Asset Allocation: A Key Step in Successful Portfolio Management5 min read

The missing piece

Every investor tries to build a great investment portfolio. However, most tend to focus more on finding the best investment option like a stock or a mutual fund, while ignoring another important aspect of portfolio management i.e. asset allocation. This could be on the basis of your experience with a stock which doubled in the last 3 months or a mutual fund that generated the highest returns in the past one year. Advertisements, newspapers and your well-wishers and friends, all tend to focus on finding that supposedly magical option to multiply your investment quickly.

In certain cases, there is some sort of excitement and thrill also attached to finding such opportunities. Unfortunately, this is not the correct approach to managing an investment portfolio. As the great investor George Soros says, “If investing is entertaining if you’re having fun, you’re probably not making any money. Good investing is boring.”

The focus on picking the best investment option (security selection) generally comes at the cost of ignoring the equally important step of “Asset allocation”. Asset allocation means allocating the right proportion of investments in different asset classes, based on your risk profile. Unless you focus on getting this right, there is little chance of creating wealth on a sustained basis over the long term.

Major Asset Classes

Every investment option can be described in terms of its risk and return characteristics. Investments that exhibit similar risk and return characteristics, and respond in a similar fashion to economic and market events are grouped together as an asset class.

There are majorly two classes of financial assets advisable for retail investors:

- Equity

- Debt

Equity is more volatile, however, can generate significant wealth over a longer duration, hence equity is typically used for wealth creation in a portfolio. Debt, on the other hand, is more stable, but has lesser returns in general, hence it is generally used for capital protection in a portfolio.

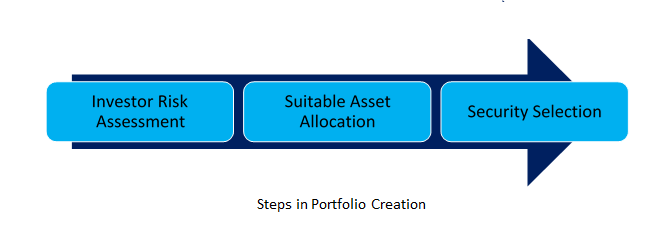

Investment decision process

Investment decision process consists of three distinct steps: Risk Assessment, Asset Allocation and Security Selection, each of which is important.

For a successful investment journey over a longer-term, it is important to remain invested and that is possible only if your portfolio is in line with your risk appetite, investment horizon, and investment goals. Your age, number of dependents, income, etc are also some of the other important considerations. All these parameters are captured using a set of questions and this process is called “Investor Risk Assessment”. This risk profile assessment is the first key step in investment decision making. The outcome of the first step is an investor’s “Risk Profile”, and based on this risk profile, a suitable mix of asset classes (Asset Allocation) is determined. Thus the asset allocation will be in line with your risk profile.

For example, if you are an investor seeking long term wealth creation and are comfortable with losses in the short term, your risk profile will most probably be “Aggressive”. Hence, depending on your risk profile, your portfolio should have a major allocation to the equity asset class.

Once the first two steps are done, Security selection i.e picking the right investment option is the third step in the process. There is no doubting the importance of this step. Our point is intelligent investing comprises of risk profiling, asset allocation, and security selection as outlined. It is never about focusing on just one of these steps.

The benefit of proper asset allocation

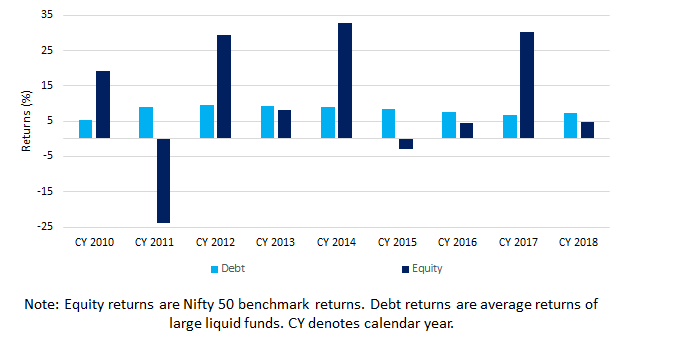

It is very difficult to determine which particular asset class would be the best performing in a given time period. Investing in only one class of asset in the expectation that it would outperform all the other investment categories could prove to be risky.

As seen in the below graph, the growth-oriented equity asset class is volatile but outperforms debt asset class in the long run. On the other hand, the debt asset class gives stable returns each year.

Equity is much more volatile than debt in terms of the calendar year returns

Remember the old saying “Not to put all your eggs in one basket”.

If a portfolio is diversified i.e. has the right mix of asset classes, then irrespective of which asset class is outperforming in a given time period, the investor will have some exposure to it. The better performing asset classes in the portfolio will help protect the portfolio from poor returns in other assets. Hence, diversification reduces overall risk in the portfolio. Asset Allocation determines this mix of asset classes based on the investor’s risk profile.

Hence remember to do your risk profiling and proper asset allocation before going to security selection. However, we understand that it is difficult and time consuming for you to carry out all these steps on your own. Please consult your investment advisor before creating your portfolio.

Paytm Money has designed a one-stop solution i.e. “Investment Packs” to address all your investment needs after taking the above steps into consideration. We provide free “Risk Profiling” facility on our app. Based on the investor’s risk profile, we do suitable “Asset Allocation” and post that “Security Selection” for you by suggesting a portfolio of 3 to 5 best suited mutual fund schemes. Investment packs ensure diversification across asset classes, subcategories within asset classes, across fund managers and fund houses. In this way, Investment Packs caters to the requirement of all categories of investors based on their risk profiles.