Craftsman Automation IPO Details – Dates, Price & Overview5 min read

This financial year saw a flurry of initial public offerings. Back to back fresh IPOs of small to medium-scale enterprises in 2021 have kept the ball rolling. With stock markets touching all-time highs, many new companies are looking to cash in on the euphoria by issuing new IPOs.

One of the latest to be notified is from the Craftsman Automation IPO which is scheduled to be launched on March 15, 2021. Here are some key details about the company you should be aware of.

About the Company

Craftsman Automation is a diversified engineering company that has vertically-integrated manufacturing capabilities in three broad segments: Powertrain and other products for the automotive segment, Aluminum products for the automotive segment, Industrial and engineering products segment.

The company is the largest player involved in the machining of cylinder blocks and cylinder heads is in the intermediate, medium, and heavy commercial vehicle segment as well as in the construction equipment industry in India.

Its comprehensive solutions include design, process engineering, and manufacturing including foundry, heat treatment, fabrication, machining, and assembly facilities. Its core competence in machining and assembly of industrial and engineering products has helped it to establish itself as a significant player in the Automotive – Powertrain and others segment.

The key products in this segment offered by Craftsman Automation are highly engineered and include engine parts such as cylinder blocks and cylinder heads, camshafts, transmission parts, gearbox housing, turbochargers, and bearing caps. The end-users for its products include OEMs (Original Equipment Manufacturers) producing commercial vehicles, special-utility vehicles, tractors, and off-highway vehicles.

Craftsman Automation has long-term relationships with several marquee domestic and global original equipment manufacturers and component manufacturers across three business segments, including Daimler India, Tata Motors, Tata Cummins, Mahindra & Mahindra, Simpson & Co, TAFE Motors and Tractors, Escorts, Ashok Leyland, Perkins, Mitsubishi Heavy Industries, TVS Motor, Royal Enfield, John Deere, and JCB India.

Success Story

Craftsman Automation Limited was incorporated in 1986 in Coimbatore, Tamil Nadu. In 2001, the company started an aluminum foundry unit at Kurichi in Coimbatore.

It also started a satellite unit in Pithampur and obtained ISO 9001: 2000 and ISO/TS 16949:2002 registration certification. By 2007, it had commissioned a satellite unit in Chennai and Jamshedpur and entered into joint ventures with Carl Stahl and Mitsubishi.

The company has satellite units in Pune, Faridabad, Sriperumbudur, and storage solutions in Arasur. Further, it also boasts of a technology division in Bengaluru and an aluminium sand foundry, HPDC, and LPDC in Arasur.

Additionally, the company has a railway and camshaft business in Coimbatore and has also received the “Star Performer Award” from EEPC India and a “Star Export House” registration certificate.

Financials

IPO Details

Craftsman Automation is coming up with an initial public offering of Rs. 824 crores, and is set to open on March 15 and close on March 17, 2021. The company is issuing shares at a price band of Rs. 1,488 to Rs. 1,490 with a minimum lot size of 10 shares and in multiples of 10 thereafter. Craftsman Automation is offering up to 5,529,514 equity shares with a face value of Rs. 5 per share.

The book running lead managers to the issue are Axis Capital and IIFL Securities while the registrar to Craftsman Automation will be Link Intime India Private Limited. The equity shares of the company are proposed to be listed on both the premier stock exchanges of the country – the NSE and BSE.

