Mutual Fund Schemes that Outperformed Others in April 20203 min read

April turned out to be a good month for equity while a flat one for debt markets in spite of the COVID-19 crisis. Equity markets fell sharply at the start of April as there was a spike in COVID-19 cases but recouped the losses amid positive global cues that the affected count had peaked in major hotspots worldwide. Markets also responded positively to a slew of measures announced by the RBI to help the economy. Indices fell slightly in the third week of April due to an unexpectedly sharp slump in global oil prices and uncertainty around a second stimulus package by the government. Equities witnessed a massive surge during month end owing to better than expected corporate earnings, large stimulus packages announced by countries globally and special liquidity facility for mutual funds unveiled by the RBI. Benchmark indices Nifty and Sensex gained 14.7% and 14.4% respectively during the month of April.

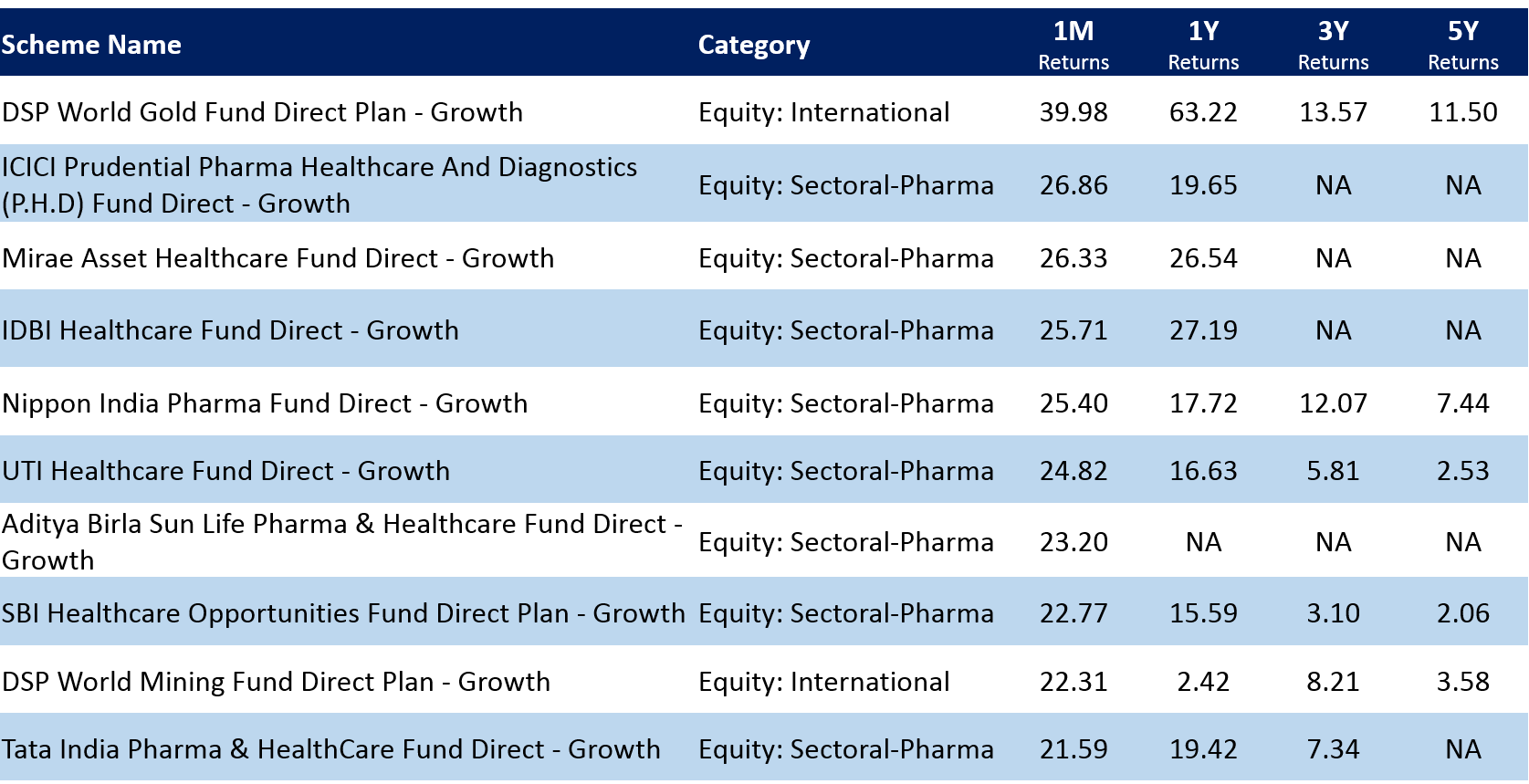

International gold oriented funds and sectoral funds focusing on Pharma did exceptionally well during the month of April. Investors who remained invested in the markets in spite of the March losses would have got some respite in April as the markets bounced back. This brings out how volatile equity as an asset class is in the short term.

