Is It The End Of The Super-Cheap Data Era?5 min read

Our desi mobile phone users seem to be enjoying the cheapest data services as compared to the global counterparts who continue to pay heavy data tariffs.

According to a UK-based price comparison website, 1GB of mobile data was priced at $0.09 (i.e. less than 10 cents) in India as compared to $8 in the USA, $1.4 in the UK, and the global average of $5. That way India shares the stage with Israel, Kyrgyzstan, Italy, and Ukraine in terms of being the least expensive nations for 1GB of mobile data.

The study also confirms that the average cost of 1GB of data has shrunk by about 65% since November 2018, as service providers started offering bigger data plans.

Some analysts attribute such a low-data regime to the operators’ way of getting new users onboarded. But the joy ride of super-cheap data may not be prolonged; that’s what the industry experts have in their mind.

A Revolution In Data Tariffs

The year 2016 was historic! Competition in the telecom sector intensified and Reliance Jio made an entry as a price warrior with cheap and high-speed mobile data & free calls. The focus was to transform voice users into data guzzlers.

Within a span of 2 years, Jio became the third-largest player in the country hosting 280 million subscribers by December 2018. According to the TRAI statement, Jio held the highest market of 34.33% as the private access service provider as of 31 May 2020. As compared to this, the share of Bharti Airtel and Vodafone Idea was 27.78% and 27.09% respectively for the same period.

Since then, a string of hyper-competition started and other operators slashed their data prices to retain the data subscribers.

It became a war of attrition that left several players cash-strapped at a time when they badly required huge money to upgrade their network to be in line with technological advancements that were taking place in the telecom industry.

Data Tariffs Should Rise!

Extremely low data tariffs have been a cause of concern for the industry players and a common consensus has been brewing up since last year that data prices need to rise in the country.

Rajan Mathews, Head-Cellular Operators, Association of India reportedly said that “low tariffs are purely the result of hyper-competition resulting in a huge “consumer surplus” – when consumers pay prices much lower than what they are willing to pay. These low prices are not sustainable if operators have to continue to make investments in network coverage, quality, and new technology. Return on capital is in the low single digits for this industry. Operators will need to review their pricing, to correct this situation.”

The country’s second-largest telecom operator called for a data tariff hike. Sunil Bharti Mittal, Chairman-Bharti Airtel, regarded the prevailing data tariffs to be a tragedy and being unsustainable. At an event, he reportedly said “You either consume 1.6GB of capacity per month either at this price point or you may prepare to pay a lot more. We don’t want $50-60 (roughly Rs. 3,700 – Rs. 4,400) like the US or Europe but certainly, $2 (roughly Rs. 160) for 16GB a month is not sustainable.”

Meanwhile, Faisal Kawoosa, founder of techArc-technology and consulting firm, resonated with the idea of stable pricing for business continuity. He reportedly said “the declining price trend is unhealthy for the industry. There is a need to have stable pricing so that operators have adequate cash flows to keep the operations up and running.”

Earlier this year, the Cellular Operators Association of India (COAI) wrote to the TRAI- the telecom regulator, requesting a floor price on mobile data tariffs till the sector’s financial condition improves.

Blame The Double Whammy

While the industry trackers may point out that the current level of data tariffs is economical and consumer-friendly, these are difficult to sustain for the sector that’s reeling under financial stress on account of two primary reasons.

As the cost of setting up the wireless networks and telecom infrastructure keeps rising and the user expectation of receiving uninterrupted services remains a constant, nowhere else globally is one gigabyte denting a user’s pocket so lightly as it does in India.

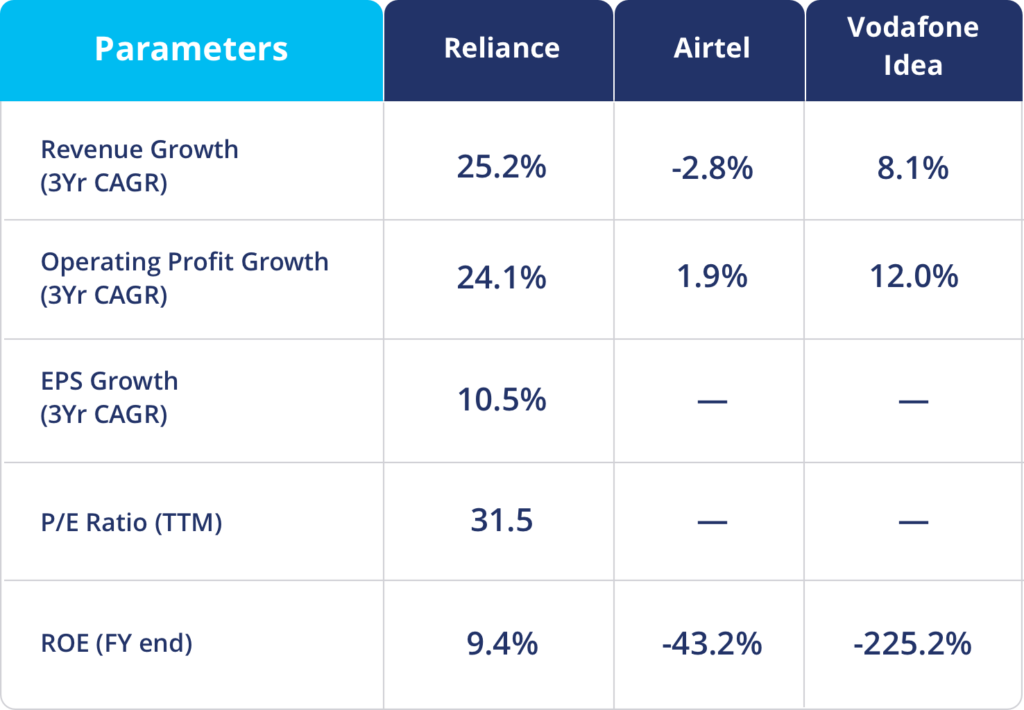

Survival has become difficult in the current circumstances. It has also led to a massive consolidation with just three private players i.e. Reliance Jio, Bharti Airtel & Vodafone-Idea running the whole show. Within these, only the first two seem to be capable of driving-in fresh investments that are required to set the latest technologies.

Nikhil Pahwa, Founder of MediaNama & digital rights activist, reportedly said that “The lowering of rates has led to consolidation, and we are down to four operators. It’s a matter of time before rates go up. This was an industry used to 30% margins, and it will want to get back there.”

Another reason is the 2019 Supreme Court order that has created an obligation on telecom operators to pay massive amounts to the telecom department on a recalculation of their outstanding dues as per a revenue-sharing deal. Before this development, they had to pay 8% of their Annual Gross Revenue (AGR) (i.e. revenue from telecom services) as license fees and 3-5% of AGR as spectrum usage charges.

But after the litigation, AGR would include all revenue from telecom and non-telecom services. Additionally, they are also required to pay dues of insolvent companies that they once acquired or whose airwaves they had utilized.

Now, the telecom companies not only owe the telecom department a shortfall in AGR for the past 14 years but also an interest on that amount along with penalty and interest on the penalty. All-in-all the total outstanding dues for all the players put together now stands at around Rs 1.6 trillion.

What Happens Next?

The ongoing state of affairs must not result in monopolistic tendencies in the industry. Healthy competition is the essence of the market for growth and for the user. Also, advancements in telecom infrastructure would eventually translate into better services to the end-user. However, in a price-sensitive country, will there be a tariff hike or not is something we need to wait and watch.

Fundamental Analysis

Note: Reliance is a diversified company with operations in Oil & Gas, Telecom, and Retail.