Mutual Fund Schemes that Outperformed Others in February 20203 min read

Indian equity market witnessed a sharp correction in the month of February 2020 tracking global markets and largely due to Coronavirus scare. The month opened with the presentation of the Union Budget. After a small correction, the markets recovered due to favorable domestic cues such as PMI data, RBI policy action etc. to post gains in the first two weeks of the month. Markets then saw a sharp sell-off as several new cases of Coronavirus were reported outside China and on concerns that global growth would be negatively impacted. The benchmark indices corrected sharply by 7% in the last week of the month and eventually Nifty 50/Sensex posted 6.36%/ 5.96% drop for February.

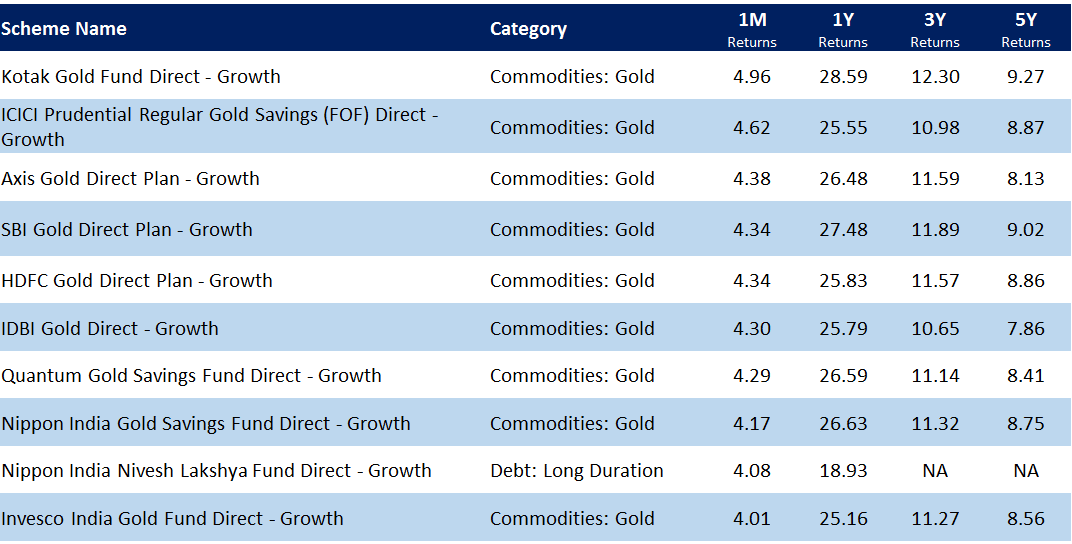

In the mutual fund space, Gold funds were the biggest gainers in the month of February. This is due to the safe haven nature of Gold and it tends to perform well in times of global turmoil such as what we are seeing today.

In times of sharp market corrections such as these, we reiterate our advice that you stick to your asset allocation, keep your SIPs going and not panic and redeem your investments.

Let’s take a look at the best performing mutual funds across categories in Feb, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized. Debt funds showing unusual NAV movement due to recovery in underlying papers have not been considered as they do not reflect the market trends.

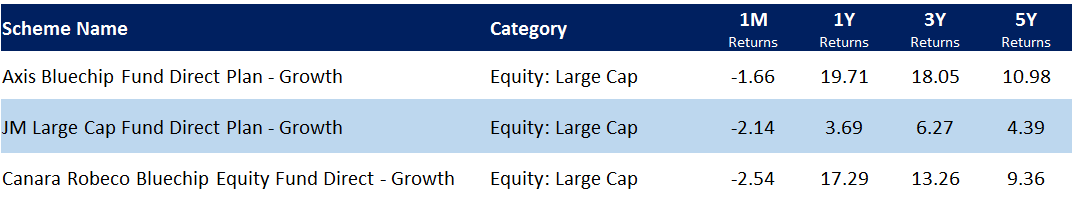

Best performing large cap funds in Feb, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