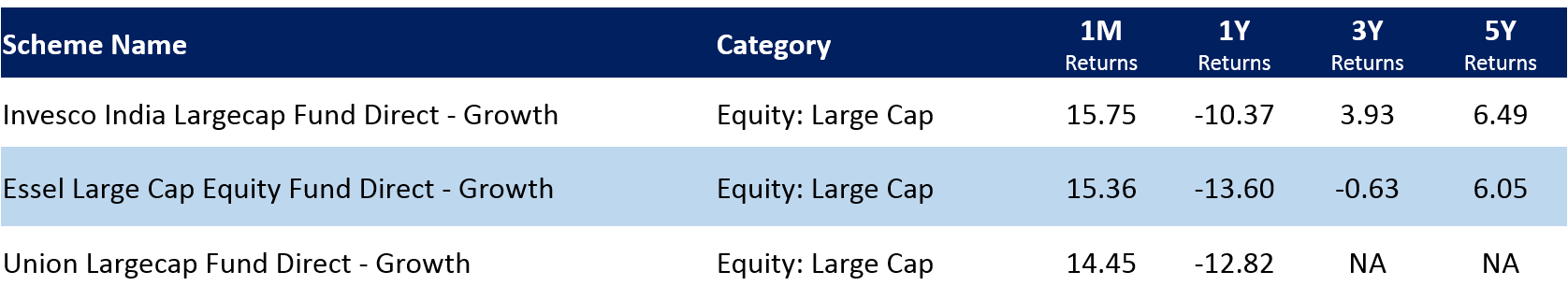

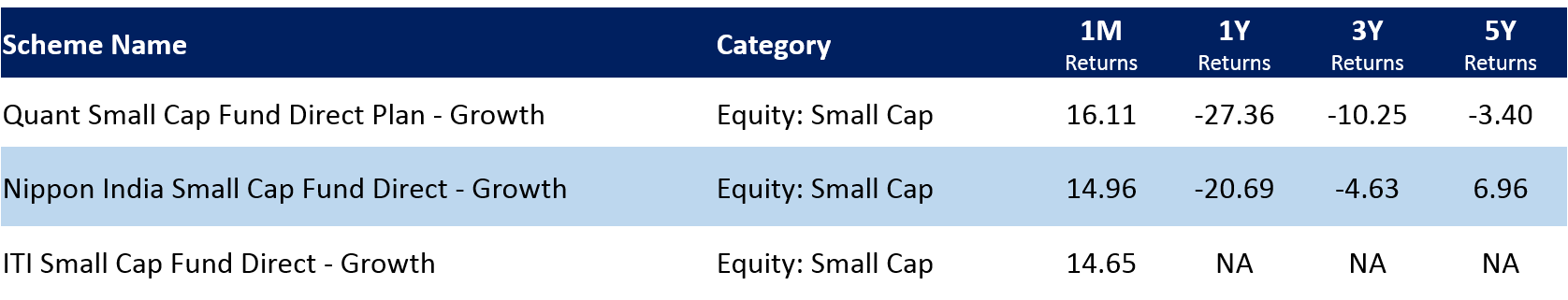

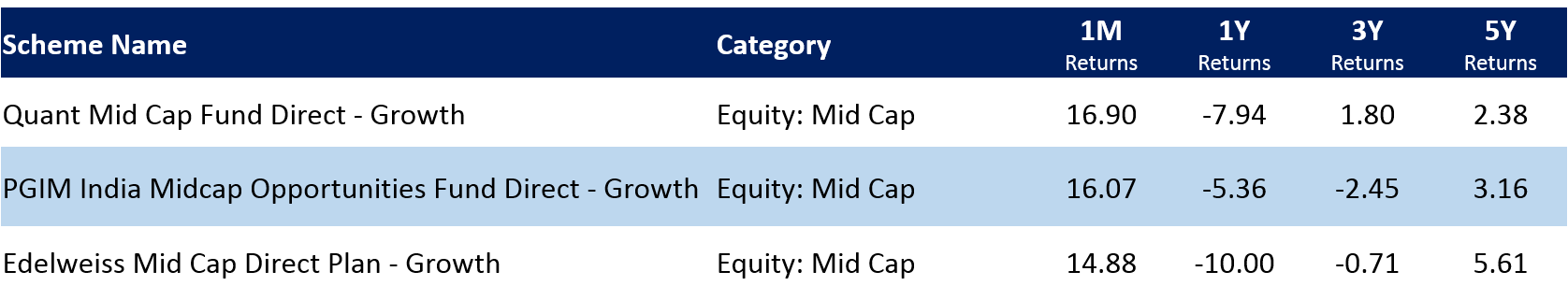

Let’s take a look at the best performing mutual funds across categories amidst this volatility in Apr, 2020:

