Mutual Fund Schemes that Outperformed Others in May 20203 min read

Contents

Equity market snapshot

The month of May turned out to be a volatile one for equity markets. Markets fell initially during the month as COVID-19 cases in India continued to rise amidst concerns over a second wave of the pandemic globally. Additionally, markets come under pressure as the finer details of the INR 20 lakh crore economic package became known to investors. Equities gained in the last week of May as RBI announced a further rate cut and there were positive global cues in the form of encouraging results for an experimental vaccine for COVID-19. Benchmark indices Nifty & Sensex fell 2.8 and 3.8% respectively during the month of May.

Debt market snapshot

Debt markets gained in the month of May as RBI cut repo rate by 40 bps to 4% currently. This announcement coupled with abundant systemic liquidity and expectations that the enhanced borrowing program would not have a big impact on fiscal deficit gave a boost to the debt markets. Yield of the benchmark 10Y G-sec fell by 11 bps during the month to 6%.

Monthly outperformers

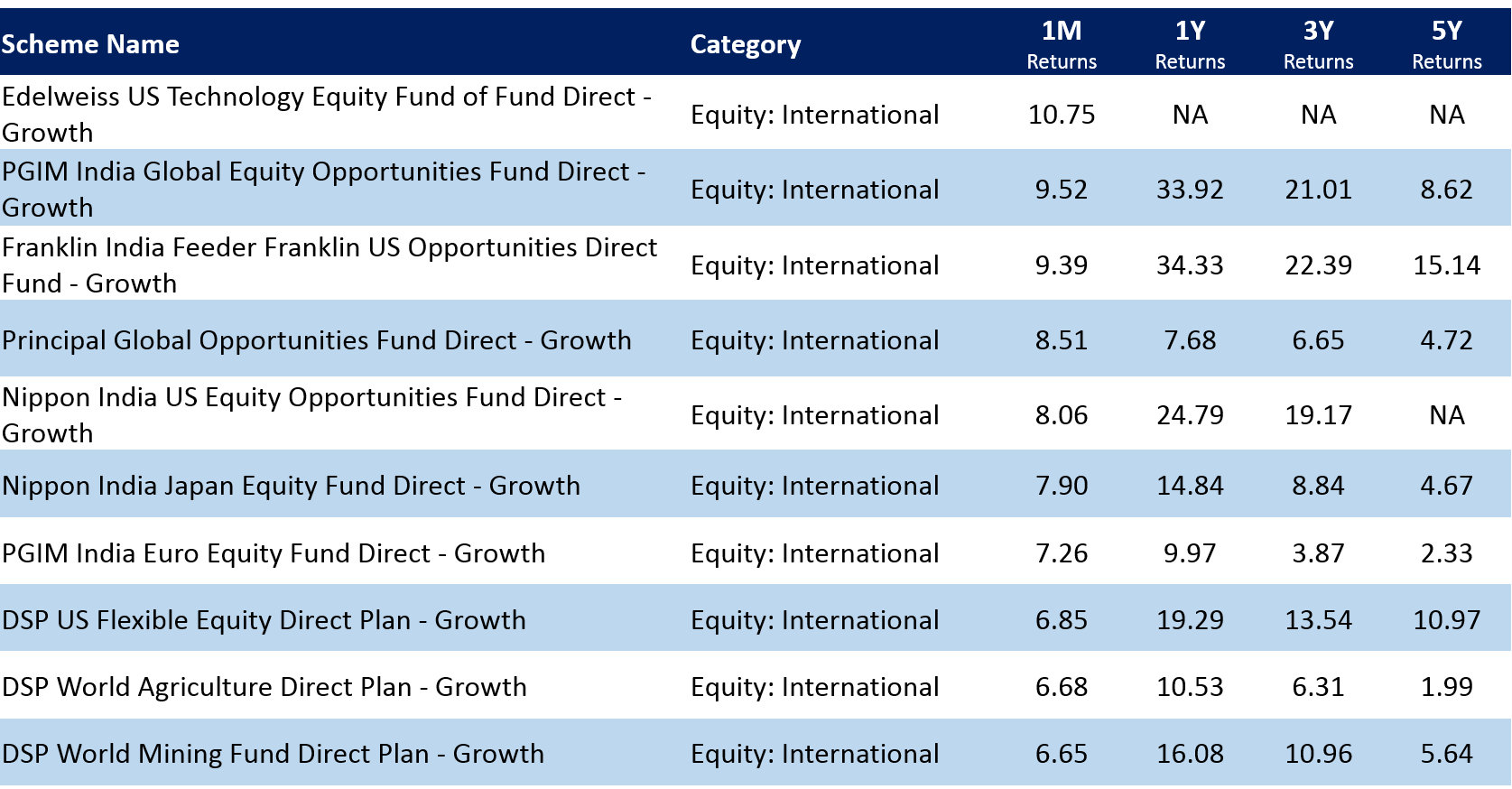

International equity funds were the top gainers during the month of May. Most global equities gained as easing lockdown restrictions across many countries raised prospects of a rebound in business activity. Encouraging quarterly results, positive trial data for potential COVID-19 vaccine and hopes of further stimulus in USA also helped global equities.

