Contents

After a huge fall in the month of March, overall industry AUM grew 7.5% month-on-month (MoM) to come in at INR 23.93 lakh crore in April. This was because inflows into debt category witnessed a comeback with the start of a new quarter and the equity market rose by over 14% in the month of April.

Though inflows into equity categories moderated, net inflows at an overall level recovered relative to March and came in at INR 55,224 crore in April 2020. Equity net inflows fell by 47% month-on-month (MoM) to INR 6,213 crore in April.

SIP inflows for the month of April witnessed a marginal fall of 3% to INR 8,376 crore. Inflows through SIP have continued to remain strong and above INR 8,000 crore for the 17th month in a row now.

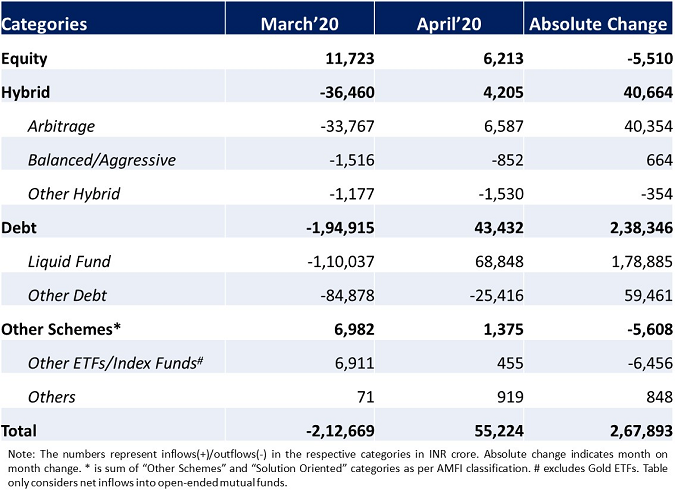

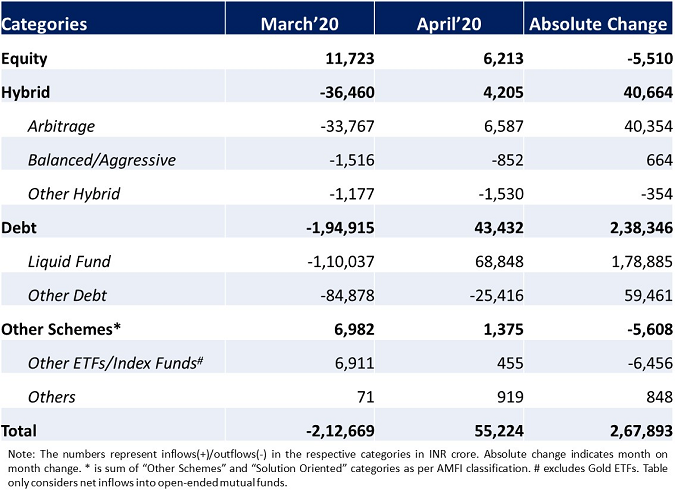

The following table shows the net inflows into various mutual fund categories in March and April 2020:

For simplicity of understanding let’s focus on the flows of open ended mutual fund categories only. Some of the salient points are highlighted.

Equity

- Net inflows into most of the equity categories apart from small cap witnessed more than 50% fall MoM as uncertainty in the markets continued. Inflows into small cap grew in April albeit on a lower base

- Highest inflow of INR 1,691 crore was in the large cap category reflecting the risk off sentiment prevalent among investors

Debt

- Inflows into liquid funds revived coming in at INR 68,848 crore with the start of a new quarter

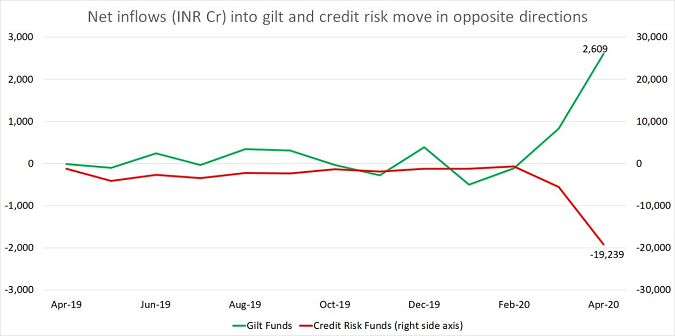

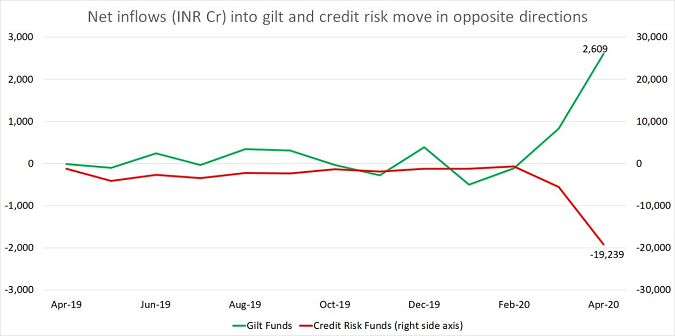

- The debt categories like credit risk, medium duration etc. which take on more credit risk witnessed heightened outflows in the month of April

- In contrast inflows into relatively safer debt categories like gilt, corporate bond, banking & PSU debt fund and long duration funds increased

- Inflows into gilt funds rose 3.4 times to INR 2,516 crore while that into credit risk funds saw huge outflows to the tune of INR 19,239 crore in April. Investors’ move to safety is pretty evident from the following graph

Hybrid

- Overall inflows into the hybrid category turned positive to INR 4,205 crore in April

- Inflows into Arbitrage category was at INR 6,587 crore while all the other hybrid categories witnessed outflows

Other Schemes & Solution Oriented

- Gold ETFs witnessed significant inflows in April at INR 731 crore demonstrating investors’ move towards safer asset class

- NFOs of L&T Nifty 50 Index Fund, L&T Nifty Next 50 Index Fund and Motilal Oswal S&P 500 Index Fund during the month garnered INR 158 crore

Markets continue to face significant volatility and uncertainty. In such an environment it is advisable for investors to keep their SIPs going and stick to their risk profile based asset allocations.

Go ahead and start investing through SIP on Paytm Money. It was never simpler! Managing SIPs is seamless. Invest with as low as Rs 100 through SIP on Paytm Money!