Brookfield India Real Estate Trust IPO – Dates, Overview, Price Details6 min read

REIT or Real Estate Investment Trust is a company that allows investors to invest in the units of a portfolio of real estate assets without having to own the physical property itself. It is a pool of investors just like mutual funds, who invest in real estate as an underlying asset to generate a return for investors.

The investor makes money on a yearly basis. REITs are mandated to give investors a certain portion of the money back on a yearly basis. Investors also earn from capital appreciation. There are three types of REITs: equity REITs which purchase, own, and manage income-generating properties; mortgage REITs which lend money directly or indirectly to real estate owners; and hybrid REITs which are a combination of the first two, according to a report by Care Ratings.

REITs allow any investor – small or big – to invest in portfolios of real estate assets. The stockholders of a REIT earn a share of the income produced through real estate investment.

About Brookfield India REIT

The Brookfield India Real Estate Trust (“Brookfield REIT”) is India’s only institutionally managed public commercial real estate vehicle. Sponsored by an affiliate of Brookfield Asset Management (“BAM”), one of the world’s largest alternative asset managers with approximately $575 billion in assets under management, as of September 30, 2020, their goal is to be the leading owner of high-quality income-producing commercial real estate assets in key gateway Indian markets, which have significant barriers to entry.

They own an Initial Portfolio of 4 large campus-format office parks, which are “business-critical”, located in some of India’s key gateway markets – Mumbai, Gurugram, Noida, and Kolkata. Their Initial Portfolio totals 14.0 MSF (million sq feet), comprising 10.3 MSF of Completed Area, 0.1 MSF of Under Construction Area, and 3.7 MSF of Future Development Potential.

Their Initial Portfolio’s Completed Area has the Same Store Committed Occupancy of 92% and an 87% Committed Occupancy, which includes the recently completed 0.5 MSF at Candor Techspace N1 and is leased to marquee tenants with 75% of Gross Contracted Rentals contracted with multi-national corporations such as Barclays, Bank of America Continuum, RBS, Accenture, Tata Consultancy Services and Cognizant.

The COVID-19 pandemic has accelerated the structural shift that was already underway prior to the crisis in relation to the usage and deployment of technology especially cloud, data analytics, e-commerce, and digital transformation.

The global spending on software and IT services is expected to grow at a robust rate between FY2020 and FY2025 and the technology industry in India is expected to grow at a CAGR of 13% to $350 billion by FY 2025 from an estimated $191 billion in FY 2020 due to the large STEM talent pool, competitive cost advantage and favorable demographics in the country.

The company’s strategy is to address this demand by owning and operating large “fully-integrated”, “campus-format” office parks in established locations, and providing a complete ecosystem to its tenants and their employees.

Issue Details

Issue Size: Rs 3800 Cr

Price Band: Rs 274 – Rs 275

Face Value: Rs 10

No. of units: 13.87 to 13.81 Cr Units

Bid Size: 200 Units and in multiples thereafter for Non-Institutional Investors

Minimum Bid Amount: ₹ 54,800 – ₹ 55,000

Registrar: Link Intime India Pvt. Ltd.

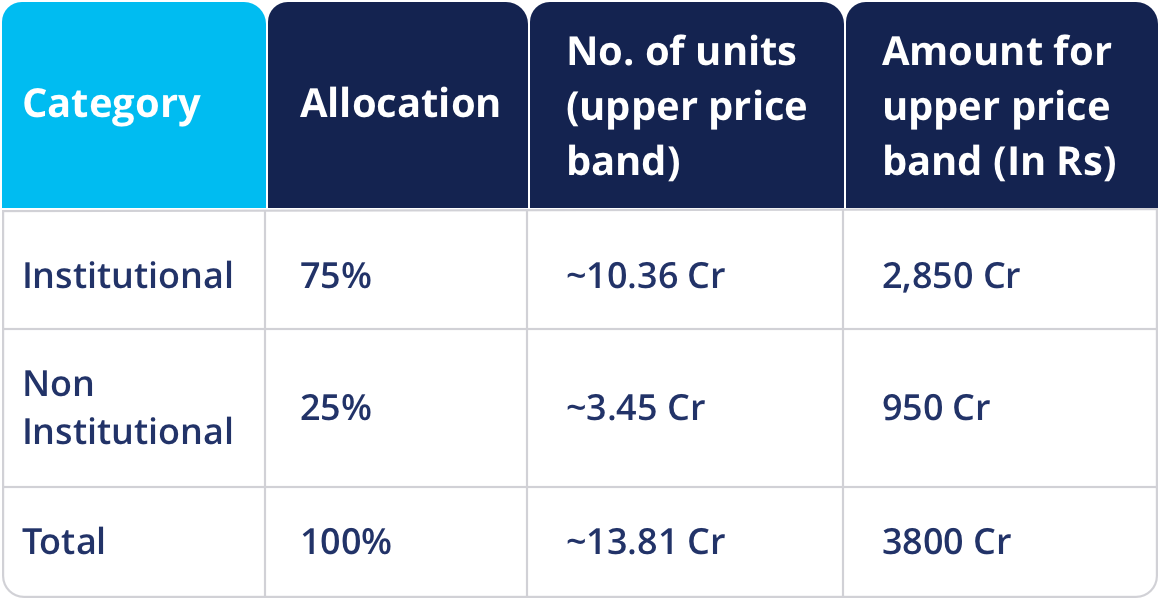

Offer Breakup

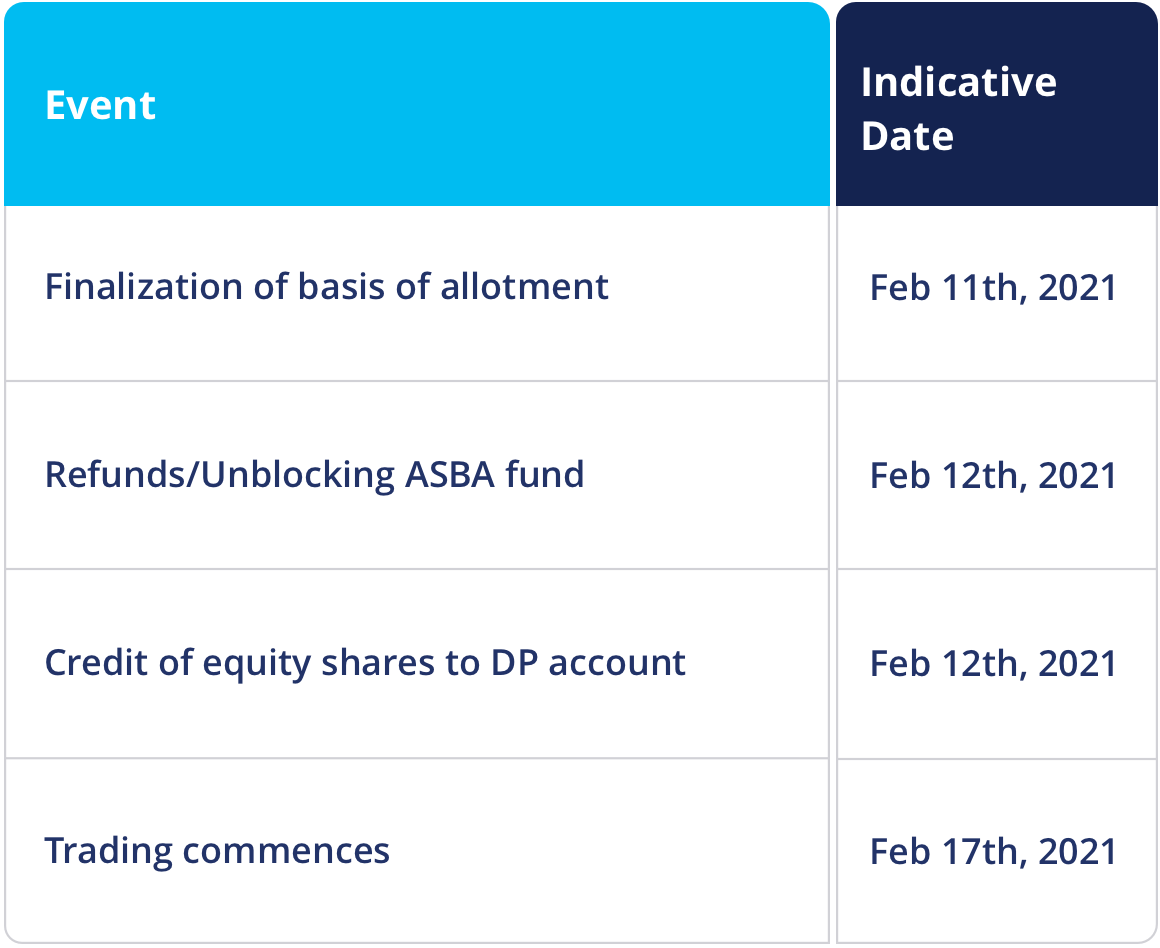

IPO Timeline

Issue opens on: Wednesday, Feb 3rd 2021 Issue closes on: Friday Feb 5th 2021

How to apply for Brookfield India Real Estate Trust IPO

The most popular mode of applying to REIT IPOs is through an online application using ASBA. Most syndicate banks (SCSB) provide access to apply via the ASBA process. You must have your net banking access and BO ID information to apply via ASBA.