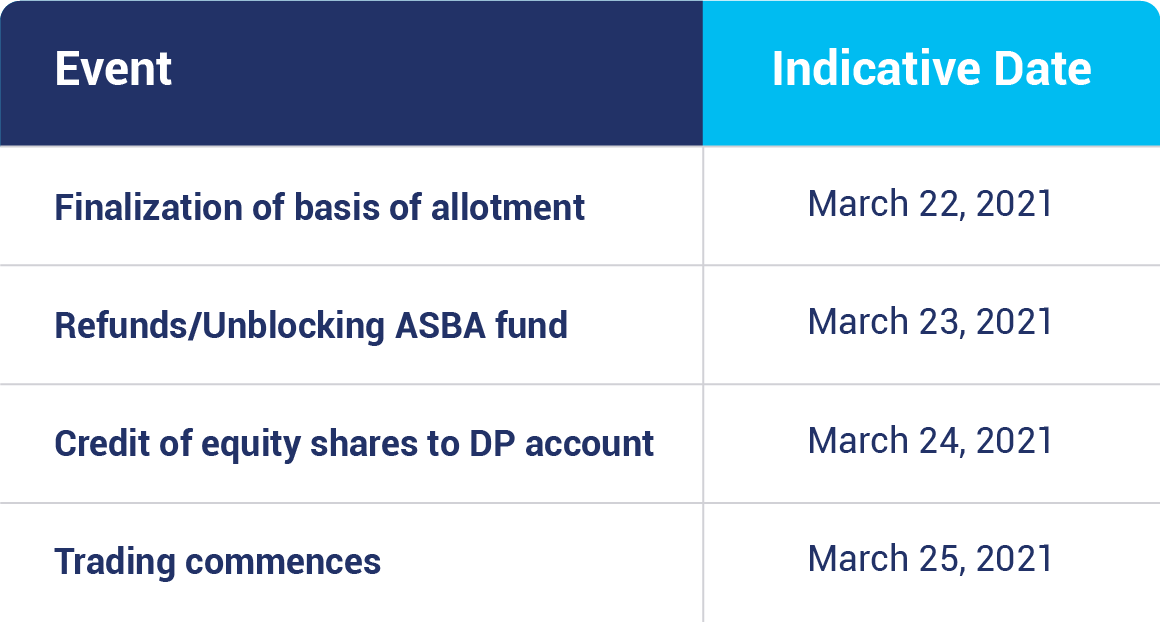

IPO Timeline

Objective of the Offer

Craftsman Automation Limited proposes to utilize the net proceeds from the fresh issue for the repayment or prepayment, in full or part, of certain borrowings and for general corporate purpose.

Moreover, Craftsman Automation expects to achieve the benefits of listing the equity shares on the stock exchanges and enhancement of the company’s brand name and creating a public market for its equity shares in India.

Strengths

- Diversified engineering company with a focus on providing comprehensive solutions and manufacturing high quality, intricate and critical products, components and parts.

- Strong in-house process and product design capabilities with the ability to interchange capacity and product mix.

- Long term and well-established relationships with marquee domestic and global OEMs.

- Extensive manufacturing footprint, with strategically located manufacturing facilities.

- Experienced management team supported by a motivated and skilled workforce.

- Robust financial performance in a challenging business environment.

Risk Factors

- There has been a significant decline in automobile sales even before COVID-19 and it is not certain that the sales will recover even after the impact of COVID-19 is over.

- Craftsman Automation’s inability to meet its obligations under its debt financing arrangements could adversely affect its business, results of operations, and cash flows.

- The company is exposed to credit risk on account of interest-free loans given by the company to its subsidiary.

- Contingent liabilities could adversely affect financial condition if they materialise.

- The COVID-19 pandemic and resulting deterioration of general economic conditions have impacted business.

- The group companies of Craftsman Automation Limited have booked losses in the last three fiscals.

You can apply for the IPO by using these simple steps

- Log in to the Paytm Money app and complete your fully digital KYC for the stock, if not done already.

- Once your details are verified and the Demat account is created, click on the IPO section on the home screen.

- You will then be able to see a list of past and upcoming IPOs where you can apply for IPOs that are open for applications.

- Next, you must add details for bidding such as quantity, amount, and so on. Maximum 3 bids are allowed.

- After that, you have to enter your UPI id so that the funds for your highest bid are blocked. You will receive a mandate for the same on your UPI app.

- Once you accept the mandate, your application will be successfully submitted.

- Once the allotment happens, you will be notified about your allotment status.

Conclusion

Craftsman Automation started its journey in 1986 in Coimbatore. It is currently present across the entire value-chain in the Automotive aluminium products segment, providing diverse products and solutions and owns and operates 12 strategically located manufacturing facilities across seven cities in India.

The company is set to launch an initial public offering in 2021 which will open for subscription on March 15. The company has fixed a price band at Rs. 1,488 to Rs. 1,490 per share for its issue which is scheduled to close on March 17.