Jana Small Finance Bank Limited

To be announced

To be announced

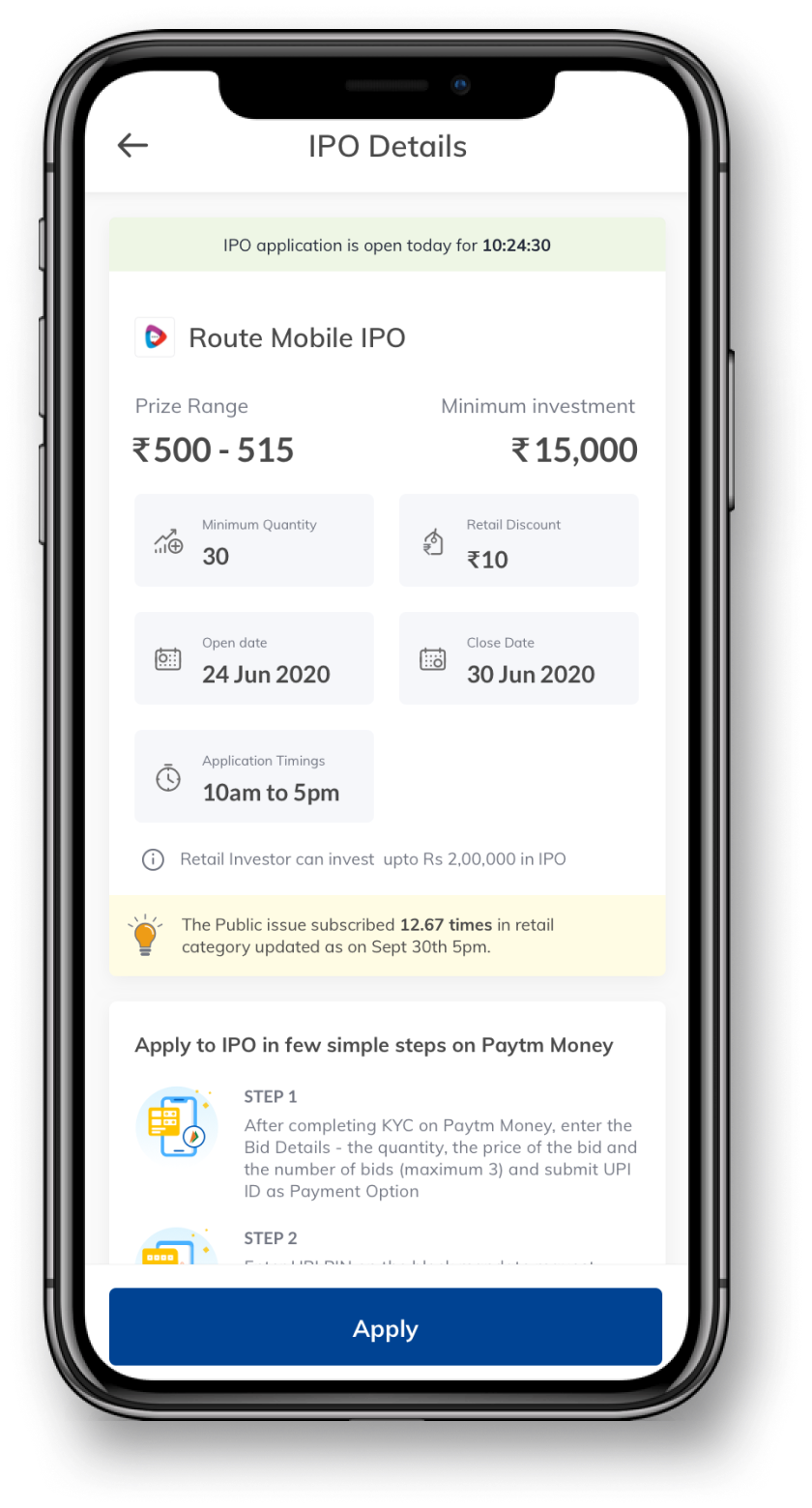

Retail Investor can invest upto Rs 2,00,000 in IPO

About the Company

Prospectus Document

Apply to IPOs using UPI and Paytm Money Demat easily

Invest in your favourite companies from their beginning in stock markets.

Dates

| Offer End | : | - |

| Allotment Finalisation | : | - |

| Refund Initiation | : | - |

| Listing | : | - |

How to Apply for IPOs on Paytm Money

Step 1

Once KYC is done, enter your bid details (quantity, price & no. of bids) and submit UPI ID.

Once KYC is done, enter your bid details (quantity, price & no. of bids) and submit UPI ID.

Step 2

Accept the “Block Funds” request on UPI app

Accept the “Block Funds” request on UPI app

Step 3

If allotted, final amount will be debited otherwise, it will be unblocked.

If allotted, final amount will be debited otherwise, it will be unblocked.

The Bidding Process

- Applying for an IPO is easier than ever with Paytm Money, in just a few clicks your application is processed. You can bid for any IPO through Paytm, the bidding process is simple and hassle free. Every company has a lot size decided & you can buy in multiples of the decided lot.

- If lot size is 15, then you have to bid for multiples of 15 share like 30,45,60 and so on.

- The maximum subscription amount for retail investors is 2 lakh.

- Any bid can be at a desired price or cut off price given by the company.

How to bid on App

- Enter the number of shares you wish to buy, as per the lot size.

- You can apply at the cut off price set by the company or bid for a desired amount within the price band.

- Maximum three bids will be accepted.

- You then need to enter the UPI ID on Paytm Money’s IPO application form.

Investing using UPI

- You will immediately get a fund block request on your UPI for the submitted IPO application.

- The funds will be blocked in your bank account until allotment when it is debited.

- The limit for IPO application is Rs 2 lakh per transaction on UPI.

- On allotment of the shares, the money will be automatically debited.

- If the share aren’t allotted the blocked funds will reflect back into your account.