Simplifying AMFI Monthly Mutual Fund Report: May 20202 min read

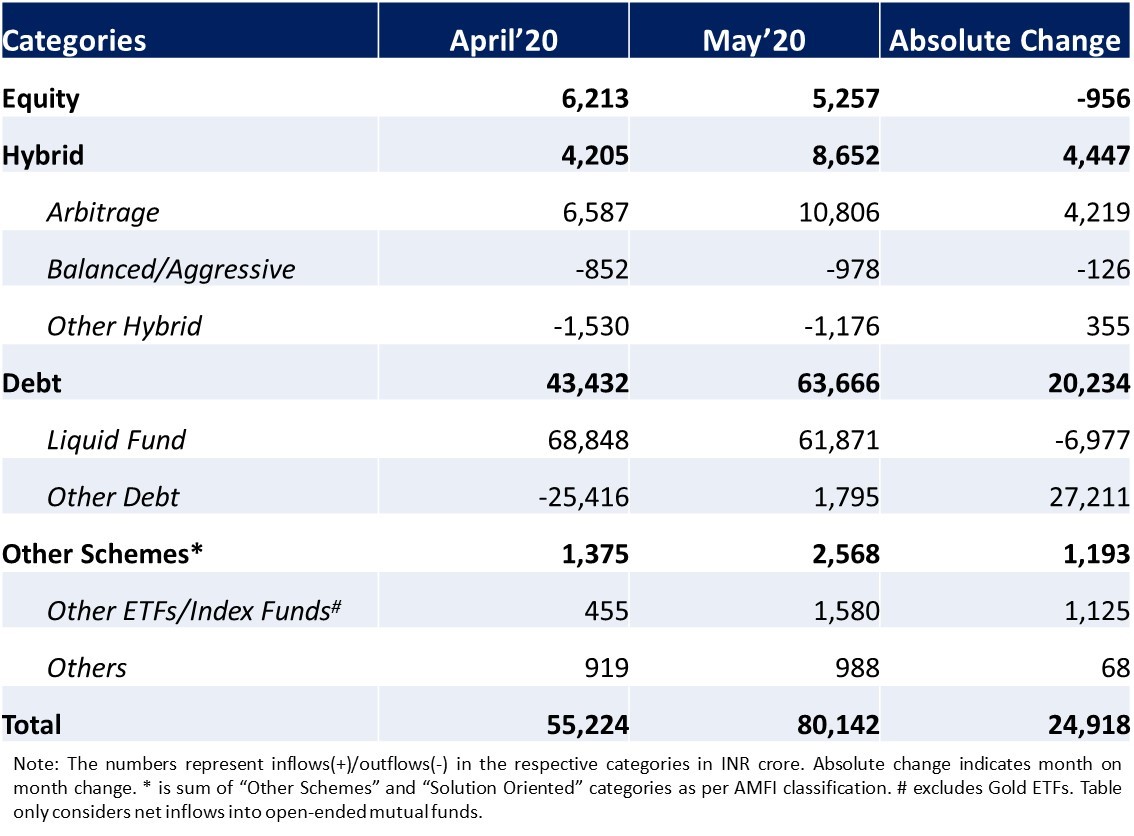

Overall inflows into open-ended mutual funds grew 45% month-on-month (MoM) in May to INR 80,142 crore. This was primarily due to robust net inflows into liquid, arbitrage and some safer debt categories. Net inflows into equity funds witnessed over 15% decline In May to INR 5,257 crore relative to April as investors shied away from the volatile market. Overall industry AUM continued its growth trend in May, growing 2.6% MoM to INR 24.54 lakh crore.

After a 3% fall in April, SIP inflows again dipped by 3% in May to INR 8,123 crore. However, inflows through SIP continued to remain strong and above INR 8,000 crore for the 18th month in a row now.

The following table shows the net inflows into various mutual fund categories in April and May 2020:

For simplicity of understanding let’s focus on the flows of open ended mutual fund categories only and highlight some salient points.

Equity

- Net inflows into most of the equity categories apart from large & mid cap declined MoM as markets continued to remain volatile during the month. Inflows into large & mid cap more than doubled in May to INR 704 crore relative to April

Debt

- Inflows into liquid funds declined 10% MoM in May coming in at INR 61,871 crore

- Inflows into shorter term debt categories like ultra short, low duration, money market and short duration revived in May as RBI cut interest rates relative to April wherein they witnessed outflows

- Outflows from credit risk funds continued in May while net inflows into safer debt categories like Banking & PSU debt, corporate bond & gilt remained robust

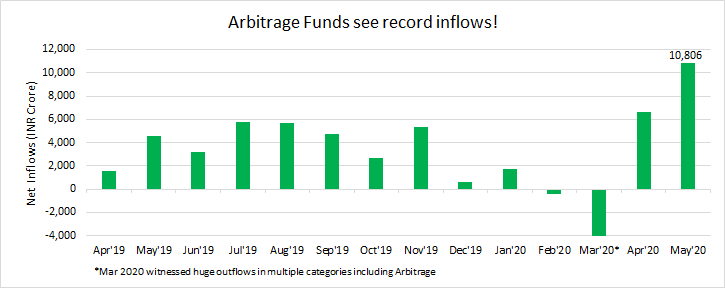

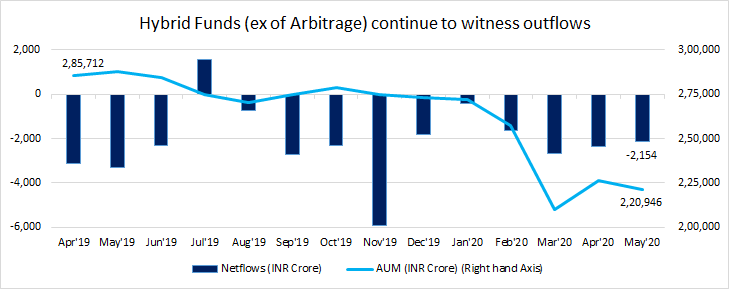

Hybrid

- Arbitrage category witnessed its highest ever net inflows in May at INR 10,806 crore as the risk-off sentiment among investors continued

- Outflows from hybrid schemes excluding arbitrage continued for 10th month in a row now. Overall hybrid AUM ex arbitrage has fallen over 23% to INR 2.2 lakh crore in May compared to April 2019

Other Schemes & Solution Oriented

- Net inflows into other ETFs was at INR 1,018 crore in May after witnessing outflows during April

- Inflows into Gold ETFs continued to rise in May to INR 815 crore as investors continue to prioritize safety amid market uncertainty

Choose the SIP route to invest in current volatile markets. It will help you in rupee cost averaging and earn you higher returns as markets bounce back. So, continue your SIPs according to your investment objective, investment horizon and risk profile.

Go ahead and start investing through SIP on Paytm Money. It was never simpler! Managing SIPs is seamless. Invest with as low as Rs 100 through SIP on Paytm Money!