Ami Organics: Dates, Details and Overview 4 min read

Ami Organics’ Initial Public Offering worth Rs. 570 crores will soon hit the Dalal Street. The IPO comprises a fresh issue worth Rs. 200 crore and an offer for sale of Rs. 369.64 crore. At the upper price band, the issue size is worth Rs. 569.64 crore.

The IPO opens on Sep 1, 2021 – Wednesday and closes on Sep 3, 2021 – Friday. The price of each share is fixed between Rs. 603- Rs.610. The minimum order quantity is 24 Shares. Link Intime India Private Ltd is the registrar for the IPO. The shares are going to be listed on BSE, NSE.

Know the company:

Ami Organics is one of the major manufacturers of Pharma Intermediates for certain key APIs, including Dolutegravir, Trazodone, Entacapone, Nintedanib and Rivaroxaban. The Pharma Intermediates which the company manufactures, find application in certain high-growth therapeutic areas including anti-retroviral, anti-inflammatory, anti-psychotic, anti-cancer, anti-Parkinson, anti-depressant and anti-coagulant, commanding significant market share globally.

Ami Organics has developed and commercialized over 450 Pharma Intermediates for APIs across 17 key therapeutic areas since inception and NCE, with a strong focus on research and development across select high-growth high margin therapeutic areas such as anti-retroviral, anti-inflammatory, anti-psychotic, anti-cancer, anti-Parkinson, anti-depressant and anticoagulant, for use across the global pharmaceutical market. AOL’s Pharma Intermediates used for manufacturing of APIs and NCEs portfolio has expanded from over 425 products as of March 31, 2019, to over 450 products as of March 31, 2021.

As of the date of this RHP, it has eight process patent applications (in respect of intermediates used in the manufacture of Apixaban, Rivaroxaban, Nintedanib, Vortioxetine, Selexipag, Pimavanserin, Efinaconazole and Eliglustat). It currently supplies its products to well-known 150 plus Indian customers and in 25 overseas countries. It has three manufacturing facilities in the state of Gujarat.

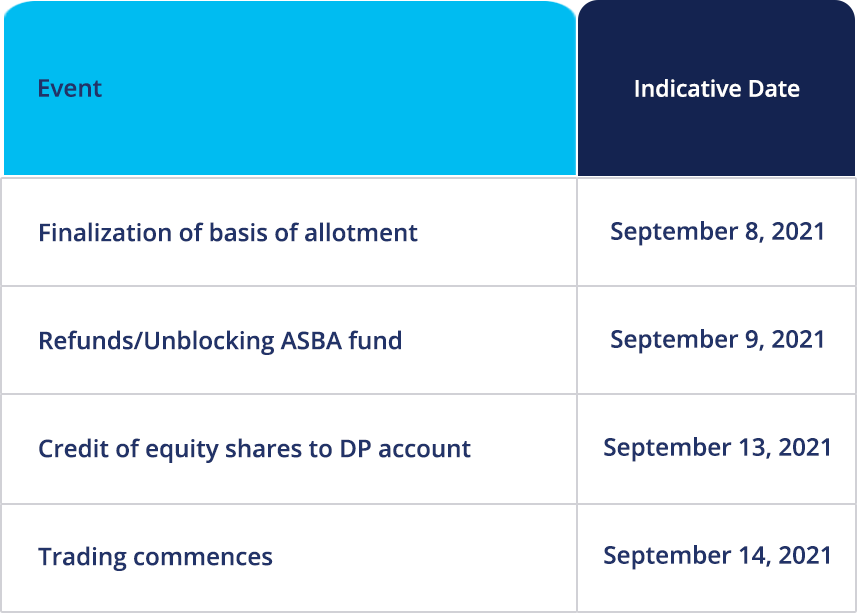

IPO Timeline:

Objective of the offer:

With the funds received from the IPO, the company intends to make a repayment/prepayment of certain financial facilities availed by the Company.

It also intends to use the same towards funding working capital requirements of the Company and for general corporate purposes.

In addition, the Company expects to receive the benefits of listing of Equity Shares on the Stock Exchanges to enhance its visibility and its brand image among its existing and potential customers and creating a public market for its Equity Shares in India.

