During the Covid-19 pandemic, the entire world saw what a health emergency would look like and hence most people rushed to insurance companies to secure a life & health cover.

- People Flocking to Buy Insurance

- Massive Opportunity Lies Ahead in Insurance

- Key Changes in the Insurance Industry in 2020

- Standardization of plain policies

- Pre-existing conditions

- Aadhaar as a valid KYC proof

- New distribution channels

- No need of physical in-person verification

- Color coding to indicate the complexity of health policies

- Health insurance may soon include OPD treatment

- Fundamental & Technical Dose

- Conclusion

If we look at the insurance sector in India, the percentage of people having insurance cover is very small. However, the onslaught of Covid-19 made everyone realise the importance of insurance as the extent of financial hardship a sudden illness can cause, both in the short term and in the long term was unimaginable.

This popularised the idea of having medical insurance that can take care of the financial aspects of medical emergencies for oneself and one’s families.

Insurance penetration in India is currently at 3.7% of the GDP as compared to the world average of 6.31%.

People Flocking to Buy Insurance

As per some media reports, the general insurance sector is growing at a robust annual pace of 18%, faster than in the previous years. Growth in this sector has picked up as covid has led more people to purchase health insurance policies. The average growth in standalone health insurance is currently at 35-40%.

In January 2021, Policybazaar.com released a report to the media stating that the COVID-19 pandemic led to a massive demand for health insurance policies. The portal alone sold 4 lakh health insurance policies between April-Dec 2020 amounting to a total sum insured of more than Rs 7 lakh crore.

Policybazaar also announced that in the April-December period, the website had one crore visitors; of which 65% were less than the age of 40 years, 25% were between the age group of 40 – 60 years and 10% were above the age of 60 years.

Non-life insurance companies registered a 6.7% increase in their gross direct premium collection in January at Rs 18,488.06 crore, according to the IRDAI data.

Among these, 25 general insurance companies witnessed a 10.8% increase in their collective premium in the first month of 2021 at Rs 16,247.24 crore as against Rs 14,663.40 crore in January 2020.

Massive Opportunity Lies Ahead in Insurance

In the month of September, IRDAI Chairman, Subhash Chandra Khuntia, at the CII 22nd Insurance and Pensions Summit said that the Indian insurance industry currently services only 10-20% protection requirements indicating that there is a huge insurance protection gap of 80-90% in India.

While life insurers have seen a decline in terms of new business premium collection, nonlife companies witnessed marginal growth in 2020.

Meanwhile, non-life insurers have recorded a 3% growth in new business premiums. The new business premium collection of general insurance companies increased to Rs.1.46 lakh crore in December 2020 from Rs.1.42 lakh crore in 2019.

Budget Push for the Sector

In the Budget 2021, the government announced that for the insurance sector to increase the foreign direct investment limit in insurance from 49% to 74% is likely to accelerate growth and spur competition in the sector, raising hopes of a flux of foreign capital into private Indian insurers.

The proposal, announced by finance minister Nirmala Sitharaman in Union budget 2021, is likely to help local private insurers grow fast and expand their presence in India, which has one of the lowest insurance penetration levels globally.

Other steps announced in the budget, such as the privatization of state-run firms and increased allocation to healthcare, are also positive for the sector.

