Contents

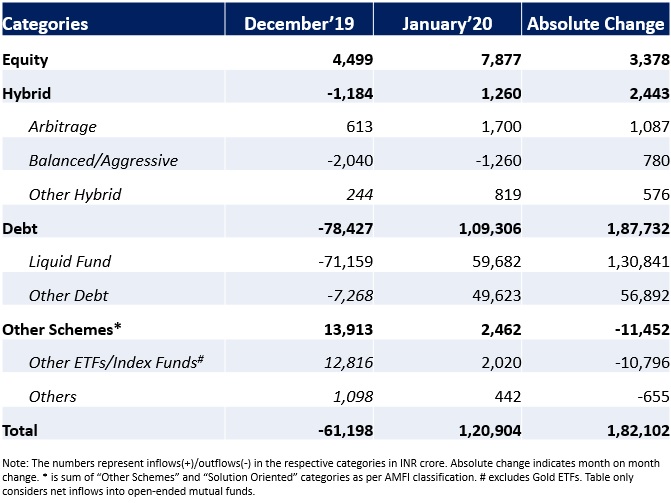

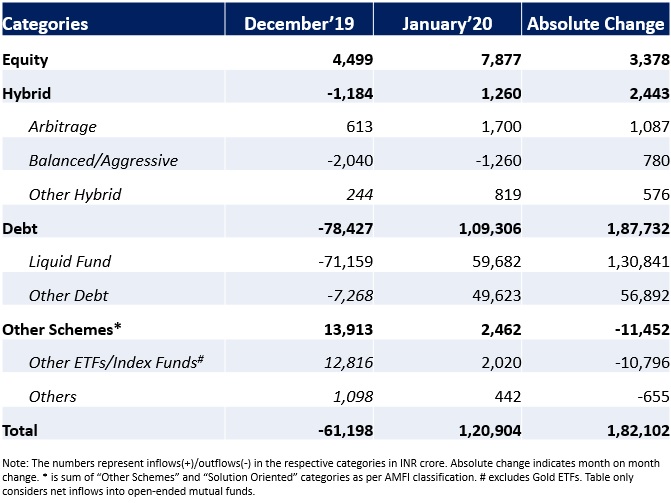

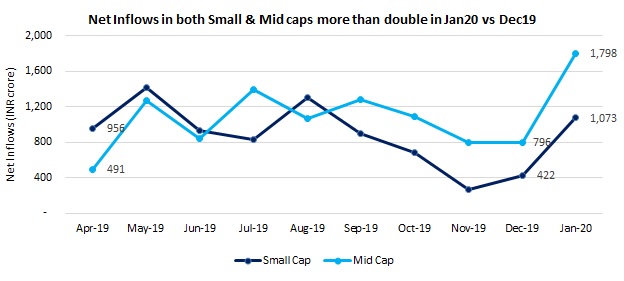

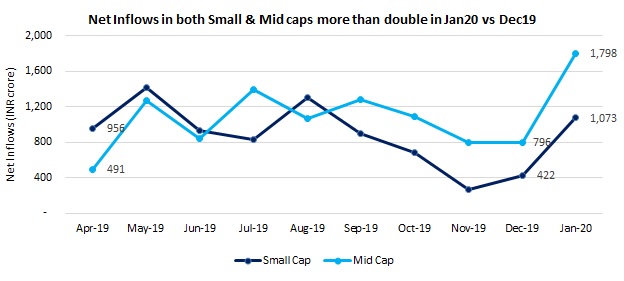

Overall industry AUM jumped almost 5% in January 2020 to a new high of INR 27.85 lakh crore owing to robust inflows in debt as well as equity category. Equity inflows witnessed a 75% growth month-on-month to INR 7,877 crore as investors pumped in investments on hopes of a favourable Union budget. SIP inflows stayed strong at INR 8,532 crore as SIP AUM scaled a new high of INR 3.25 lakh crore.

Equity

• Midcap and small cap category contributed to more than one-third of overall equity net inflows. These categories witnessed huge inflows owing to steep valuation corrections since start of 2018.

• Tata Quant Fund NFO during the month garnered INR 106 crore

Debt

• Net inflows into liquid and overnight categories witnessed huge revival with the start of the new quarter. Inflows into short duration categories like ultra-short, money market, low duration and short duration also stabilized. A couple of overnight fund NFOs and a Ultra-Short fund NFO raised INR 1,987 crore in January.

Hybrid

• Inflows into dynamic asset allocation funds came in at a 5-month high of INR 1,301 crore i.e. a 59% jump relative to December

Other Schemes & Solution Oriented

• ICICI Prudential Midcap 150 ETF and Mirae Asset Nifty Next 50 ETF went live in January and raised INR 41 crores

It is not advisable to take investment decisions based on inflows/outflows as these can be volatile. Your investment decisions should be based on your investment objective, investment horizon and risk profile. Consider investing for long term through SIP as it ensures rupee cost averaging.

Go ahead and start investing through SIP on Paytm Money. It was never simpler! Managing SIPs is seamless. Invest with as low as Rs 100 through SIP on Paytm Money!