Mutual Fund Schemes that Outperformed Others in June 20203 min read

Contents

Equity market snapshot

Equities bounced back strongly in the month of June after a volatile May. Equity markets started the month on a high amid a global rally owing to opening up of economies but sustained a big fall mid-month with the rapid rise in COVID-19 cases triggering fears of an upcoming second wave and grim economic outlook. But huge FII inflows in June, pulled back the markets. Markets continued their up move as various economic indicators witnessed high growth in June compared to May & April and a few corporate and sector specific news. Sensex gained 7.7% while Nifty gained 7.5% during the month of June.

Debt market snapshot

Debt markets too continued their good performance in the month of June owing to the abundant systemic liquidity provided by RBI. The benchmark 10 year G-sec yield fell by 13 bps (100 bps = 1%) to 5.88% during June as RBI continued with their intensive bond buying programme.

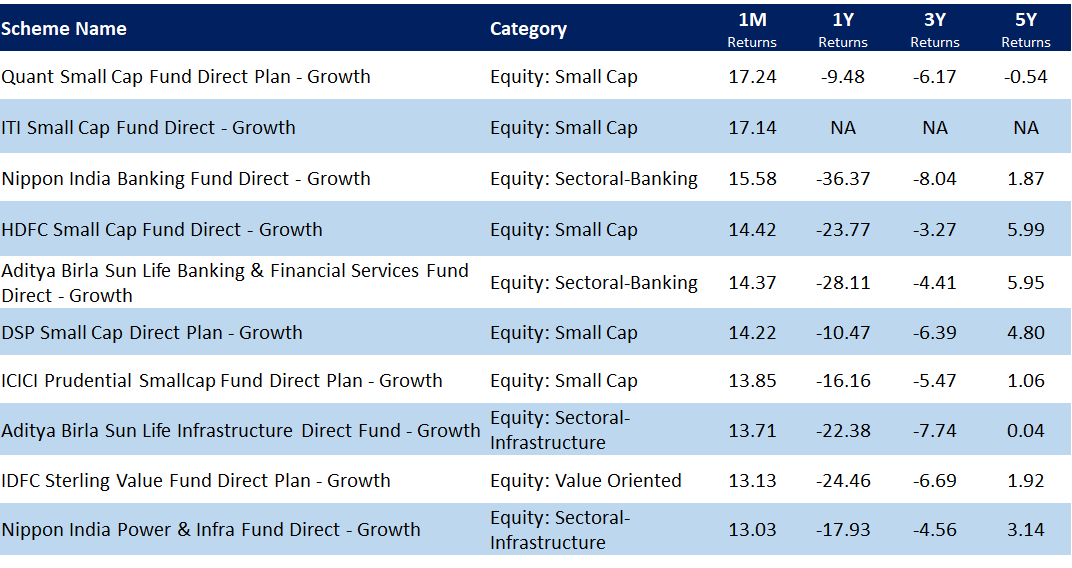

Monthly outperformers

Small cap funds were the dominant outperformers in June relative to other mutual fund categories. The small cap rally was primarily a liquidity led rally owing to the beaten down valuation of these stocks since the last couple of years. As we have emphasized time and again, investors who would have stayed invested in the markets in spite of the short term losses would have benefited from this long awaited rally.

Let’s take a look at the best performing mutual funds across categories in June, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized. Funds showing unusual NAV movement have not been considered as they do not reflect the market trends.

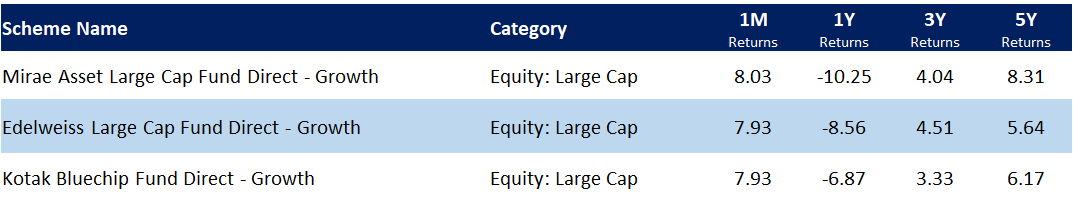

Best performing large cap funds in June, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