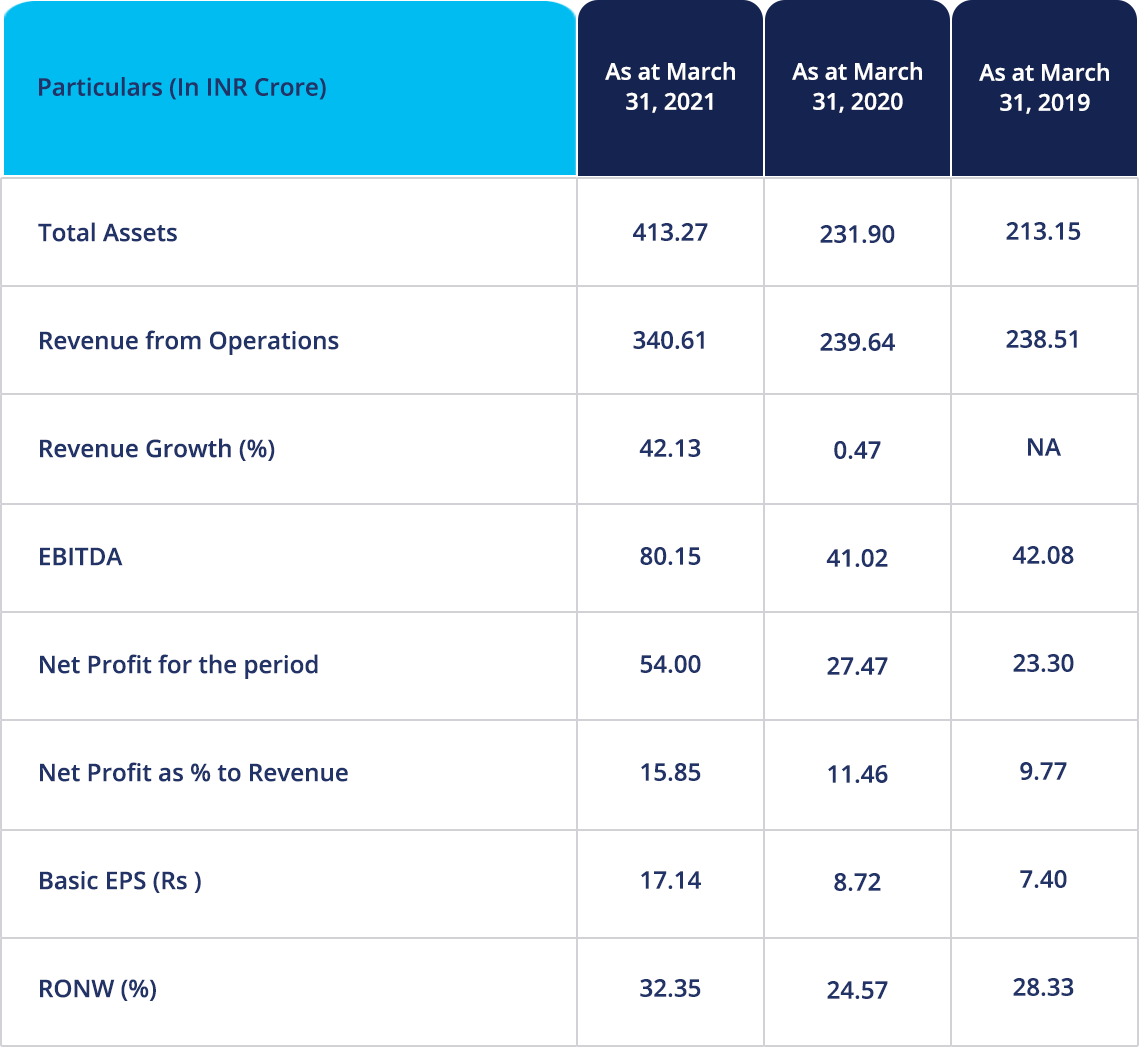

Important Financial data:

Strengths:

- Ami Organics has a diversified product portfolio ably supported by strong Research and Development and process chemistry skills.

- The company has an extensive geographical presence and diversified customer base with long standing relationships.

- It has a high entry barriers in the chemicals manufacturing industry in which the Company operates;

- The company has strong sales and marketing capabilities.

- It has an experienced and dedicated management team and has a proven track record of consistent financial performance.

Risks involved:

- The company is facing a continuing impact of the COVID-19 pandemic on its business and operations is uncertain and it may be significant and continue to have an adverse effect on the business,

- It’s inability to meet the obligations, including financial and other covenants under its debt financing arrangements could adversely affect the business;

- The company’s operations are dependent on continuous R&D to develop and commercialise new products and its inability to identify and understand evolving industry trends, technological advancements, customer preferences may adversely affect its business;

- It’s business is working capital intensive. If the company experiences insufficient cash flows from its operations or are unable to borrow to meet its working capital requirements, it may materially and adversely affect to business;

- It derives a significant portion of the revenue from the sale of products in certain therapeutic areas and any reduction in demand for these products could have an adverse effect on its business;

- Any adverse developments or inability to enter into or maintain such relationships could have an adverse effect on the business, results of operations and financial condition.

Source – RHP, BRLM

Disclaimer – This content is purely for informational purposes and is in no way advice or recommendation.

Investment in the securities market is subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers