Global Central Banks Are Diversifying Into Gold. Take A Cue4 min read

Are you striving to optimize your investment returns in these uncertain times where financial markets and economic readings are giving conflicting signs? If yes, then it’ll serve you well to gain insight on where global central bank money is flowing. Central bank money, given its scale and influence can help investors gauge the direction in which global markets, policies, economics are headed, and thus make better investment decisions.

The World Gold Council recently published its 2020 Central Bank Gold Reserves Survey. But before we dive into the insights of the survey, let’s revisit central bank gold buying behaviour over the last few decades.

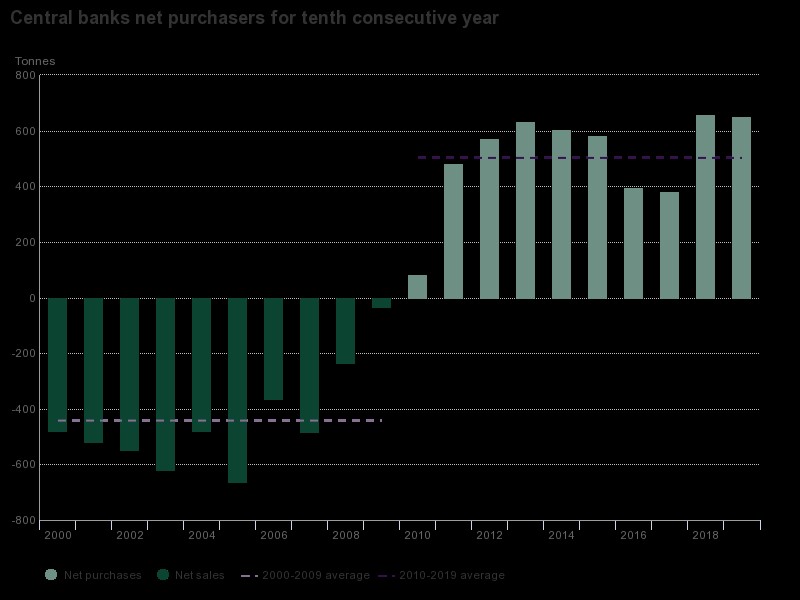

Central banks around the world have been doing a lot of gold shopping since 2009, with Russia, China, Turkey, Kazakhstan, and India taking the lead. And why is this important? Because for decades prior to that global central banks were consistently gold sellers!

This data gives rise to a number of pertinent questions for investors. What prompted this major structural change in the central bank’s attitude towards gold? Why 2009? What could central banks be preparing for that we don’t know about? And what should we as prudent investors learn from this central bank gold acquisition?

Well, obviously the Global Financial Crisis (GFC) of 2007-2008 preceded this central bank policy shift. With its profound effect on financial markets and economies, the GFC resulted in a renewed focus on risk and risk management for investors all around the world, central banks included. This prompted the reappraisal of gold’s role and relevance, not necessarily as a source of returns, but definitely as a portfolio diversifier.

Preference for gold after decades of selling was indicative of central banks’ intention to diversify reserves amid concerns about radical monetary policies, decade long quantitative easing, exploding world debt, fiscal sustainability, deteriorating quality of the primary reserve assets like the dollar.

These concerns will now be further exacerbated thanks to the economic disruption caused by Covid-19 and the unprecedented policy response to it. The following key findings of the 2020 Central Bank Gold Reserves Survey by WGC reinforce this.

- 20% of respondents say that they plan to add gold to their reserves this year, up from 8% in the 2019 survey.

- 88% of the 51 central banks that were polled picked “negative interest rates” as relevant for their investment decisions.

- When central bankers were asked to rank the factors behind their decision to hold gold reserves, “Historical position” and “Long-term store of value” emerged as the top two factors. “Performance during times of crisis”, “No default risk”, “Effective portfolio diversifier”, and “Highly liquid asset” were other important factors.

- 75% say that global central bank gold holdings will increase in 2020. No respondents believe that global central bank gold holdings will decrease.

It comes from the horse’s mouth and seconds our view that central banks are unlikely to sell gold, so you can dump that speculation right away.

More so, this survey indicates a further strengthening of the decade-long trend of central bank gold purchases as they prepare for an extended period of low and negative rates, fiscal unsustainability, and financial market volatility. Findings from the survey also highlight that central bank confidence in paper currencies/the dollar is set to dwindle further as massive stimulus measures targeted at the pandemic-induced recession will lead to the debasement of global currencies. After all, for how long can the world trust currencies which are based on unlimited debt creation and money printing?

No longer a “barbarous relic” as Keynes called it during the Great Depression; gold is preserving value at a time when currencies are losing theirs. The true value of gold for a central bank is that when its currency is threatened, whether by deflation or inflation, confidence falls in national currencies. Amid the worst circumstances, be it war or economic crisis, gold has come to the rescue of nations. This quality transcends its value as a true monetary asset.

Just like the global central banks, we need to relook at our risk management practices and diversify our investments by parking 10-15% of our money in gold. Gold is a valuable strategic asset that can play a value-preserving, stabilizing role in an investment portfolio. The policymakers themselves think so and are lapping up the shiny metal. Are you?

Author: Mr. Chirag Mehta – Senior Fund Manager, Alternative Investments, Quantum Mutual Funds

Ranked as the 4th best Fund Manager by Citywire in 2017; Mr. Mehta specializes in the field of alternative Investment Strategies and holds more than 15 years of experience in managing commodities.