Chasing Returns ? It does not help you reach your financial goals!3 min read

Contents

“Past Performance does not guarantee future returns”

This sounds like a clichéd and often repeated disclaimer but one that is really important for all investors to understand before you make their investment decisions.

Are returns everything?

The first thing that most investors think about while deciding between mutual funds is Returns. You would surely check out how these funds have performed recently and probably decide to invest in the fund which delivered higher returns over recent past, probably the last one year or so. The catch here is that these returns are historical returns based on past performance over a short time period and making investment decisions based solely on these is plain wrong!

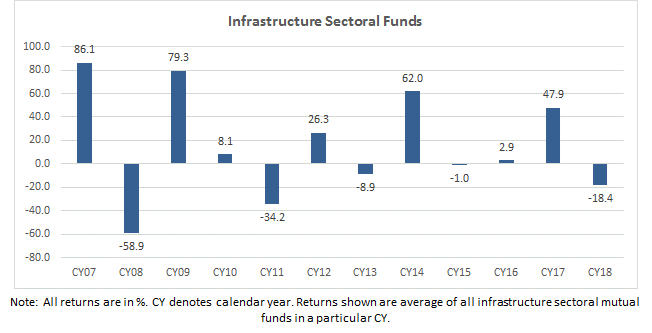

Take a look at the calendar year returns of “Equity — Infrastructure” sectoral funds over the last several years.

Imagine that you invested in one of these sectoral funds at the start of CY08, CY10, CY13 or CY15, simply because these funds gave good returns over the last 1 year (CY means calendar year). As you can see above, after performing well in one year, these funds generally delivered poor (often negative) returns in the subsequent one or two years. Hence the short term historical returns that you saw while choosing the mutual fund, were not repeated in near future.

Similarly, the most volatile category of mutual funds will deliver the best returns in a few intermittent years, like we have seen above, and that may not be repeated in future consistently year after year. The consistency of returns over a longer time frame is better suited to assess a fund rather than just recent short term returns.

Consistency is key

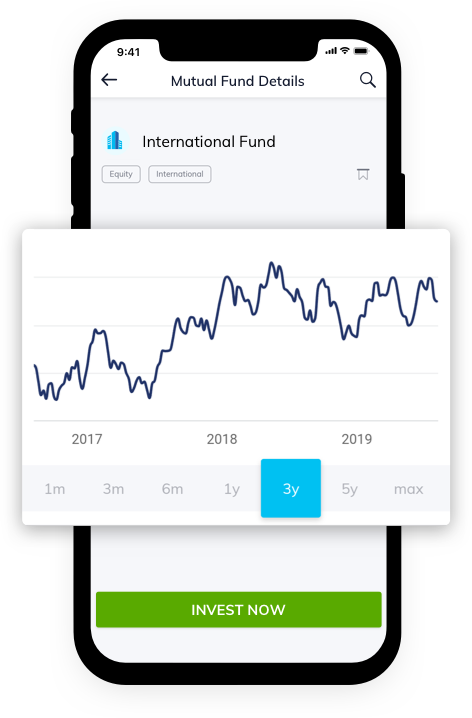

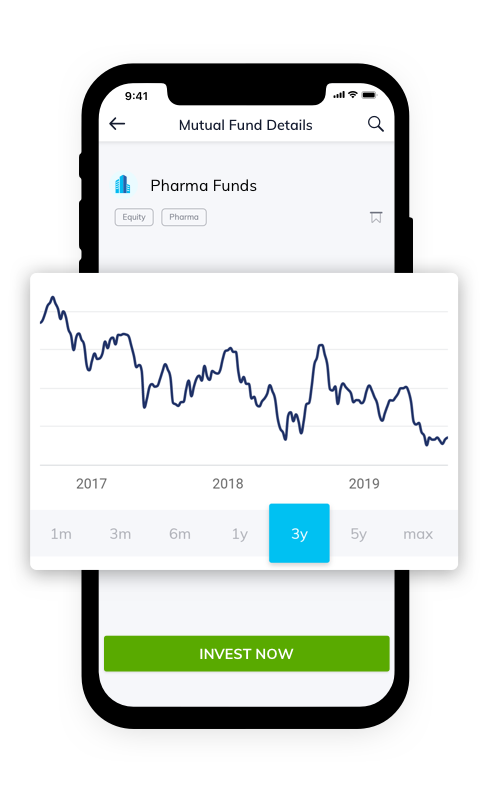

You can check for consistency of a fund by looking at its NAV growth graph over a reasonable time frame such as 3 years or more. Take a look at the graphs for an International Fund and a Pharma Fund.

You can clearly see how these funds are cyclical and have delivered good short term returns but it was followed by equally sharp downturns.

Rear view driving!

A simple analogy can be drawn with driving a vehicle. You look ahead (in-front) while driving a car or a bike. At the same time, you do need to keep a watch on the rear-view mirror from time to time to make sure you are driving safely. But you are primarily focused in-front and not at the rear-view mirror! The gist is that “You cannot drive a car looking in the rear view mirror”. Similarly, short term historical returns cannot be the primary reason to invest in a fund. Historical returns are something that have gone and may not repeat in future.

Not just equity funds

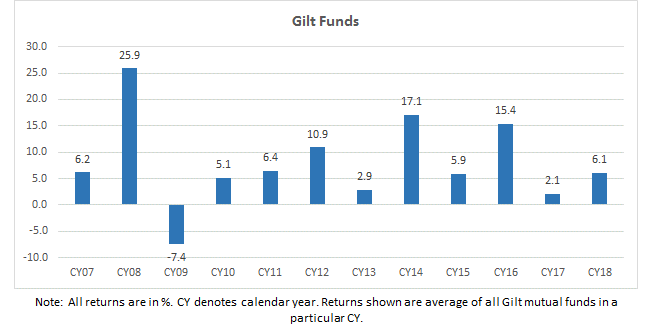

If you think this is only restricted to equity mutual funds and not debt mutual funds, well think again! Gilt is a sub-category of debt mutual funds that invest in government bonds, hence one of the safest categories in terms of credit risk. Also debt (bonds) as an asset class is much less volatile than equity. Yet the underlying lesson is the same.

If you had invested in one of these funds simply by seeing the past one year performance, you would have been disappointed with your investment returns in the next one or two years.

What should you do?

To sum it up, we as human beings suffer from certain biases. The one that we are talking about is “Recency bias” where we attach undue importance to good performance in the recent past. We then start thinking that it will keep performing well in the future also. We need to consciously overcome our biases while making an investment decision.

Do remember that you should keep in mind your investment objective, risk profile and investment horizon while making the choice to invest in a particular mutual fund. In general, you should look at the consistency of returns over a longer history rather than just recent and short term returns.

Keeping all this in mind, we at Paytm Money have designed Investment Packs that will take care of your specific investment needs.