Simplifying AMFI Monthly Mutual Fund Report: March 20203 min read

Equity oriented schemes witnessed good inflows in March 2020 whereas all other categories witnessed huge outflows amid the ongoing COVID-19 crisis. Net inflows into open ended equity funds jumped 8.6% month-on-month (MoM) to INR 11,723 crore in March, coming in at a 12-month high. But, overall net outflows from open ended mutual funds stood at INR 2.12 lakh crore in March, highest since September 2018 (IL&FS crisis).

Overall industry AUM dipped 18.2% MoM to INR 22.26 lakh crore in March, mainly due to the fall in equity markets and corporates withdrawing from debt funds. Benchmark indices Nifty and Sensex fell by 23% in March 2020.

However, the COVID-19 crisis did not impact retail investors and they continued investing via SIP route as the inflows through SIP touched record highs of INR 8,641 crore. SIP inflows remained above INR 8,000 crore for the 16th month straight.

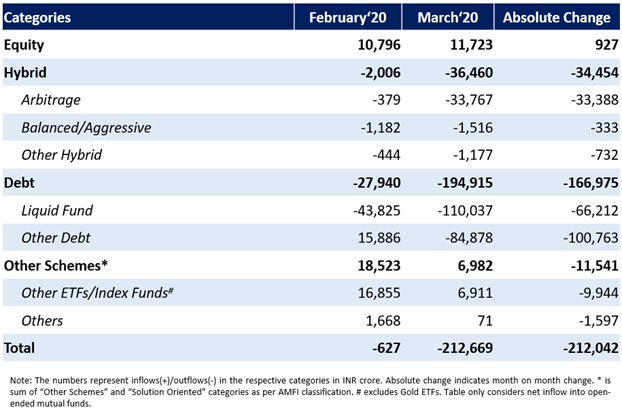

The following table shows the net inflows into various mutual fund categories in Feb and March 2020:

For simplicity of understanding, we are focussing on the flows in open ended mutual funds only while highlighting the key takeaways in following categories:

