Clean Science and Technology IPO Details – Date, Price & Overview4 min read

The initial public offering of Clean Science and Technology, a Pune-based company that manufactures speciality chemicals, will open for bidding on Wednesday, July 7. This will be the second company to launch an IPO in July 2021 after GR Infraprojects Limited.

Company Overview

Clean Science is among the few companies that are globally focused entirely on developing newer technologies using in-house catalytic processes, which are eco-friendly and cost-competitive.

This has enabled the company to emerge as the largest manufacturer globally of certain specialty chemicals in terms of installed manufacturing capacities as of March 31, 2021.

Its continued focus on product identification, process innovation, catalyst development, the significant scale of operations as well as the measures towards strategic backward integration have all contributed to the company’s success as one of the fastest-growing and amongst the most profitable specialty chemical companies globally.

The company manufactures functionally critical specialty chemicals such as performance chemicals, pharmaceutical intermediates, and FMCG chemicals.

In FY21, exports contributed 67.86 per cent to total revenue from operations. Its key customers include Bayer AG, SRF, Gennex Laboratories, Nutriad International NV and Vinati Organics. It has two certified production facilities in India at Kurkumbh (Maharashtra), with a combined installed capacity of 29,900 million tonnes per annum (MTPA) as of March 2021.

It has also recently set up a unit at the third facility adjacent to existing facilities at Kurkumbh (Maharashtra) and has recently been allotted land for the construction of a fourth facility at Kurkumbh (Maharashtra).

Awards

- Best Export Award by CM Fadnavis at Magnetic Maharashtra Summit – February 2018