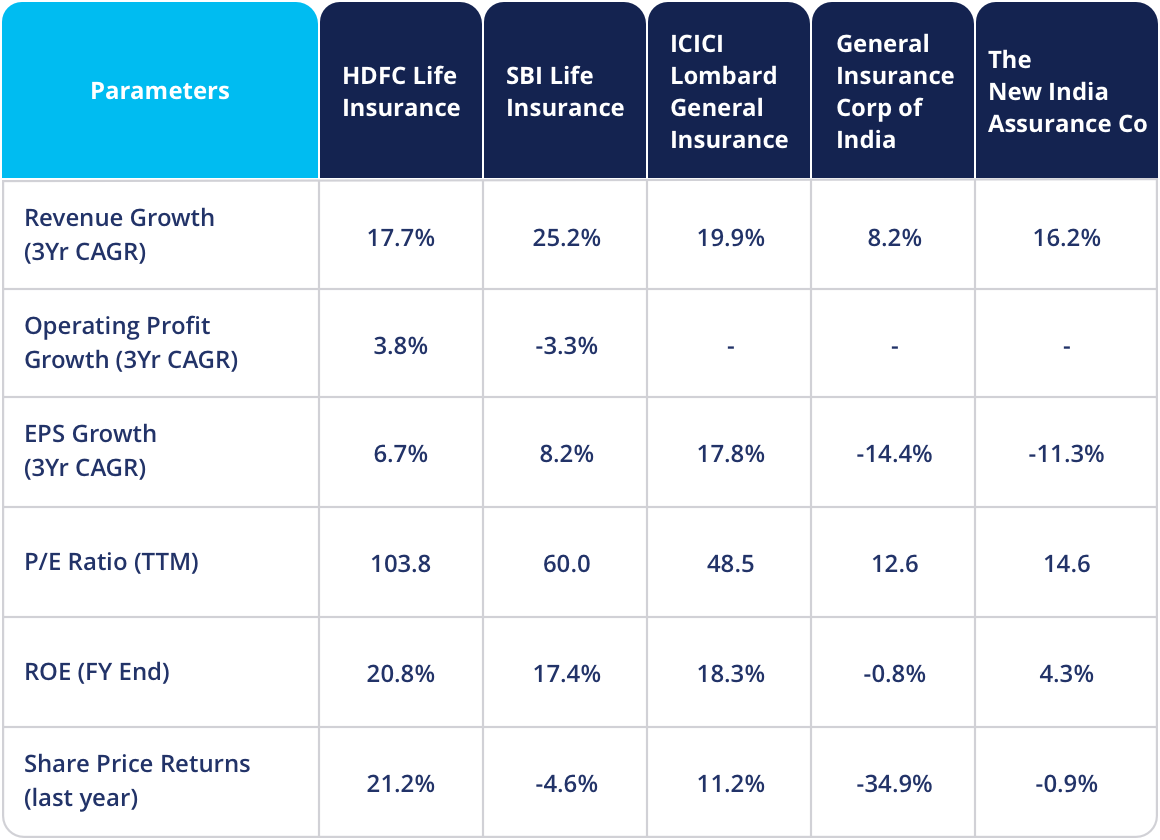

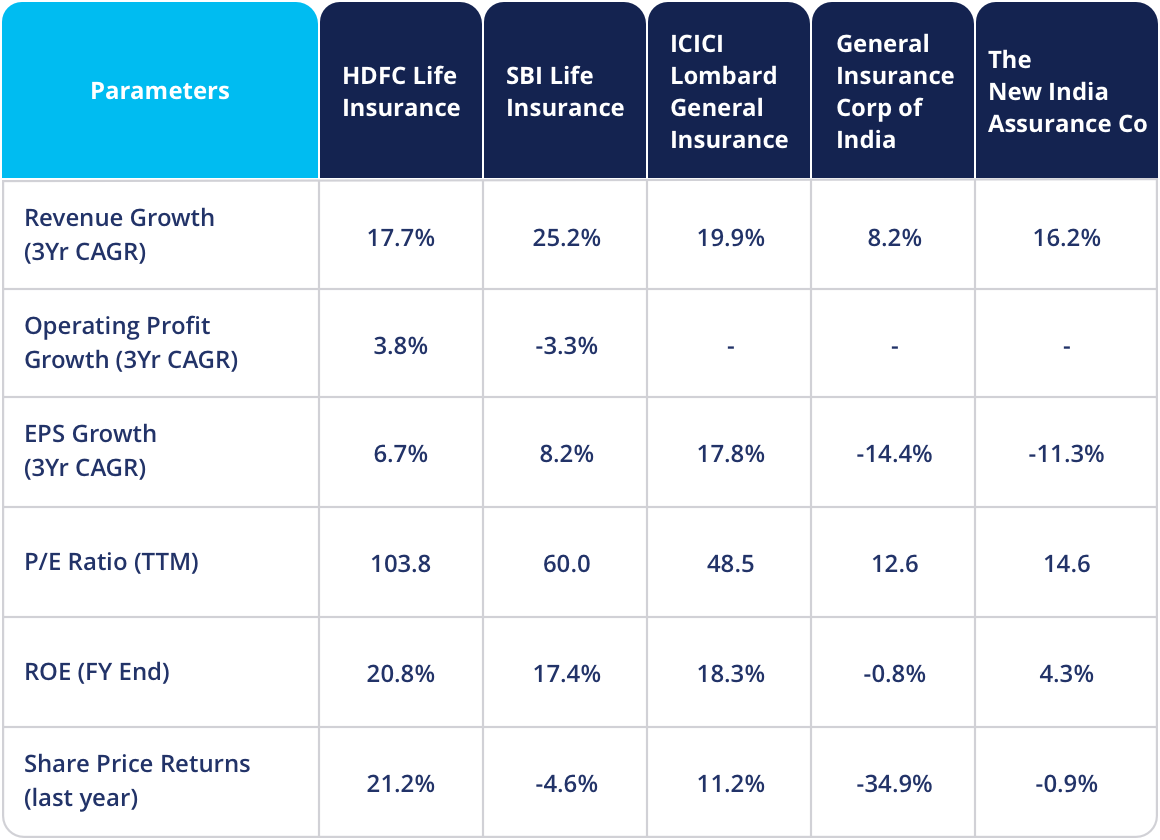

Since the Budget was announced, the shares of the listed insurers’ life & non-life companies such as HDFC Life Insurance, SBI Life Insurance, ICICI Prudential Life Insurance, ICICI Lombard General Insurance, General Insurance Corp of India, and The New India Assurance Co were up 5%, 2%, 3%, 15%, 8%, and 8% respectively.

These announcements have also benefitted the holding companies of these Insurance companies like HDFC, ICICI Bank, SBI, and so on as they have climbed almost 25% each.

Key Changes in the Insurance Industry in 2020

Standardization of plain policies

In line with the insurance regulator IRDAI’s direction, all general and standalone health insurers have launched Arogya Sanjeevani Policy, standard health insurance that comes with uniform features. This policy comes with a sum insured of up to Rs.5 lakh at a competitive premium. Very soon, non-life insurers will also offer standard personal accident insurance products with uniform features and benefits.

Similarly, life insurance companies have come up with a standard term insurance policy called Saral Jeevan Bima from January 1, 2021.

IRDAI feels that the introduction of standard policies will reduce mis-spelling and potential disputes at the time of claim settlement.

Pre-existing conditions

Insurance companies will have to honour claim requests on diseases that a policyholder contracts after buying a health insurance policy. The move is expected to reduce instances of claim rejection in health insurance.

Thus far, if a policyholder was diagnosed with a major ailment within three months of buying a policy, insurance companies would consider the disease as a pre-existing condition.

Aadhaar as a valid KYC proof

IRDAI has simplified the KYC process by allowing insurance companies and intermediaries to onboard new clients through Aadhaar authentication.

