Most of us are more aware about mutual funds today, than we were, say 5 years back. This is due to the widespread campaigns and efforts made by AMFI and industry stakeholders. We have also overcome the myth that mutual funds only invest in equities or stock market, as more people became aware about debt mutual funds. However most people had started assuming that debt mutual funds are safe investments to get higher returns compared to keeping money in bank account or fixed deposits. Such belief has been busted by the turmoil faced by debt funds over the past year.

At the outset, we want to clarify that we are not trying to pitch equity funds instead of debt funds. We are just highlighting that there are some risks involved with debt funds that one should know. Overall we believe that most retail investors put money in debt mutual funds with the primary goal of safety and expect a reasonable growth in investment value.

What are debt mutual funds?

Debt mutual funds are a category of mutual funds that invest primarily in fixed income instruments (example bonds) issued by government, public and private companies. Or simply you can understand that the money you put in a debt mutual fund, is in turn lent out to private/public companies or government bodies. Mutual funds get interest from these borrowers which is reflected in the returns of the mutual fund.

Now recollect an old saying “High Risk, High Returns” i.e. someone is expected to take higher risk if he/she expects higher returns. Hence like any financial instrument, a debt mutual fund which offers a possibility of high returns, will inherently have higher risk attached to it. But most investors or industry participants typically ignore/neglect the associated risk and only look at expected returns.

Risks involved in debt funds

Let’s understand two types of risk associated with debt mutual funds using an example.

Consider two people, Ram and Rahul, approach you asking for a loan with a promise to repay after 1 year. Ram is a close friend whom you trust and have known him for a long time, whereas Rahul is relatively a new colleague of yours. Think about the interest rate that you would charge Ram and Rahul for the same transaction, will it be same or different? Most probably, you will lend to Ram at a lower interest rate and would charge Rahul a higher interest rate. Let’s understand why.

This is because you are confident that Ram will certainly return your money. While, you are not so confident whether Rahul will return it. This is called credit risk or default risk. Lesser the confidence of the lender, higher is the interest rate charged by the lender. As explained earlier, this interest earned by the fund is part of the return generated by the fund. Hence if a mutual fund is expected to deliver higher returns, it has to lend at higher interest rate to its borrowers, which is possible when it lends to risky borrowers. On the other hand, mutual funds lend to Government of India through bonds and treasury bills at lower interest rates because government is considered to have negligible chance of default.

Now imagine that Ram is asking for a long term loan, say 10 years instead of 1 year earlier. You will surely charge a higher interest rate this time compared to previous example because it will take you longer time to recover your principal. Debt mutual funds also charge higher interest on longer tenure/duration loans. This is called as interest rate risk or duration risk. These funds see more fluctuation in returns due to regular changes in the current interest rates in the market. So a fund that is expected to deliver higher returns may also be lending for longer term.

Hence debt funds are not completely risk free.

Risks in action

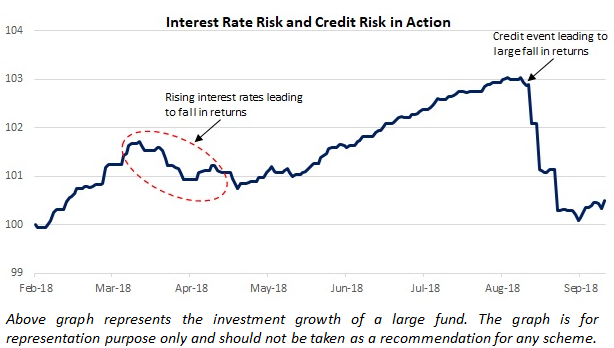

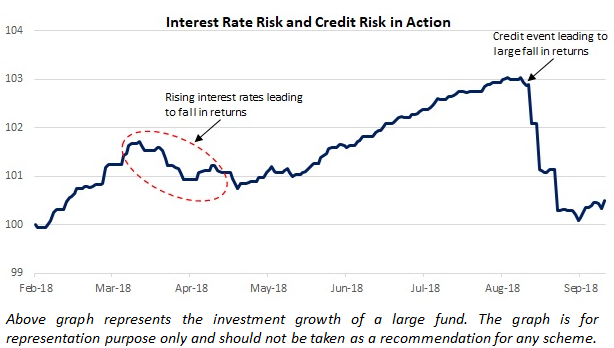

In September 2018, a big corporate defaulted on its debt repayments. This is a case of credit risk in action. Mutual funds which had lent money to this corporate saw a steep fall in their NAVs to account for the default, resulting in loss to investors.

In mid 2018, Reserve Bank of India (RBI) increased the interest rates a couple of times. Around that time, increase in prevailing interest rates in the market led to a fall in the NAVs of mutual funds having longer duration lending. This was a case of interest rate risk in action.

Choose wisely

Hence, the choice of a debt mutual fund, like any financial investment, should not be simply based on returns. Now that we know that higher returns are generated by assuming higher risk, it would be unwise to ignore the associated risks. It should be clear that a debt fund giving a much higher return compared to its peers is surely taking on more risk.

All said, there is no reason to shy away from investing in debt funds. Take help of a financial adviser in choosing the right mutual funds according to your risk taking ability and willingness, so that you don’t get surprises with your hard earned money.

To help you with your decision making process, we have analyzed select debt funds based on above mentioned risks and other relevant qualitative and quantitative parameters. Our curated list of debt mutual funds can be found under Investment Ideas “Better than Fixed Deposit” , “Better than Savings Account” and “High Quality Debt Funds“.