Equity

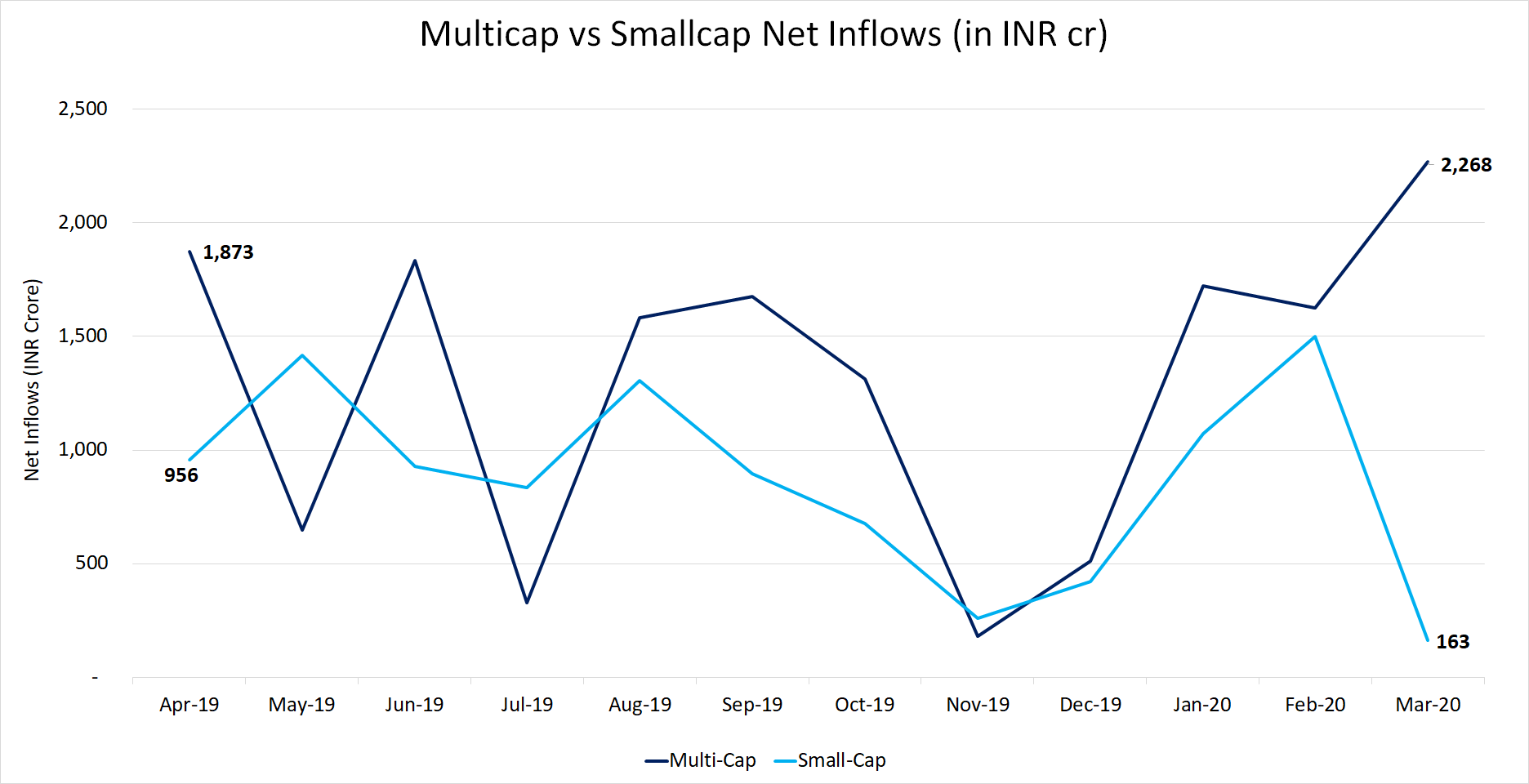

- Net inflows into Multi cap funds jumped 40% MoM and touched a 12-month high

- Where as inflows into small cap funds declined steeply by 89% MoM and touched a 12-month low

- Net inflows into Mid cap category declined by 15% inspite of an NFO from Union Mutual Fund

- After seeing outflows for 5 consecutive months, Value/Contra funds witnessed inflows of INR 828 crore

Debt

- All of the debt categories (except Overnight, Long Duration and Gilt funds) witnessed huge outflows mainly attributed to corporates withdrawing money at the end of quarter to pay advance tax and for other requirements due to the COVID-19 crisis

- Outflows from Liquid Funds were INR 1.10 lakh crore, highest since September 2018

- BPSU category witnessed an outflow of INR 6,000 crore in March, the first in last 12 months

