Simplifying AMFI Monthly Mutual Fund Report: June 20203 min read

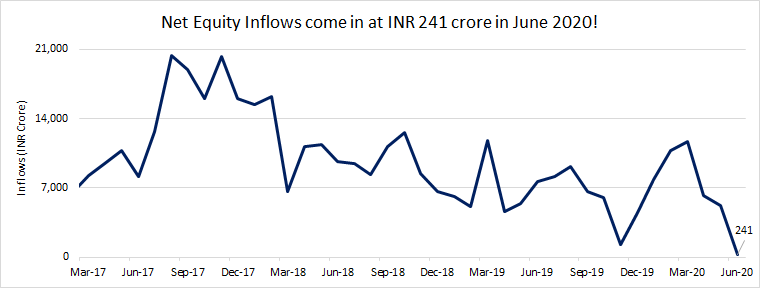

The mutual fund industry witnessed a growth of 3.8% in overall AUM to INR 25.38 lakh crore month-on-month (MoM) in June. This was on the back of a phenomenal rally in both equity as well as debt asset classes. But, this was negated to some extent by investors booking profits accrued during June. Thus, net inflows into equity funds touched a new low since 2017 to INR 241 crore. Debt funds also witnessed a steep fall in net inflows to INR 2,862 crore a 96% fall compared to May, due to advance tax payments by corporates. This resulted in the overall inflows into open ended mutual funds to fall by 89% in June to INR 8,466 crore relative to May.

SIP inflows broke an 18-month streak to fall below INR 8,000 crore in June 2020. The main reason behind the same is the SIP-pause facility that was availed to investors by many asset management companies (AMCs) due to the ongoing COVID-19 crisis which impacted investor cash flows. Inflows into SIP saw a 2.4% decline in June to INR 7,927 crore vis-à-vis May.

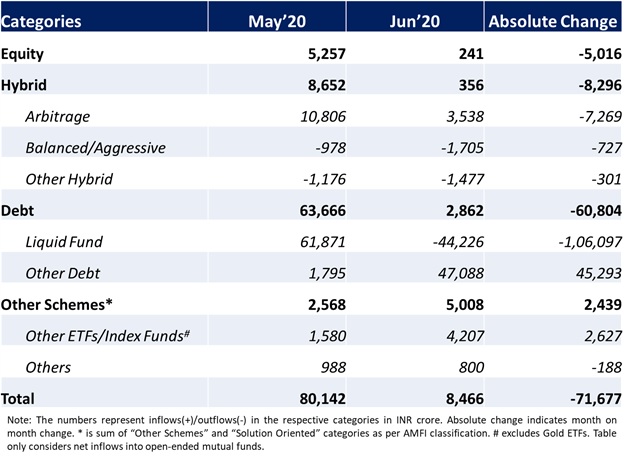

The following table shows the net inflows into various mutual fund categories in May & June 2020:

For simplicity of understanding let’s focus on the flows of open ended mutual fund categories only and highlight some salient points.

Equity

• Large cap and Multi cap categories witnessed outflows for the first time since 2019. Outflows from Large cap category stood at INR 213 crore while that from Multi cap was at INR 778 crore

• Investments into equity categories came in at INR 13,760 crore while redemptions were at INR 13,520 crore. Equities witnessed heightened redemptions during the month of June which might be ascribed to the huge rally seen in the markets during the month

• BOI AXA AMC came out with a multi cap fund NFO during the month which garnered INR 32 crore

Debt

• Net inflows into Low Duration, Short Duration and Corporate Bond witnessed all-time highs since 2019 coming in at INR 12,236 crore, INR 8,324 crore and INR 10,737 crore respectively irrespective of advance tax payments by corporates

• There was a massive outflow of INR 44,226 from liquid funds owing to quarter end phenomenon

Hybrid

• The month witnessed the NFO of Mirae Arbitrage fund which collected INR 152 crore

• Outflows from hybrid schemes excluding arbitrage continued for 11th month in a row now

• Net inflows into the category fell more than 95% MoM to INR 356 crore in June

Other Schemes & Solution Oriented

• Nippon AMC launched a sectoral ETF i.e. the Nippon India ETF Nifty IT during the month

• Inflows into Gold ETFs registered a 39% fall MoM to INR 494 crore

Investors should not be bothered by industry data nor should they consider the trend as a buy or sell call. It is advisable to continue to stick to your asset allocation and to invest via SIP route into equities. Sticking to your asset allocation ensures you do not take on additional risks while SIP investing provides you the benefit of rupee cost averaging. So, continue your SIPs according to your investment objective, investment horizon and risk profile.

Go ahead and start investing through SIP on Paytm Money. It was never simpler! Managing SIPs is seamless. Invest with as low as Rs 100 through SIP on Paytm Money!