Mutual Fund Schemes that Outperformed Others in January 20202 min read

The month of January turned out to be a not so good month for equities as global events cast a shadow on investor sentiments, while the debt markets remained flat. Tensions between US & Iran affected the equity markets at the start of the calendar year. Indices gained mid-month with the signing of initial trade deal between US & China. But mounting concerns over the economic impact of the coronavirus outbreak in China on the world economy coupled with lacklustre domestic corporate earnings dented investor confidence. A sell off in equities ahead of Futures & Options (F&O) expiry and profit booking just before the Union Budget also weighed on equity markets. Nifty and Sensex after touching lifetime highs in December, fell 1.69% and 1.28% respectively in January 2020.

Small cap funds were the biggest gainer among all other mutual fund categories during the month of January as beaten down valuations supported growth.

If you had remained invested in the markets, you would have reaped benefits of the same. This reiterates our advice of remaining invested in the markets for the long term in spite of short term losses.

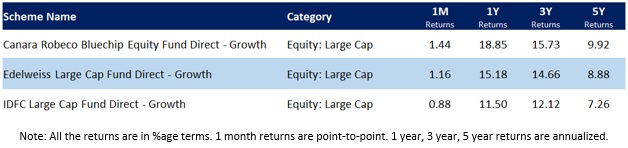

Best performing large cap funds in Jan, 2020:

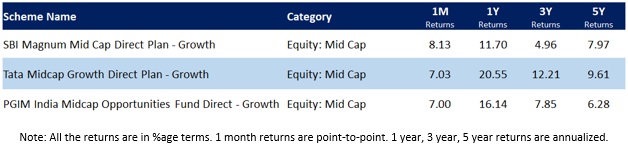

Best performing mid cap funds in Jan, 2020:

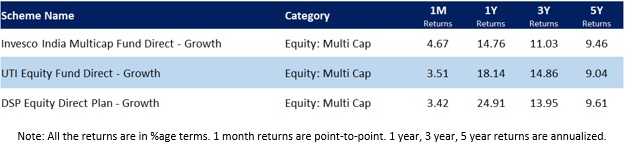

Best performing multi cap funds in Jan, 2020:

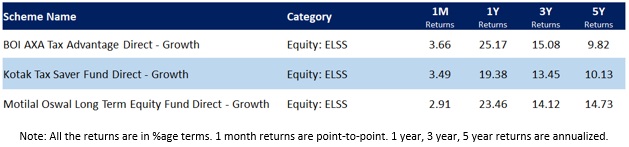

Best performing ELSS Tax Saver Funds in Jan, 2020:

A sudden spike in inflation figure for December 2019 hurt investor sentiments in the debt market. Although cooling oil prices, falling US yields and special open market operations (OMOs) conducted by RBI supported bond prices, persistent fears of additional borrowing and fiscal slippage ahead of the Union Budget dented sentiment. The 10 year G-Sec yields witnessed a mere 4 bps (100 bps= 1%) rise during the month. System liquidity continued to remain in a state of surplus.

As an investor you should make investment decisions based on consistency of returns rather than very short term returns. Take the SIP route while investing in volatile assets like equity mutual funds. This will ensure that you invest in a disciplined manner and take advantage of rupee cost averaging over your investment horizon.

It is advisable to take into account your investment objective, investment horizon and risk profile before making any investment decisions. Explore investment packs on Paytm Money app which are designed to take care of all your investment needs.