Anupam Rasayan India IPO Details – Dates, Price & Overview5 min read

The streak of upcoming IPOs never seems to end. With IPOs following each other in quick succession, this market segment is enjoying its purple patch and with positive sentiments spurring from every corner, more businesses are willing to go public.

After some of the successful IPOs of the financial year 2021, the latest in a long list of new IPOs is Anupam Rasayan India. Established in 1984 in the state of Gujarat, Anupam Rasayan is one of India’s leading manufacturers of specialty chemicals. In addition to manufacturing chemicals, the company is also involved in the custom synthesis of chemicals.

Overview

The product portfolio of Anupam Rasayan can be classified into two – life science-related chemicals and other specialty chemicals. In the life science-related chemicals segment, the company manufactures agrochemicals, personal care, and pharmaceutical products. Meanwhile, in the other specialty chemicals segment, the company manufactures pigments, dyes, and polymer additives.

The company has developed strong and long-term relationships with various multinational corporations, including Syngenta Asia Pacific Pte. Ltd., Sumitomo Chemical Company, and UPL that has helped it expand product offerings and geographic reach across Europe, Japan, the United States, and India.

In particular, the company has been manufacturing products for certain customers for over 10 years. In the nine months ended December 31, 2020, it manufactured products for over 53 domestic and international customers, including 17 multinational companies. The Government of India has also recognized it as a three-star export house.

Growth in Business

Anupam Rasayan India is also one of the leading companies in manufacturing products using continuous and flow chemistry technology on a commercial scale in India.

India’s specialty chemicals industry is expected to grow at a CAGR of approximately 10% to 11% over the next five years due to rising demand from end-user industries, along with tight global supply on account of stringent environmental norms in China.

Furthermore, India accounts for approximately 1% to 2% of the global exportable specialty chemicals, indicating a large scope of improvement and widespread opportunity.

In addition, custom synthesis manufacturing is on the rise in India, and the contract research and manufacturing services market is expected to grow at a rate of 12% in the next five years, owing to strong growth from end-user demand.

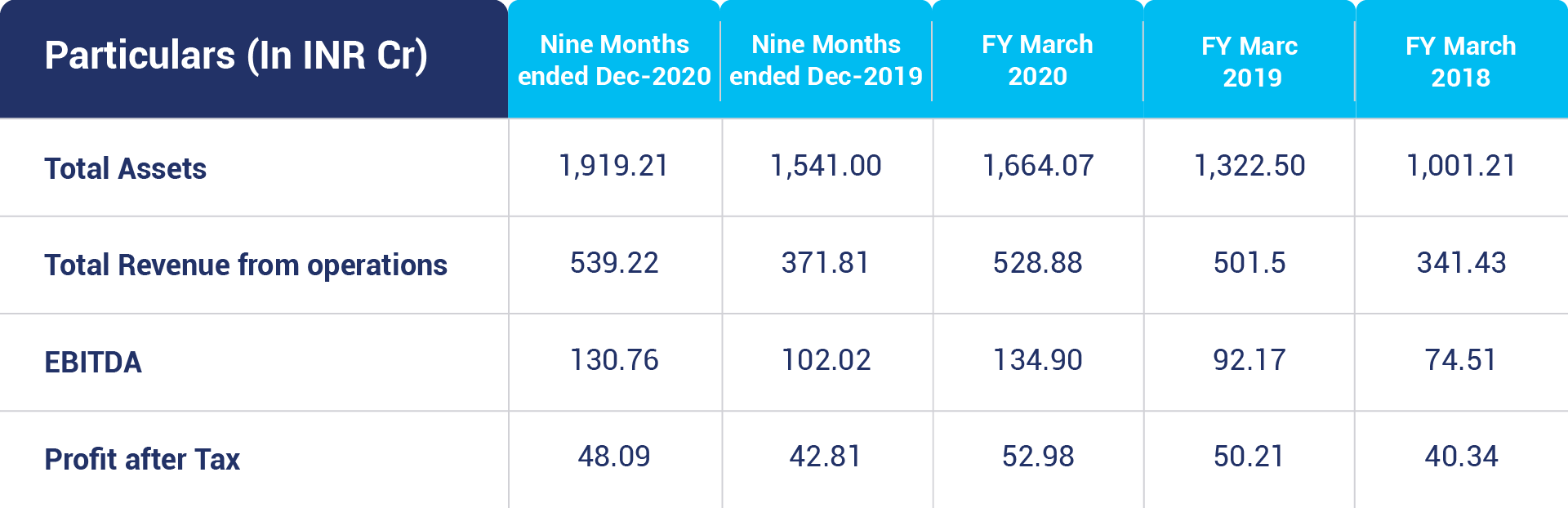

Financials

A quick look into the past financial records of the company to understand its performance and evaluate its growth prospectus

IPO Details

Anupam Rasayan is coming up with an initial public offering of Rs. 760 crores, and is set to open on March 12 and close on March 16, 2021. The company is issuing shares at a price band of Rs. 553 to Rs. 555 with a minimum lot size of 27 shares and in multiples thereafter. Anupam Rasayan is offering up to 13,765,000 equity shares with a face value of Rs. 10 per share.

The book running lead managers to the issue are Axis Capital Ltd, Ambit Private Ltd, IIFL Securities Ltd and JM Financial Ltd, while the registrar to Anupam Rasayan India Ltd will be KFin Technologies Private Ltd. The equity shares of the company are slated to be listed on both the premier stock exchanges of the country – the Bombay Stock Exchange and the National Stock Exchange.

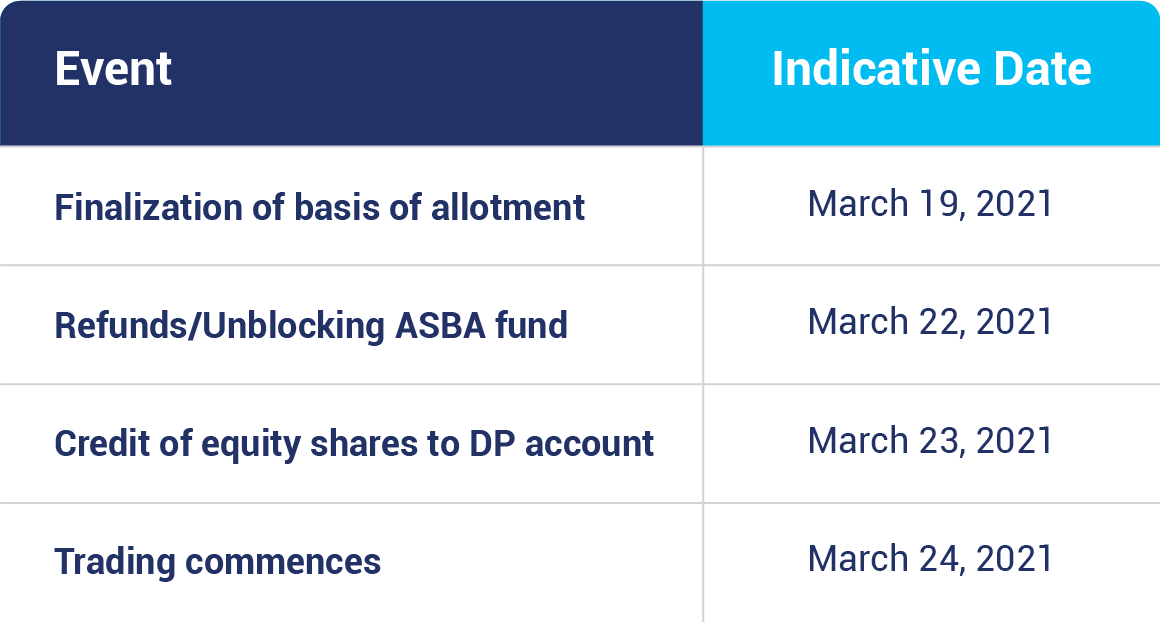

IPO Timeline

Anupam Rasayan Issue Objective

The company is looking to use the net proceeds from its latest IPO issue towards the repayment or prepayment of indebtedness and for general corporate purposes.

Additionally, Anupam Rasayan expects to achieve the benefits of listing its equity shares on the stock exchanges, enhancement of the company’s brand name and creation of a public market for its equity shares in India.

Strengths

- Strong and long-term relationships with diversified customers across geographies.

- The core focuses on process innovation through consistent R&D, value engineering and complex chemistries.

- Diversified and customized product portfolio with a strong supply chain.

- Automated manufacturing facilities with a strong focus on the environment, sustainability, health and safety measures.

- Consistent track record of financial performance.

- Experienced promoters and a strong management team.

Risks Involved

- Dependent on successful relationships with MNC customers. Adverse developments will impact the business.

- The company depends on manufacturing facilities which are subject to manufacturing risks.

- A significant portion of revenue comes from a few customers and a limited number of markets.

- The operations are dependent on R&D and any failure to innovate or come up with new products will impact the business.

- No long term agreements with suppliers and volatility in raw material prices pose operations risk.

How to apply for IPO on Paytm Money

- Log in to the Paytm Money app and complete your fully digital KYC for the stock, if not done already.

- Once your details are verified and the Demat account is created, click on the IPO section on the home screen.

- You will then be able to see a list of past and upcoming IPOs where you can apply for IPOs that are open for applications.

- Next, you must add details for bidding such as quantity, amount, and so on. Maximum 3 bids are allowed.

- After that, you have to enter your UPI id so that the funds for your highest bid are blocked. You will receive a mandate for the same on your UPI app.

- Once you accept the mandate, your application will be successfully submitted.

- Once the allotment happens, you will be notified about your allotment status.

Conclusion

Anupam Rasayan would be the 11th company to launch an initial public offering in 2021 which will open for subscription on March 12. The company has fixed a price band at Rs. 553-555 per share for its issue which is scheduled to close on March 16.