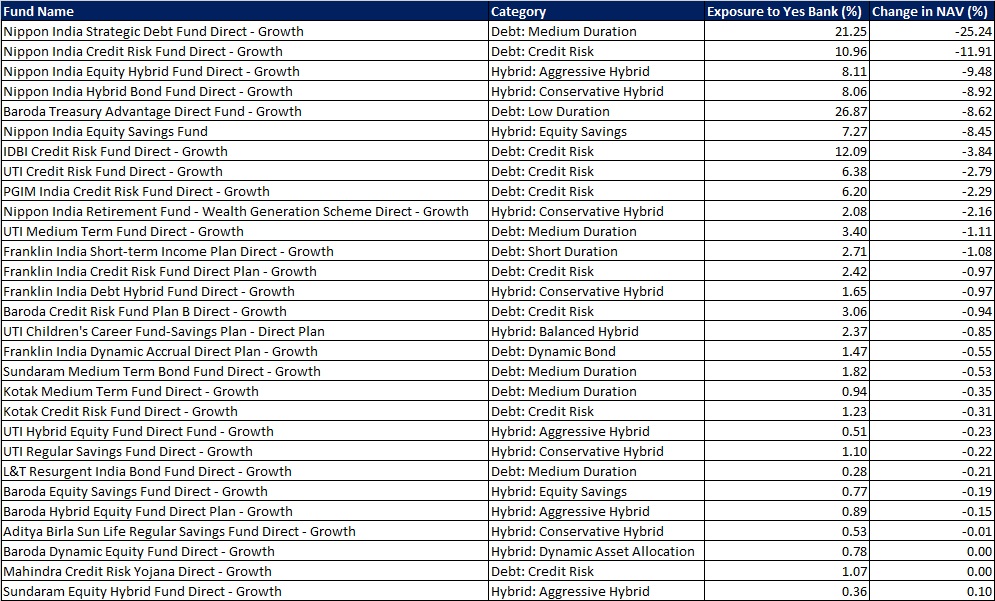

Debt and Hybrid funds having exposure to Yes Bank with one day change in NAV are given below.

Note: Exposure to Yes Bank bonds as a % portfolio as on 31-Jan-2020. One day change in NAV as on 5th March, 2020.Only Direct-Growth scheme variants are shown above.

Investors should note that the situation with respect to Yes Bank and its impact is still evolving.