Mutual Fund Schemes that Outperformed Others in March 20203 min read

The month of March witnessed heightened volatility in the equity and debt markets as the novel Coronavirus was declared a global pandemic by the WHO. The panic led to FIIs selling off more than $15 bn worth of equity and debt from Indian markets resulting in massive fall in equity indices during the month. The imposition of lockdown by government led to fall in economic growth projections and casted uncertainty over corporate earnings leading to further losses. Benchmark indices Nifty and Sensex fell 23.2% and 23% respectively during the month of March. Global indices also suffered huge losses as the case count across the world rose sharply. Globally Central Banks have announced huge stimulus packages to tide over the crisis, effects of which would play out eventually.

Debt markets which were impacted due to the massive FII sell off got some respite as the RBI came up with a slew of measures to boost the economy and markets. RBI pumped significant liquidity in the markets and cut interest rates sharply to provide relief to banks and corporates. Systemic liquidity continued to remain in a state of surplus.

Gold continued to outperform other asset classes this month as well as investors rushed towards safe assets amid uncertainty in equity and debt markets.

We would urge investors to remain invested in the markets in spite of the short term losses as redemptions would make these losses permanent.

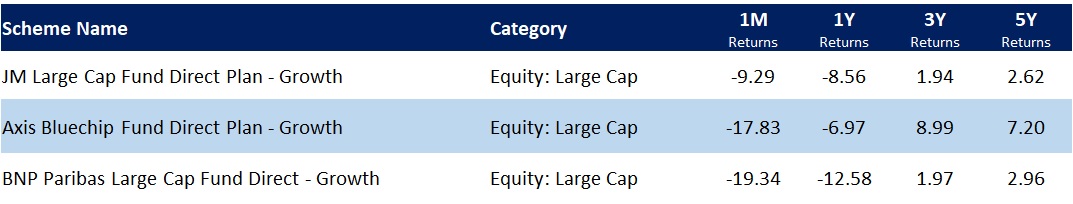

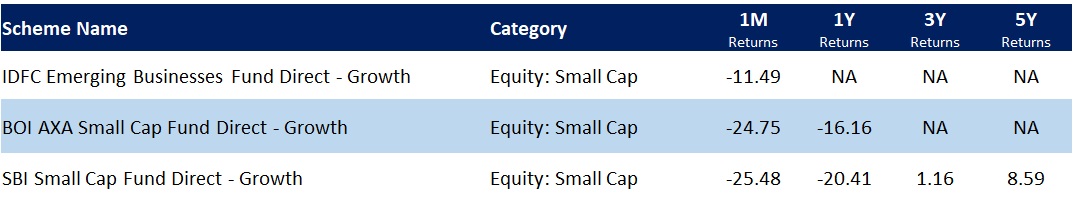

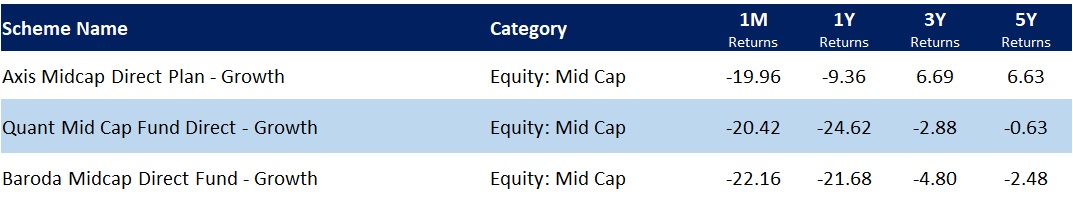

Let’s take a look at the best performing mutual funds across categories amidst this volatility in Mar, 2020:

Best performing large cap funds in Mar, 2020:

Best performing small cap funds in Mar, 2020:

Best performing mid cap funds in Mar, 2020:

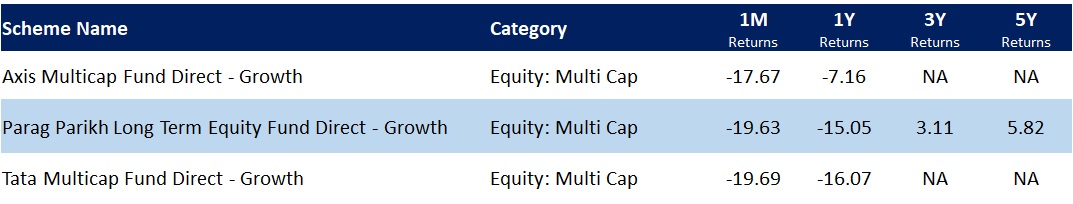

Best performing multi cap funds in Mar, 2020:

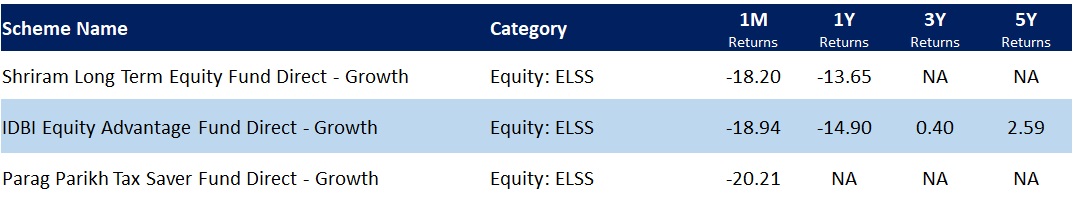

Best performing ELSS Tax Saver Funds in Mar, 2020:

As an investor you should make investment decisions based on consistency of returns rather than very short term returns. The aim should be to invest in a staggered manner in equity mutual funds now. So stick to your SIP investments. This will ensure that you invest in a disciplined manner and take advantage of rupee cost averaging over your investment horizon.

However, do take into account your investment objective, investment horizon and risk profile before making any investment decisions. Explore investment packs on Paytm Money app which are designed to take care of all your investment needs.