Budget 2020 for You: A TaxPayer, An Investor and A Citizen5 min read

Contents

Union Budget 2020, presented on 1st Feb 2020 by the Honorable Finance Minister, was among the longest budget speeches in the recent past. She proposed various policies to address the needs of numerous industry sectors and sections of the society.

There is no dearth of expert analysis on the budget available to you through the media. So we would like to see through all this and focus on the budget impact for you as a tax payer, an investor and a citizen – some of the roles we all play in our daily lives.

As a Tax Payer:

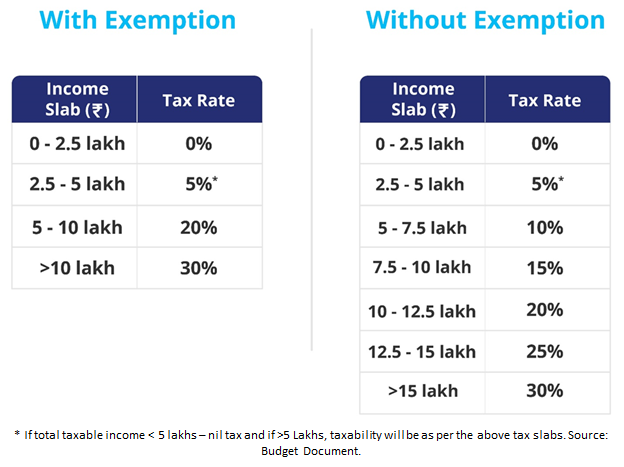

The government literally put the ‘personal’ back in the personal income tax regime. The budget has proposed a new tax regime for individuals while people will have the flexibility to choose the existing regime too. New regime will have more slabs and reduced tax rates for the corresponding slabs but more importantly fewer exemptions. A comparison between the existing regime (with exemptions) and new regime (without exemptions) is shown below:

The big catch here is that unlike the existing regime where you can claim various exemptions and deductions to reduce your overall tax outgo, in the new regime you would have to forego the same.

Some of the popular deductions and exemptions that are not allowed under the new regime are:

- Section 80C (PF, Insurance premium, ELSS etc) of up to INR 1.5 lakh

- Section 80D (health insurance premium)

- Interest on home loan

- Interest on education loan

- Extra NPS contribution of INR 50,000

- Standard deduction on salary income of INR 50,000

- House rent allowance

- Leave travel concession

However, employer’s contribution to PF, NPS and other superannuation funds can be availed as deductions under the new regime also, subject to an annual cap of INR 7.5 lakhs.

The choice of picking the suitable tax regime has been left to you now. You would need to do a cost-benefit analysis to figure out which regime would be more suitable for you. If you have no business income, you can choose between the regimes every year.

As an Investor:

To boost depositors’ confidence, this budget raised insurance cover on bank deposits from INR 1 lakh to INR 5 lakh after a span of 27 years.

Dividend Distribution Tax (DDT) has been abolished at the company and mutual fund level in Budget 2020. Dividends which were earlier tax free in the hands of the investor (was being paid at source by the company or AMC) will now be added to your income and taxed as per your existing slab rate. On the whole, this move will benefit investors in the lower tax brackets. Further, for dividends paid out by mutual funds in excess of INR 5,000, the AMC would deduct TDS (Tax Deducted at Source) at the rate of 10%. At the time of filing of returns, you can claim the TDS credit.

There was a lot of expectation around changes in capital gains taxation, especially LTCG on stocks and equity oriented mutual funds. But the budget has left the capital gains taxation unchanged.

After the success of Bharat Bond ETF that consisted of bonds issued by PSUs and other government companies, this budget proposed issuance of G-sec ETFs. This ETF will help you invest easily in government bonds at a lower cost.

The FM has also announced instant issuance of PAN card based on Aadhar number. This is set to bring more investors into mutual funds and simplify the investment process.

The government proposes to launch the ‘Mother of all IPOs’ in India – that of LIC. As an investor, this will give you a chance to invest in the largest life insurance player in India.

As a Citizen:

The government, through the budget, has stated that it aims to improve ‘Ease of Living’ of all the citizens of our country. To achieve this, the budget has three broad themes as shown below:

The government continues to focus on providing affordable housing for all. For this, additional deduction of INR 1.5 lakh was earlier available for interest paid on loans taken for purchase of affordable house by 31st March 2020. To help more people avail this benefit, the loan sanction date is being extended by one year to 31st March 2021.

It is well known that India needs a lot of investment in infrastructure to improve the quality of living. Inline with this, the government has set a target of INR 100 lakh crore investment in infrastructure over the next 5 years. Towards this end, a National Infrastructure Pipeline (NIP) of INR 103 lakh crore consisting of 6,500 projects was announced. To help fund this, the government has unveiled several measures to attract foreign capital and has provided equity capital to infrastructure financing vehicles such as NIIF.

Government’s infra push will focus on housing, safe drinking water, access to clean and affordable energy, healthcare for all, world-class educational institutes, modern railway stations, airports, bus terminals, metro and railway transportation, logistics and warehousing, irrigation projects, etc.

Transportation continues to be in focus with proposed high speed development of highways. The Delhi-Mumbai expressway and two other packages are set to be completed by 2023, while the work on Chennai-Bengaluru expressway would be started. Bengaluru’s traffic woes may ease with sanction given to the 148 km Bengaluru suburban rail transport project.

To provide piped water supply to all households, the government has unveiled Jal Jeevan Mission and has provided INR 3.6 lakh crore for the same.

By 2022, when India completes 75 years of independence, the government has targeted to double the farmer’s income. To achieve this, the budget has come out with a comprehensive 16 point action plan that covers the gamut of rural development, agriculture and allied activities.

We are sure this gives you better clarity on various policies and proposals unveiled in Budget 2020!