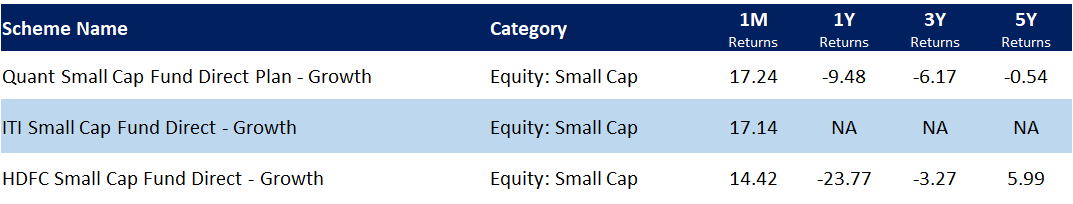

Best performing small cap funds in June, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

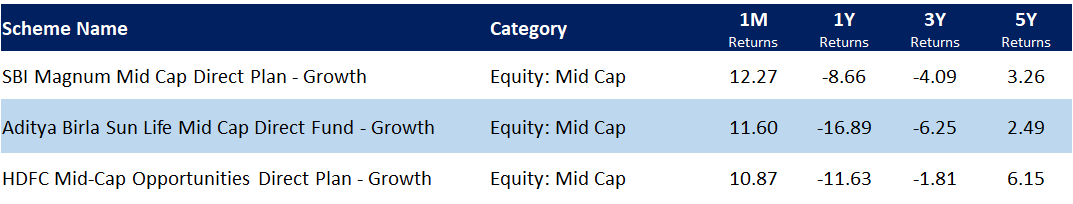

Best performing mid cap funds in June, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

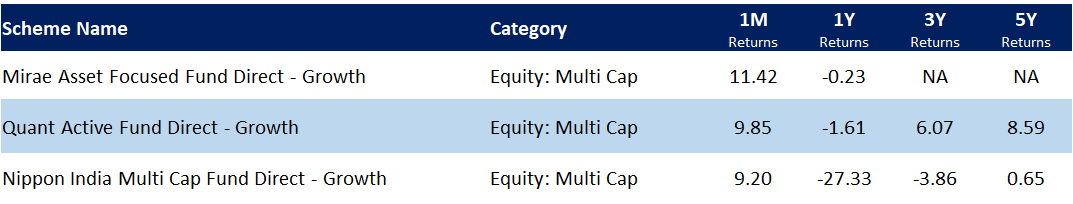

Best performing multi cap funds in June, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

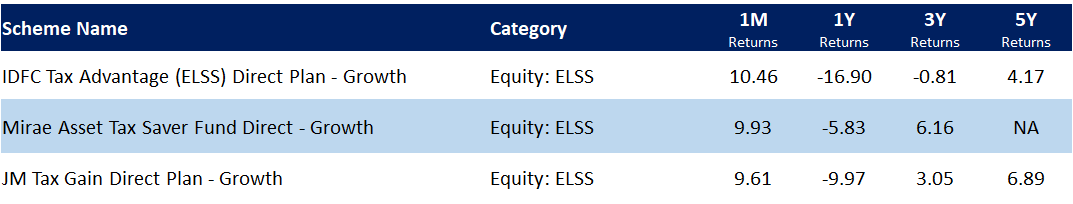

Best performing ELSS tax saver funds in June, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

What you should be doing?

Keep in mind that investing in equities should be done with a long term view. As an investor you should make investment decisions based on consistency of returns rather than very short term returns. Investing through SIP is the right way to go, especially in volatile asset classes like equities, as it ensures disciplined investing coupled with the benefit of rupee cost averaging.

It is advisable to take into account your investment objective, investment horizon and risk profile before making any investment decisions. Explore Investment Packs on Paytm Money app which are designed to take care of all your investment needs.