New distribution channels

IRDAI gave corporate agency licenses to Apollo Pharmacy, which runs a chain of hospitals and medical stores. With this, we may see more clinics, hospitals, pathology labs, and pharmacies becoming health insurance distributors to increase their offerings.

No need of physical in-person verification

Insurance agents and intermediaries can onboard new customers sitting at home as IRDAI has done away with the requirement of doing in-person verification physically.

Today, anyone seeking insurance cover can undergo a video-based identification process (VBIP) through any insurance company and submit necessary documents like PAN card, address proof, and bank details verified by ‘Digilocker’. Clients can authenticate the purchase of policies through OTP or simply by clicking the confirmation link before buying a term plan.

Color coding to indicate the complexity of health policies

Recently, IRDAI has proposed to introduce color-coding – green, orange, and red in health insurance policies to indicate the level of complexity, with green being the easiest to understand.

Health insurance may soon include OPD treatment

IRDAI Chairman Subhash Chandra Khuntiaa has asked non-life insurance and standalone general insurance companies to include OPD treatment cover under all health insurance policies. OPD treatment includes coverage for doctors’ consultation fees and the cost of medicines based on prescription.

Fundamental & Technical Dose

Conclusion

The Budget announcements coupled with the renewed interest in insurance because of the COVID-19 pandemic and the immense growth potential that the sector holds due to the low penetration in the country has generated a renewed interest in the insurance sector. Do you think that insurance is a good bet? Let us know in the comments section.