Let’s take a look at the best performing mutual funds across categories in May, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized. Funds showing unusual NAV movement have not been considered as they do not reflect the market trends.

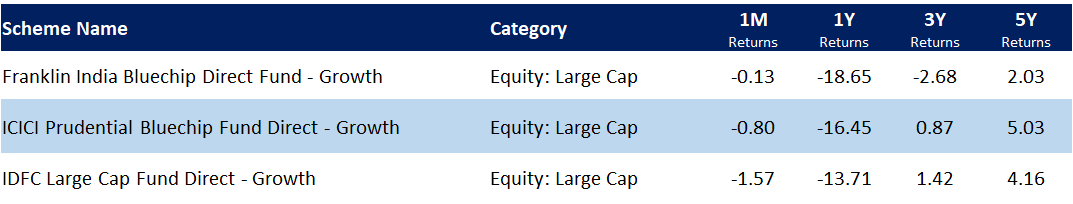

Best performing large cap funds in May, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

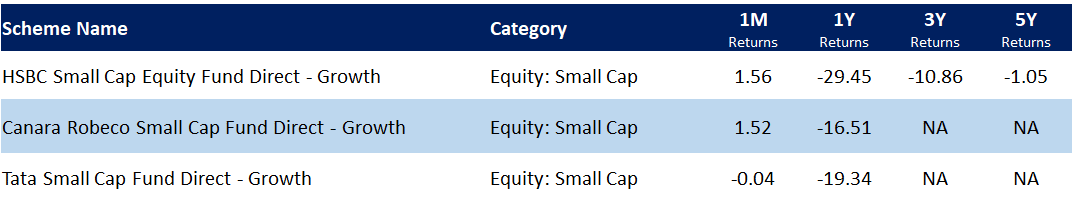

Best performing small cap funds in May, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

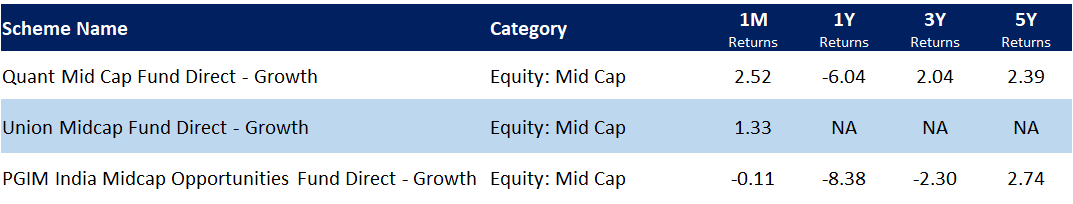

Best performing mid cap funds in May, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

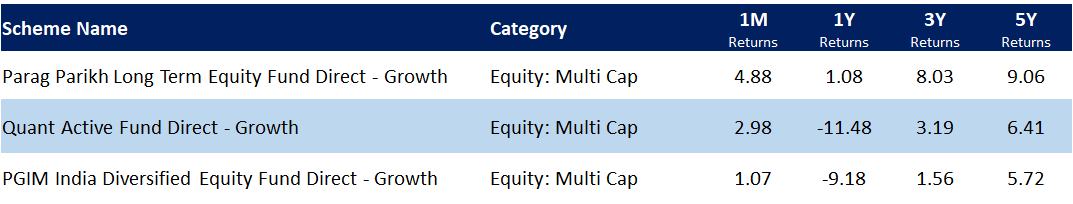

Best performing multi cap funds in May, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

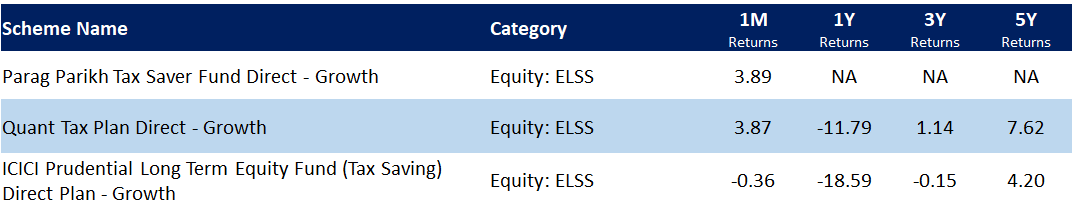

Best performing ELSS tax saver funds in May, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

What you should be doing?

Keep in mind that investing in equities should be done with a long term view. So consistency of a mutual fund over a longer time frame is what you should be looking at rather than short term returns. Investing through SIP is the right way to go, especially in volatile asset classes like equities, as it ensures disciplined investing coupled with the benefit of rupee cost averaging.

Your investing decisions should be based on your investment objective, investment horizon and risk profile. Take a look at Investment Packs on Paytm Money that is designed to fulfill all your investing needs.