NAV

₹38.2401

as on 18 Feb 2026, 11:18 PM

₹-0.0038(0.01%)

Last Change

Scheme Ratings

1

rated by Value Research

Dynamic Bond

Rankings based on | as on Invalid date

×

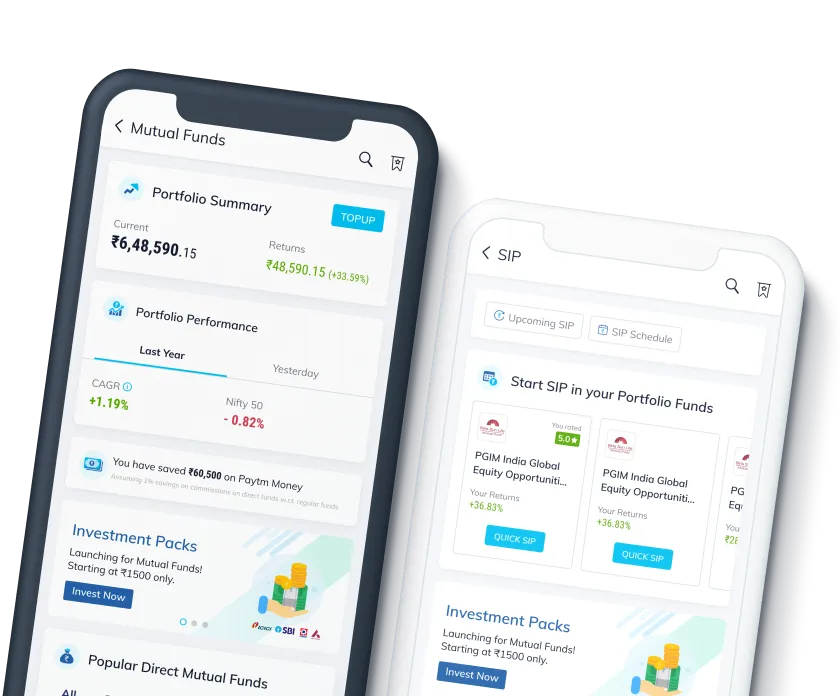

Download the Paytm Money app now!

Invest in Stocks, F&O, Mutual Funds, IPOs, NFOS and Bonds.

Zero brokerage for 30 days

Zero account opening fees

Zero AMC for life

Scan QR code to download the app

Investment Performance

would have given a return of

₹1,10,871

₹1,21,647

₹1,20,967

₹1,24,140

Bank Account

Fixed Deposit

Regular Mutual Fund

This Fund on Paytm Money

This Mutual Fund

₹24,140

Profit (absolute return)

24.14%

in the last

1m

3m

1y

3y

5y

max

+1% Higher Returns

With Direct Plans on Paytm MoneyInvestment Returns

In the last 1 month

0.68%

In the last 3 months

0.88%

In the last 6 months

2.92%

In the last 1 year

4.50%

In the last 3 years

24.14%

In the last 5 years

33.12%

In the last 10 years

111.77%

Absolute Returns

CAGR

Scheme Riskometer

low

low to moderate

moderate

moderately high

high

very high

Investors understand that their principal will be at moderate risk

Scheme Information

Bandhan Dynamic Bond Fund Direct-Growth

as of 31 Jan 2026, 05:30 AM

Sectors Holding in this Mutual Fund

as on 31 Jan 2026

Cash Holding

14.70%

₹334.45 Cr

Others

85.30%

₹1,940.45 Cr

Companies Holding in this Mutual Fund

as on 31 Jan 2026

Indian Railway Finance Corporation Ltd.

11.07%

₹251.83 Cr

National Bank For Agriculture & Rural Development

9.82%

₹223.39 Cr

Small Industries Devp. Bank of India Ltd.

8.75%

₹199.05 Cr

Bajaj Housing Finance Ltd.

8.29%

₹188.59 Cr

Others

62.07%

₹1,412.00 Cr

View All

View All

Companies Holding in this Mutual Fund

as on 31 Jan 2026

Indian Railway Finance Corporation Ltd.

11.07%

₹251.83 Cr

National Bank For Agriculture & Rural Development

9.82%

₹223.39 Cr

Small Industries Devp. Bank of India Ltd.

8.75%

₹199.05 Cr

Bajaj Housing Finance Ltd.

8.29%

₹188.59 Cr

Others

62.07%

₹1,412.00 Cr

View All

View All

Instruments Holding in this Mutual Fund

as on 31 Jan 2026

Debenture

30.45%

₹692.60 Cr

CD

16.37%

₹372.40 Cr

Bonds

15.44%

₹351.24 Cr

Reverse Repo

12.63%

₹287.26 Cr

NCD

11.07%

₹251.87 Cr

Others

14.04%

₹319.39 Cr

View All

View All

Instruments Holding in this Mutual Fund

as on 31 Jan 2026

Debenture

30.45%

₹692.60 Cr

CD

16.37%

₹372.40 Cr

Bonds

15.44%

₹351.24 Cr

Reverse Repo

12.63%

₹287.26 Cr

NCD

11.07%

₹251.87 Cr

Others

14.04%

₹319.39 Cr

View All

View All

This fund's returns:

7.46%Return Duration

3 Years

360 ONE Dynamic Bond Fund Direct-Growth

DebtDynamic Bond

Min. Investment

₹1000

Category Returns

6.04%

8.77%

3Y Returns

8.77

ICICI Prudential All Seasons Bond Fund Direct Plan-Growth

DebtDynamic Bond

Min. Investment

₹100

Category Returns

6.04%

8.77%

3Y Returns

8.29

Kotak Dynamic Bond Fund Direct-Growth

DebtDynamic Bond

Min. Investment

₹100

Category Returns

6.04%

8.77%

3Y Returns

8.24

About Bandhan Dynamic Bond Fund Direct-Growth

Bandhan Dynamic Bond Fund Direct-Growth is a Debt mutual fund scheme from Bandhan Mutual Fund. This scheme was launched on Invalid date. It has an AUM of ₹2,274.86 Crores and the latest NAV decalared is ₹38.240 as on 20 Feb 2026 at 1:46 pm.

Bandhan Dynamic Bond Fund Direct-Growth scheme return performance in last 1 year is 4.50%, in last 3 years is 24.14% and 179.91% since scheme launch. The min. SIP amount to invest in this scheme is ₹100.

Scheme Details

| AUM: | ₹2,274.86 Cr |

| Category: | Debt: Dynamic Bond |

| Launch Date: | Invalid date |

| Fund Type: | Open-End |

AMC Information

Bandhan Mutual Fund

View AMC Details

₹1,94,296.46 Cr

AUM

202

Schemes

Address

One World Centre, 6th Floor, Tower 1C,Senapati Bapat Marg, Prabhadevi400013

Phone Number

Fax : 24215052 / 24215051

Email / Website

Start investing in minutes

Download app to Explore

Scan this QR code to download the app now!

Or download from