Best performing large cap funds in Apr, 2020:

Best performing small cap funds in Apr, 2020:

Best performing mid cap funds in Apr, 2020:

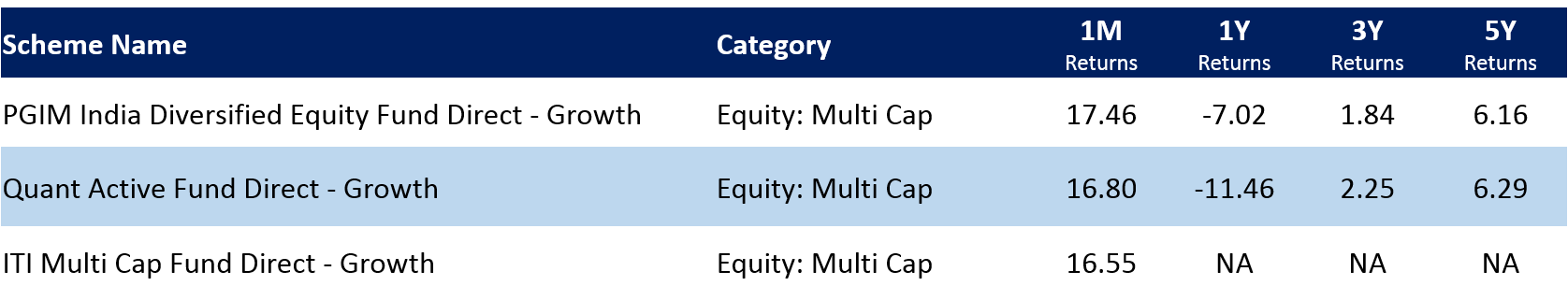

Best performing multi cap funds in Apr, 2020:

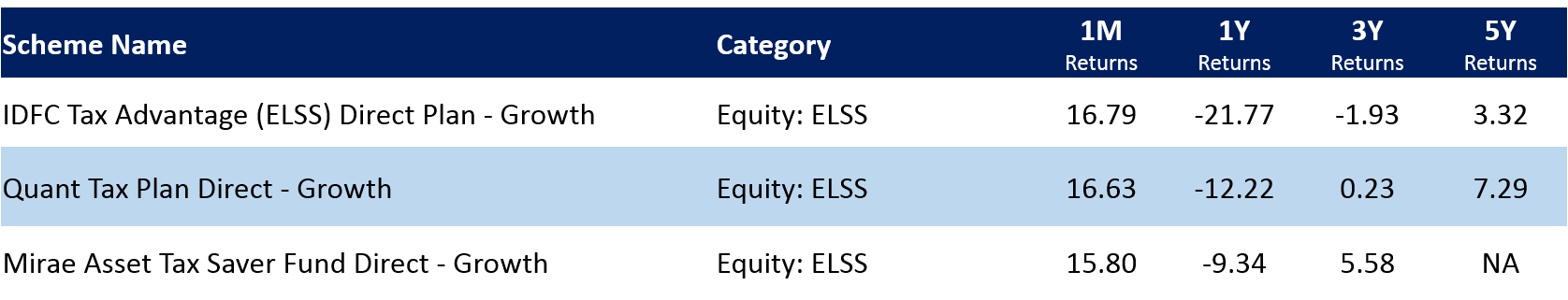

Best performing ELSS Tax Saver Funds in Apr, 2020:

Debt markets turned out to be flat in the month of April. Yields on the 10Y benchmark bond shot up initially during the month but witnessed a massive fall as RBI took several steps like multiple TLTRO (Targeted Long Term Repo Operations) and additional liquidity boosting measures to ease the financial stress in the markets.

Keep in mind that one month returns are not to be used while making investment decisions. You should rather look for consistency of returns over a longer period of time. Making use of SIP while investing in volatile assets classes helps enforce disciple and reaps the benefits of rupee-cost averaging.

It is advisable for you to take into account investment objective, investment horizon and risk profile before making any investment decisions. Explore investment packs on Paytm Money app which are designed to take care of all your investment needs.