Simplifying AMFI Monthly Mutual Fund Report : December 20191 min read

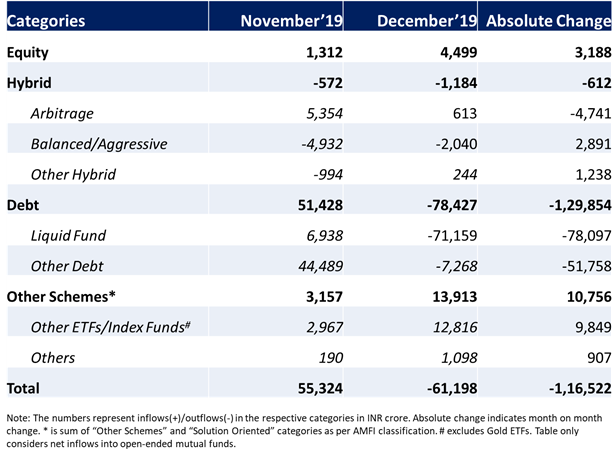

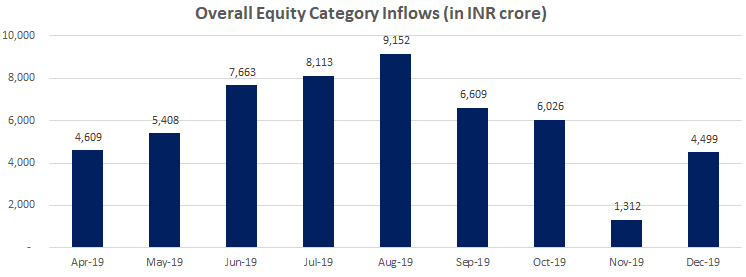

After a lull in November, equity inflows bounced back strongly in December coming in at INR 4,499 crores amid markets touching all-time highs due to easing US-China trade tensions. SIP inflows scaled a new high of INR 8,518 crores. Overall industry AUM witnessed a 1.9% fall to INR 26.5 lakh crore owing to huge redemption from the debt category due to quarter end phenomenon.

Highlights for the month of December’19

Equity

- Focused funds inflow at INR 1,837 crore was the biggest contributor to overall equity inflows in December 2019, owing to Tata Focused Fund NFO which mopped up INR 1,375 crore alone

Debt

- Liquid, overnight along with shorter duration categories like ultra-short, low duration and money market witnessed huge outflows as corporates redeemed their investments for quarterly advance tax outgo

Hybrid

- Inflows into arbitrage funds witnessed a massive 89% drop to INR 613 crore in December relative to previous month. This was after seven months of healthy inflows into the category

Other Schemes & Solution Oriented

- The success of the Bharat Bond ETFs which mopped up INR 12,378 crore led to massive inflows in the other ETFs category

- NFO of Axis Retirement Fund garnered INR 863 crore, leading to a sudden spike in solution oriented category inflows

It is not advisable to take investment decisions based on inflows/outflows as these can be volatile. Your investment decisions should be based on your investment objective, investment horizon and risk profile. Consider investing for long term through SIP as it ensures rupee cost averaging.

Does this sound complicated? To simplify this, we have created ‘Investment Packs’ on Paytm Money. So what are you waiting for? Invest Now!