NAV

₹99.6050

as on 20 Feb 2026, 11:17 PM

₹0.4190(0.42%)

Last Change

Scheme Ratings

5

rated by Value Research

Flexi Cap

Rankings based on | as on Invalid date

×

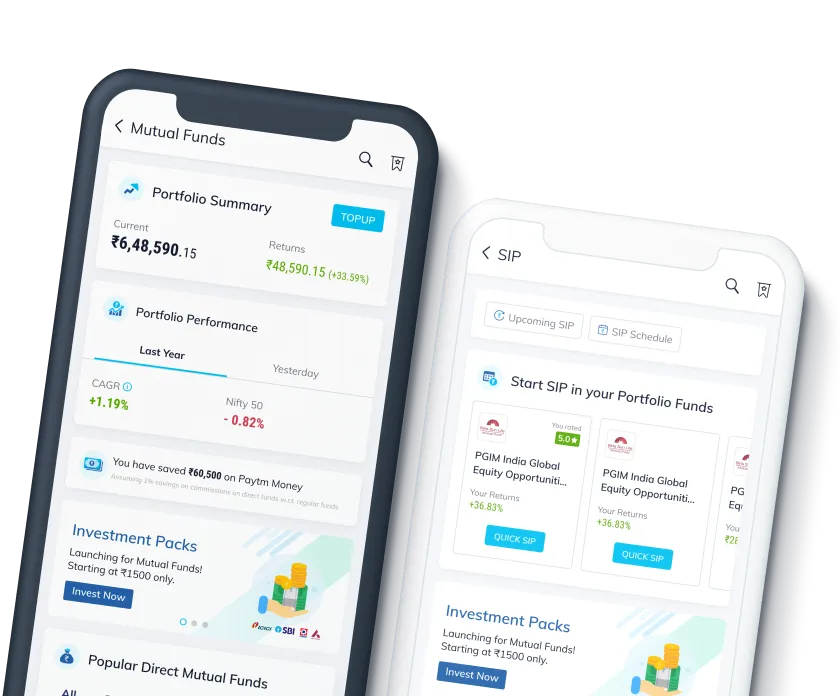

Download the Paytm Money app now!

Invest in Stocks, F&O, Mutual Funds, IPOs, NFOS and Bonds.

Zero brokerage for 30 days

Zero account opening fees

Zero AMC for life

Scan QR code to download the app

Investment Performance

would have given a return of

₹1,10,871

₹1,21,647

₹1,82,415

₹1,86,052

Bank Account

Fixed Deposit

Regular Mutual Fund

This Fund on Paytm Money

This Mutual Fund

₹86,052

Profit (absolute return)

86.05%

in the last

1m

3m

1y

3y

5y

max

+1% Higher Returns

With Direct Plans on Paytm MoneyInvestment Returns

In the last 1 month

1.81%

In the last 3 months

0.19%

In the last 6 months

3.84%

In the last 1 year

16.67%

In the last 3 years

86.05%

In the last 5 years

161.82%

In the last 10 years

494.38%

Absolute Returns

CAGR

Scheme Riskometer

low

low to moderate

moderate

moderately high

high

very high

Investors understand that their principal will be at very high risk

Scheme Information

HDFC Flexi Cap Direct Plan-IDCW Reinvestment

as of 31 Jan 2026, 05:30 AM

₹97,451.56 Cr

Scheme Asset Size

Fund Type

Open-End

Exit Load

Exit load of 1% if redeemed within 1 year

0.69%

Expense Ratio

Plan

Dividend

Benchmark

NIFTY 500 Total Return Index

Exit Load

Exit load of 1% if redeemed within 1 year

Scheme Document

Sectors Holding in this Mutual Fund

as on 31 Jan 2026

Financial

34.58%

₹33,698.75 Cr

Automobile

11.90%

₹11,596.74 Cr

Healthcare

6.72%

₹6,548.75 Cr

Technology

6.29%

₹6,129.70 Cr

Metals & Mining

4.38%

₹4,268.38 Cr

Others

36.13%

₹35,209.25 Cr

View All

View All

Companies Holding in this Mutual Fund

as on 31 Jan 2026

ICICI Bank Ltd.

8.90%

₹8,673.19 Cr

HDFC Bank Ltd.

7.82%

₹7,620.71 Cr

Axis Bank Ltd.

7.59%

₹7,396.57 Cr

State Bank of India

4.86%

₹4,736.15 Cr

Others

70.83%

₹69,024.94 Cr

View All

View All

This fund's returns:

22.97%Return Duration

3 Years

ICICI Prudential Focused Equity Fund Direct-Growth

EquityFlexi Cap

Min. Investment

₹100

Category Returns

3.42%

27.56%

3Y Returns

24.46

Bank of India Flexi Cap Fund Direct-Growth

EquityFlexi Cap

Min. Investment

₹1000

Category Returns

3.42%

27.56%

3Y Returns

23.50

Invesco India Focused Fund Direct - Growth

EquityFlexi Cap

Min. Investment

₹101

Category Returns

3.42%

27.56%

3Y Returns

23.29

About HDFC Flexi Cap Direct Plan-IDCW Reinvestment

HDFC Flexi Cap Direct Plan-IDCW Reinvestment is a Equity mutual fund scheme from HDFC Mutual Fund. This scheme was launched on Invalid date. It has an AUM of ₹97,451.56 Crores and the latest NAV decalared is ₹99.605 as on 22 Feb 2026 at 8:25 pm.

HDFC Flexi Cap Direct Plan-IDCW Reinvestment scheme return performance in last 1 year is 16.67%, in last 3 years is 86.05% and 668.27% since scheme launch. The min. SIP amount to invest in this scheme is ₹100.

Scheme Details

| AUM: | ₹97,451.56 Cr |

| Category: | Equity: Flexi Cap |

| Launch Date: | Invalid date |

| Fund Type: | Open-End |

AMC Information

HDFC Mutual Fund

View AMC Details

₹9,37,232.21 Cr

AUM

171

Schemes

Address

"HDFC House", 2nd Floor, H. T. Parekh Marg, 165-166, BackbayReclamation, Churchgate400020

Phone Number

Phone : 022 – 66316333

Fax : 022 – 66580203

Email / Website

Start investing in minutes

Download app to Explore

Scan this QR code to download the app now!

Or download from