ASBA: Applications Supported by Blocked Amount (ASBA) is a process developed by India’s Stock Market Regulator SEBI to apply to IPO. ASBA is an application containing an authorization to block the application money in the bank account, for subscribing to an issue. If an investor is applying through ASBA, his/her application money shall be debited from the bank account only if his/her application is selected for allotment after the basis of allotment is finalized, or the issue is withdrawn/failed.

Self Certified Syndicate Bank (SCSB): SCSB is a bank that offers the facility of applying through the ASBA process. Please click the link below to see if your bank is eligible for ASBA.

https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=35

BO ID or Demat Account Number: BO ID is Beneficial Owner Identification Number or Demat Account Number which is of 16 digits consisting of 08 digits DP ID and 08 digits Client ID.

To identify your BO ID or Demat Account number and depository in Paytm money, please follow the below steps.

- In the main dashboard please select the stock option

- In the bottom right corner, please select Account

- Then select the top tab where your name appears

- A page will open which will show your Demat account number and DP ID as well as depository services used. Depository for Paytm Money is CDSL

The process of applying using some of the bigger banks like HDFC, ICICI, SBI, Kotak Mahindra and Axis bank has been shown briefly below

Steps to apply IPO through HDFC bank

Please login to your HDFC Bank net banking account. (https://www.hdfcbank.com/personal/invest/ipo-application-through-asba)

Click on the link named “IPO Application” under Request on the left side menu

Select one of the IPOs you want to apply for and mention up to 3 bids.

Enter your depository details.

Place and confirm your Order.

You would then be required to accept the “Terms & Conditions” before submitting the bid.

Steps to apply IPO through ICICI bank

Login to your ICICI NetBanking Account. (https://www.icicibank.com/Personal-Banking/investments/ASBA/ASBA.page)

1.Click on the “Investments & Insurance” tab on the top menu. Then click on Invest Online on the dropdown menu.

2. Go to IPO “online box” and click on “Invest in IPO”.

3. Select your account number from the dropdown and click “submit”.

4. Enter and confirm your personal details and authorize your transaction.

5. Select the IPO you wish to apply from the list and click “GO”.

6. Enter IPO details and click on “Submit”.

7. Verify and Confirm the details.

Steps to apply IPO through State Bank of India

Login to SBI Bank NetBanking. (https://www.onlinesbi.com/)

The IPO applicant needs to be added.

After logging in, please select your profile in the left tab. Select “Manage IPO applicant”. Validate the same with your profile password, fill in the necessary details, and add IPO applicant.

Then proceed with Brookfield REIT IPO application as per the below process

1. Click on eServices Tab

2. Click on Demat & ASBA Services

3. Click on IPO Equity

4. Select IPO

5. Enter Details in the Form such as DP ID, BID, Name, Pan Card, and more

6. Verify & Confirm Your Order

Steps to apply IPO through Kotak Mahindra bank

Login to your Kotak Net Banking. (https://www.kotak.com/en/personal-banking/investments/asba-facility.html)

Go to Investments IPO ASBA Beneficiary registration Select Depository Name CDSL and register your 16 digits Demat A/c no

To apply, follow the steps below:

1. Once you register your Demat as beneficiary click on apply now

2. Select your Demat from the drop-down

3. Select IPO you wish to Apply (Brookfield)

4. Select Investment Category and apply in multiples of 200

5. Enter other details to apply

Steps to apply IPO through Axis bank

Login to your Axis Net Banking. (https://www.axisbank.com/retail/investment/iposmart/apply-for-iposmart)

1. Go to Investments / Online IPO

2. Click on Register ASBA and fill in your Paytm Money Demat ID Details

3. Once registered, apply using the below steps

4. Investments / Online IPO

5. Select the Demat account you want to use and click on Apply for Equity IPO

6. Select IPO from the list and click Initiate payment

7. Select Investor Category as NII and proceed to select the bid details and confirm