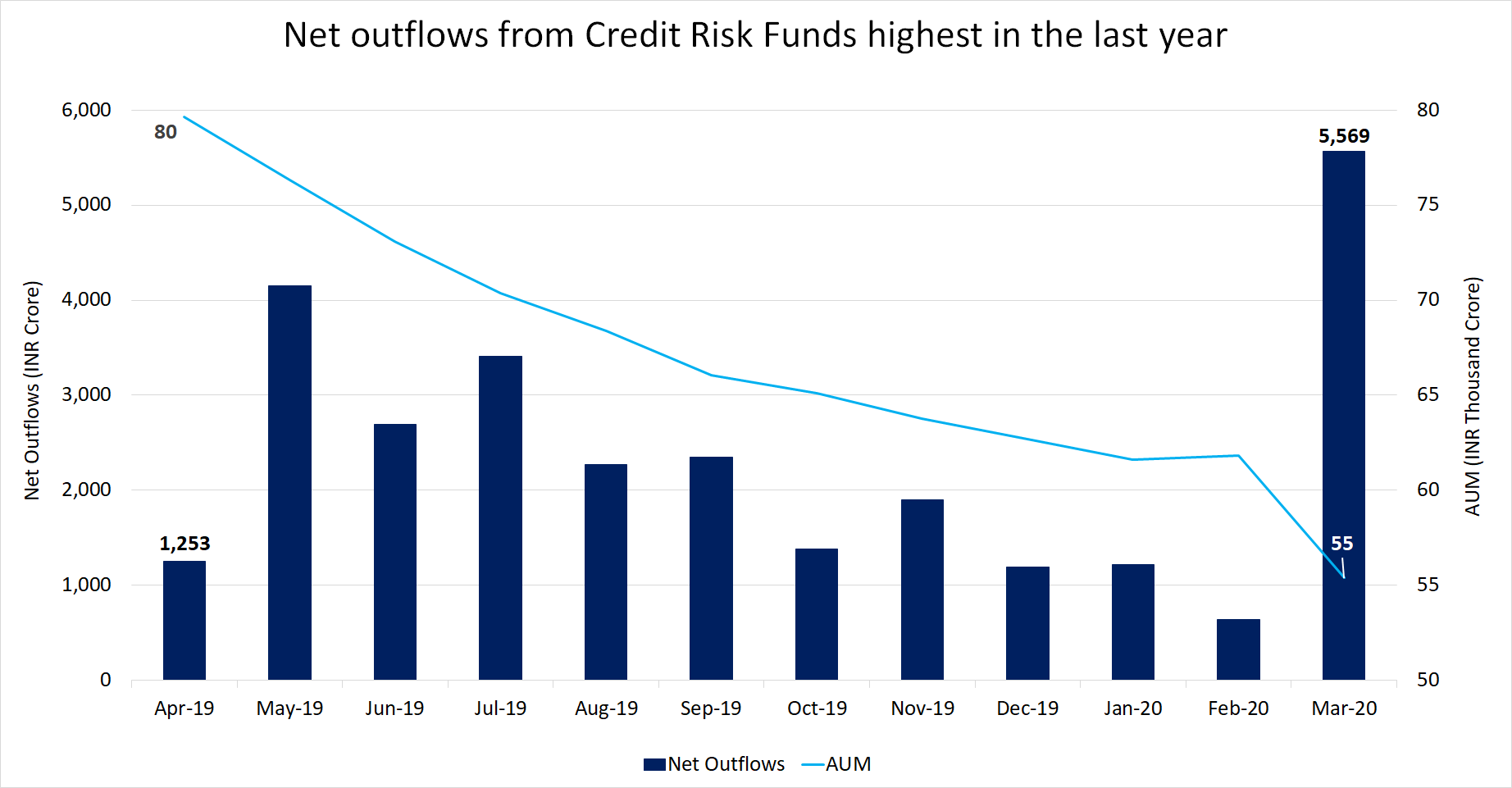

- There were outflows of INR 5,569 crore from Credit Risk category, an 8-time jump MoM

- AUM of Credit Risk category dropped from INR 80,000 crore to INR 55,000 crore in the last 1 year

- Inflows into Overnight Funds were INR 26,000 crore, highest till date and the AUM also touched a new high

Hybrid

- All the categories of Hybrid funds except for Multi Asset Allocation funds saw heavy outflows

- NFO from Tata AMC in Multi Asset Allocation category garnered INR 363 crore making the overall flows in the category positive

- NFO of Sundaram Balanced Advantage Fund garnered INR 485 crore

Other Schemes & Solution Oriented

- Inflows into Index Funds category touched a 12-month high of INR 2,000 crore

- NFO of Edelweiss US technology Equity Fund of Fund raised INR 89 crore and helped the “Fund of funds investing overseas” category inflows to touch INR 197 crore

Given the current volatility in the markets, it is advisable to invest in equity oriented schemes via SIP route. SIP investments will help in rupee cost averaging. So, continue your SIPs according to your investment objective, investment horizon and risk profile.

Investing in SIPs was never simpler! Go ahead and invest through SIP on Paytm Money for as low as INR 100!