- Winner of SME Elite 50 Jury Round, conducted by ICICI Bank

- Best Export Performance in 2016-2017

- Distinguished Alumnus (Entrepreneur) Award – May 2014

- Distinguished Alumnus (Entrepreneur) Award – October 2009

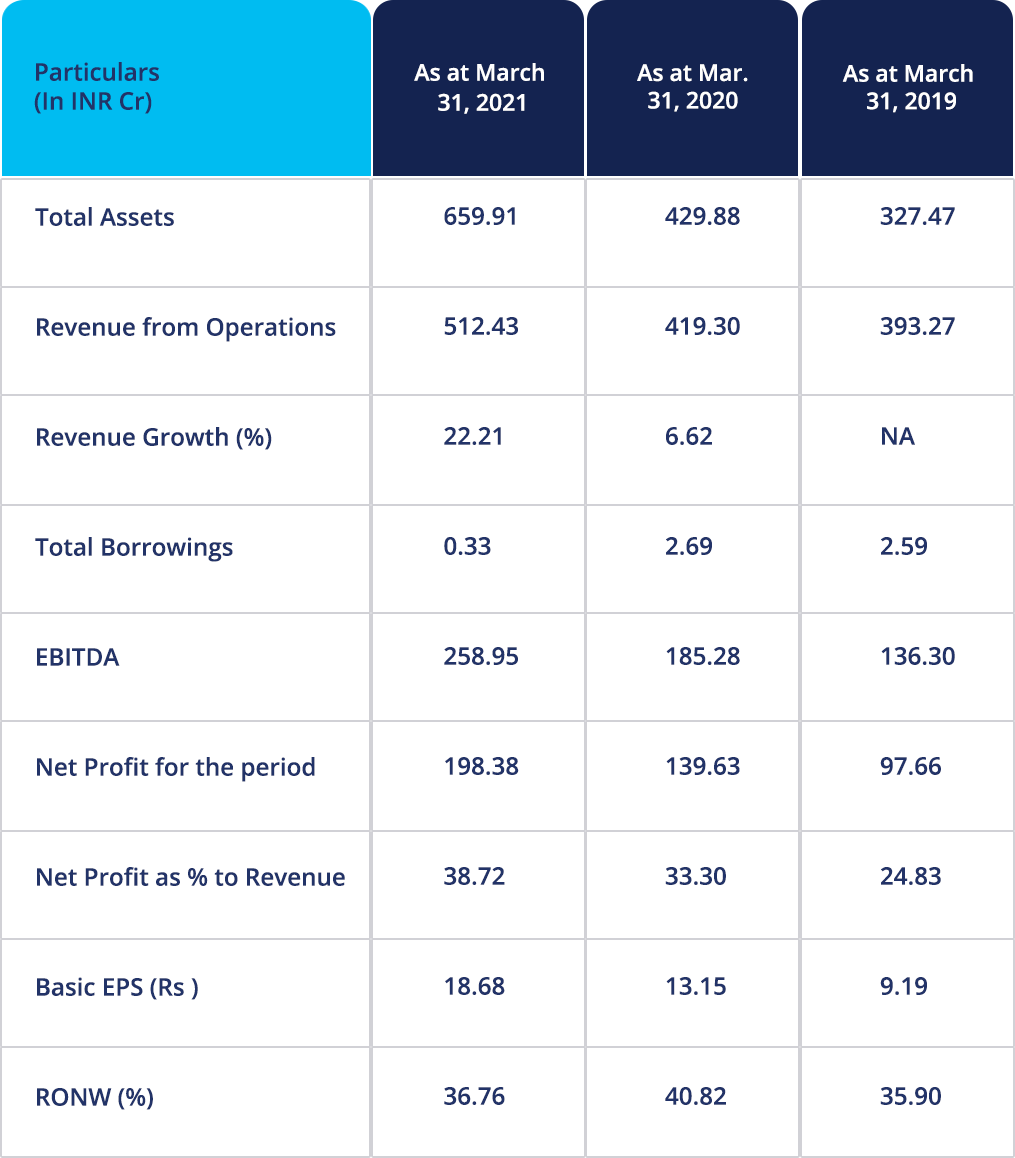

Financial Performance

Let’s take a quick look into the past financial trends of the company to understand its performance of the business and evaluate the growth prospectus:

IPO Details

Clean Science and Technology IPO will open for subscription on July 7th and will close on July 9th. The shares will be offered in a price band of Rs. 880 to Rs. 900 with a lot size of 16 shares. The company is offering up to 17,575,245 equity shares in its IPO and aims to raise an issue amount of Rs. 1,546.62 Crores.

Axis Capital, JM Financials and Kotak Mahindra Capital are the book running lead managers to the issue and Link Intime India is the registrar to the issue. The listing will also provide a public market on NSE and BSE for equity shares in India.

IPO Timeline

The objectives of the offer are:

- To achieve the share listing benefits on the BSE and NSE.

- To make an offer for sale of up to 17,575,245 shares.

Strengths & Risks of the company

Strengths:

- The company’s track record of strategic process innovation through consistent R&D initiatives

- Being among the largest producers globally of functionally critical specialty chemicals used across various industries and geographies resulting in a de-risked business model

- Experienced promoters and senior management with extensive domain knowledge

- Strong and long-standing relationships with key customers

- Automated manufacturing facilities with proven design and commercialization capabilities and a strong focus on EHS

- Strong and consistent financial performance in the last three fiscals

Risks:

- Operations have extreme dependence on their R&D capabilities

- None of its catalytic processes is patented and its IP may not be adequately protected

- Any unscheduled, unplanned or prolonged disruption of its manufacturing operations could affect business

- It does not have long-term agreements with suppliers for the raw materials

- Outstanding litigation proceedings against the company and directors

- The continuing impact of the COVID-19 pandemic on business and operations is uncertain

Conclusion

The initial public offer (IPO) of speciality chemicals manufacturer Clean Science and Technology will open for subscription on Wednesday, July 7 and close on Friday, July 9. The price band for Clean Science and Technology has been fixed between Rs. 880-900 per share with a lot size of 16 shares and the company aims to raise an issue amount of Rs. 1,546.62 Crores.

Source – RHP, BRLM

Disclaimer – This content is purely for informational purposes and is in no way advice or recommendation.

Investment in the securities market is subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.