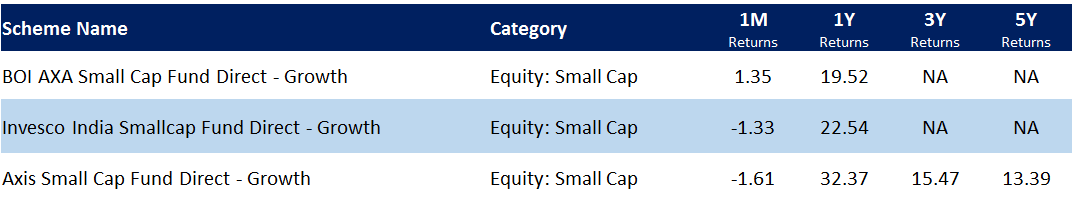

Best performing small cap funds in Feb, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

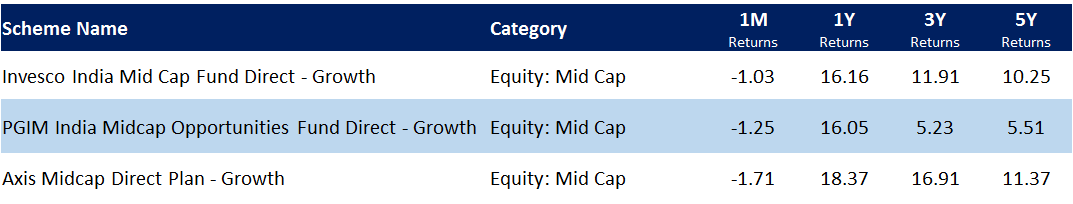

Best performing mid cap funds in Feb, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

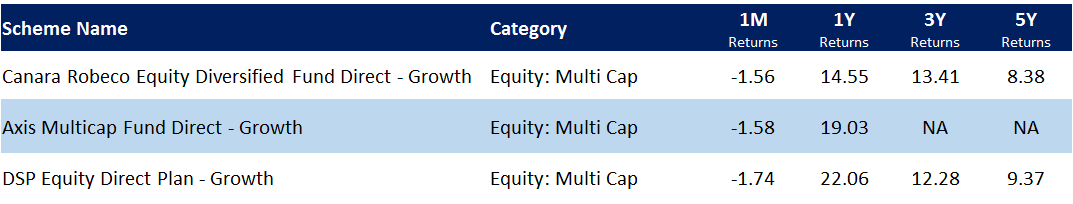

Best performing multi cap funds in Feb, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

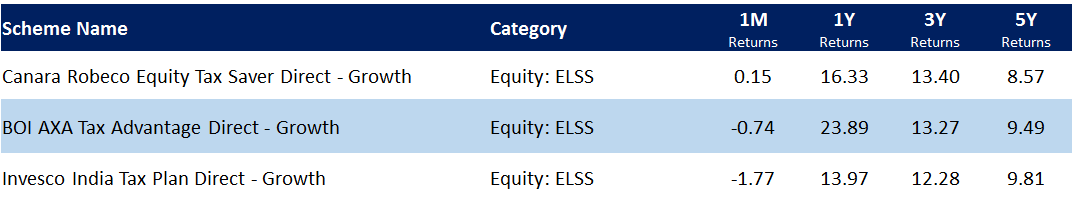

Best performing ELSS Tax Saver Funds in Feb, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

It was a good month for the debt market as the government stuck to its gross borrowing for the current year and announced plans to list certain debt securities in the global markets. The RBI announced that it would maintain an accommodative stance as long as necessary to revive growth. Additional measures such as a new liquidity management framework and Long-term Repo Operations (LTRO) helped the debt market. Finally, falling crude oil prices due to Coronavirus scare ensured that 10Y G-sec yields fall by 19 bps (100 bps =1%) to close at 6.38%. System liquidity continued to remain in surplus.

Keep in mind that one month returns are not to be used while making investment decisions. You should rather look for consistency of returns over a longer period of time. Making use of SIP while investing in volatile assets classes helps enforce disciple and reaps the benefits of rupee-cost averaging.

It is advisable for you to take into account investment objective, investment horizon and risk profile before making any investment decisions. Explore investment packs on Paytm Money app which are designed to take care of all your investment needs.