Just In: Now Adding Multiple SIPs to the Same Fund Simplified2 min read

We have been listening to you and endeavor to make your mutual fund investing experience convenient and smarter.

SIP-based investing in mutual funds is a disciplined way to accumulate wealth over the long term. We are glad to announce our efforts in this regard — bringing new features to help you stay committed to your SIPs and realise the benefits of long-term investing.

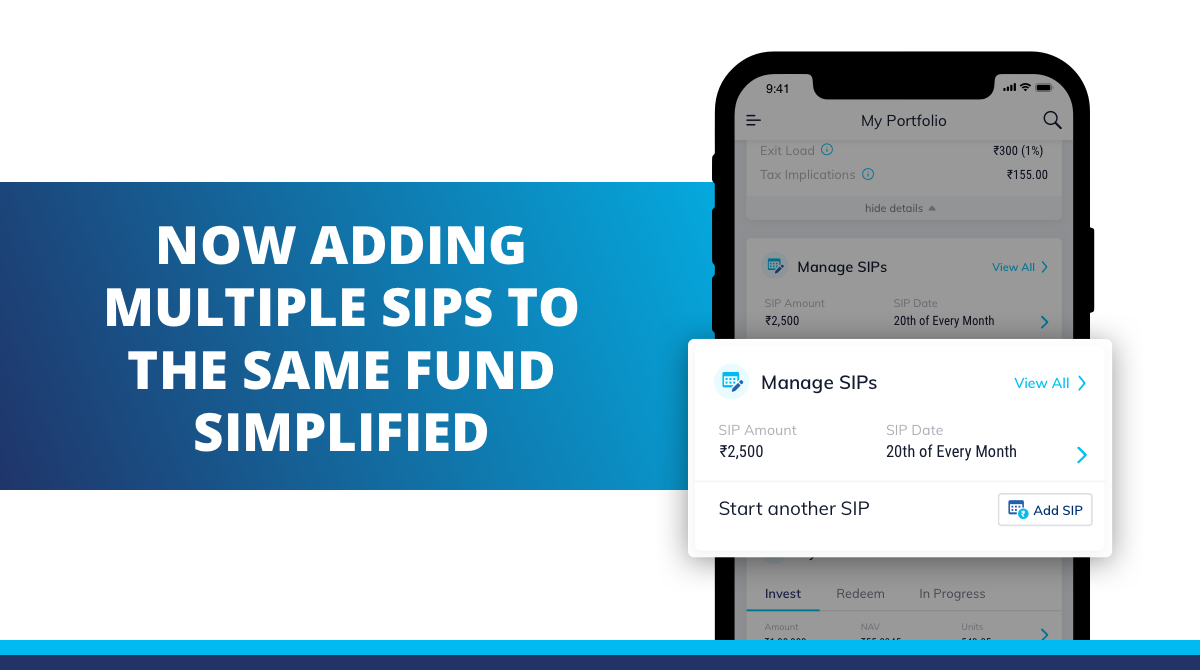

Be it Auto Pay based on the Net Banking mandate or the flexibility to manage SIPs, we continually strive to make your investing experience seamless and stress-free. Many of our investors requested for the option to add multiple SIPs to the same mutual fund scheme, driving us to come up with a new feature in support of this request — the Multi-SIPs.

Now you will be able to add multiple SIPs on different/same dates to the same mutual fund scheme of your choice. It not only makes investing via SIPs convenient but also helps to spread out the risks involved in investing bigger amounts.

How to add Multiple SIPs?

In 4 simple steps you can now add Multiple SIPs:

- Login to the Paytm Money app.

- In the ‘Portfolio’ section, click on the ‘Investments at Paytm Money’.

- Click on the mutual fund scheme in which you want to add multiple SIPs.

- Under ‘Manage SIP’, click on ‘Add SIP’.

To enjoy the benefits of the Multi-SIP feature, you should have previously done SIPs in a mutual fund scheme on our app. While adding multiple SIPs for various financial goals, make sure that the fund category matches your goal’s investment horizon.

How does the Multi-SIP benefit?

Multi-SIPs is one of the newest features on the Paytm Money App which intends to simplify the management of SIPs. Let’s have a look at its various benefits:

Invest for multiple goals: You can add multiple SIPs to the same fund for different financial goals like wealth creation, planning for retirement, children’s higher education, and the likes. This allows you to aim for multiple goals simultaneously and takes away the stress of asset allocation.

Make the best use of multiple incomes: If you receive incomes at different dates of a month you can use the same to add multiple SIPs to the same mutual fund. Thus, instead of leaving them idle in the savings bank account, you could step-up your investments.

Averaging out of costs: As the fund NAV changes daily, and cannot be predicted with certainty, adding multiple SIPs to the same fund helps to average out NAV during market swings.

Investing is simplified and made convenient on Paytm Money. If you haven’t invested in mutual funds, then download the Paytm Money app and get investment ready within minutes.

Happy Investing :- )

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Past performance is not an indicator of future returns.