All You Need To Know About Debt Mutual Funds4 min read

By now, most of you would know that mutual funds don’t just invest in stocks (equity) and that there are debt mutual funds that invest in fixed income products like bonds. Just like in the case of equity mutual funds, there are a large number of sub-categories within debt mutual funds too. All these categories have been defined by SEBI, and in the next series of articles, we will further explain these categories in terms of how they differ from each other and the kind of securities they invest in. But for now, let’s get a better understanding of debt funds.

What Are Debt Mutual Funds?

Debt mutual funds are a category of mutual funds that invest primarily in fixed income instruments, such as bonds, issued by the government, or public and private companies. Simply put, the money you put in a debt mutual fund, is in turn lent out to private/public companies or government bodies. Mutual funds get interests from these borrowers which are then reflected in the returns of the debt mutual fund. Because Debt mutual funds invest the maximum percentage of their corpus in fixed-interest generating opportunities and fixed-income instruments, the risk factor is reduced by a huge margin.

Types Of Debt Instruments

Debt mutual funds mainly invest in the following different types of instruments:

Tri-Party Repo: This is an instrument for borrowing funds by selling securities with an agreement to repurchase the securities on a mutually agreed future date at an agreed price which includes interest for the funds borrowed.

Commercial Paper (CP): Short term borrowings by corporates and financial institutions up to 1 year.

Certificates of Deposit (CD): Short term deposits with banks up to 1 year and financial institutions up to 3 years.

Treasury Bill (T-bill): Short term securities of Indian Government with maturity less than 1 year.

Corporate Bond: Long term borrowings by corporates with a maturity of more than 1 year.

Government Bonds: Long term borrowings by state/central government with a maturity of 1 year or more.

Debt mutual funds can be broadly classified in two buckets:

Theme based: SEBI has defined some categories based on the kind of instruments the mutual fund invests in, for example, corporate bonds, Government bonds, etc. Typically, the greater the risk in the instruments that the mutual fund holds, the higher the expected returns.

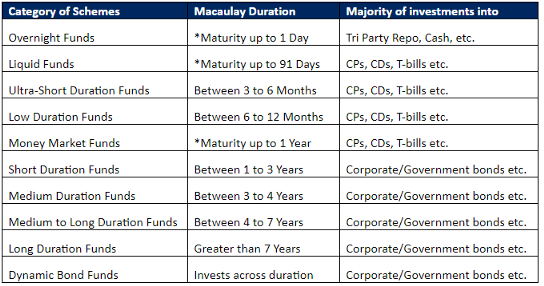

Maturity/Duration based: SEBI has defined categories of mutual funds based on maturity or Macaulay duration of the fund. Put very simply, Macaulay Duration is the time taken for a bond to repay its own purchase price in present value terms. Generally, the longer the maturity of the instruments that the mutual fund holds, the higher the Macaulay duration of the fund. Typically the longer the maturity/duration of the fund, the higher the expected returns. But the higher duration also leads to higher volatility in returns with a change in interest rates.

There are ten such categories according to SEBI’s definition, and each of them is explained below:

Best Debt Funds

Debt funds are a good avenue to accumulate wealth if you are a risk-averse investor. These funds offer the stability of a regular rate of return versus high-risk exposure capital appreciation of its counterpart i.e. equity funds. Enlisted here are some of the best debt funds.

How To Invest In The Best Debt Funds Via Paytm Money?

Investing in debt funds is a smart way to park your funds for your financial goals without taking too much risk. The Paytm Money app and Paytm Money website offer only the top-rated funds for you to pick from. Here are a few steps that you need to follow to invest in the best debt funds:

Step 1: Download the Paytm Money app to complete your KYC & become investment-ready within minutes

Step 2: Select ‘MF Direct’ option. You will land on the Mutual fund dashboard screen. Go to ‘Invest’ tab from the bottom bar.

Step 3: Select ‘Debt tab in the ‘Fund Category’ section. Select any sub category and select any fund in the list.

Step 4: Select a fund of your choice and ‘Invest Now’ via SIP or the Lump-sum mode and enter the amount of investment. Tap on ‘Proceed to Payment’.

Step 5: Make payment using Auto Pay, Netbanking or UPI. Tap again on ‘Proceed to Payment’ to complete the transaction.