Understanding the basics of Debt Funds5 min read

Contents

By now, most of you would know that mutual funds do not only invest in stocks (equity) and there are debt mutual funds which invest in fixed income products (for example: bonds). Like equity mutual funds, there are a large number of sub-categories within debt mutual funds. All these categories have been defined by SEBI (the securities market regulator), and in this article we will explain you these categories in terms of how they differ from each other and the kind of securities they invest in.

What are debt mutual funds?

Before understanding the sub categories, let us understand debt mutual funds. Debt mutual funds are a category of mutual funds that invest primarily in fixed income instruments (such as bonds) issued by government, public and private companies. Or simply you can understand that the money you put in a debt mutual fund, is in turn lent out to private/public companies or government bodies. Mutual funds get interest from these borrowers which is reflected in the returns of the debt mutual fund.

Types of Debt instruments

Debt mutual funds mainly invest in the following different types of instruments:

- Tri Party Repo: This is an instrument for borrowing funds by selling securities with an agreement to repurchase the securities on a mutually agreed future date at an agreed price which includes interest for the funds borrowed.

- Commercial Paper (CP): Short term borrowings by corporates and financial institutions up to 1 year.

- Certificates of Deposit (CD): Short term deposits with banks up to 1 year and financial institutions up to 3 years.

- Treasury Bill (T-bill): Short term securities of Indian Government with maturity less than 1 year.

- Corporate Bond: Long term borrowings by corporates with a maturity of more than 1 year.

- Government Bonds: Long term borrowings by state/central government with a maturity of 1 year or more.

Broad classification of debt funds

Debt mutual funds can be broadly classified in two buckets:

- Theme based: SEBI has defined some categories based on the kind of instruments the mutual fund invests in, for example, corporate bonds, Government bonds, etc. Typically, the greater the risk in the instruments that the mutual fund holds, the higher the expected returns.

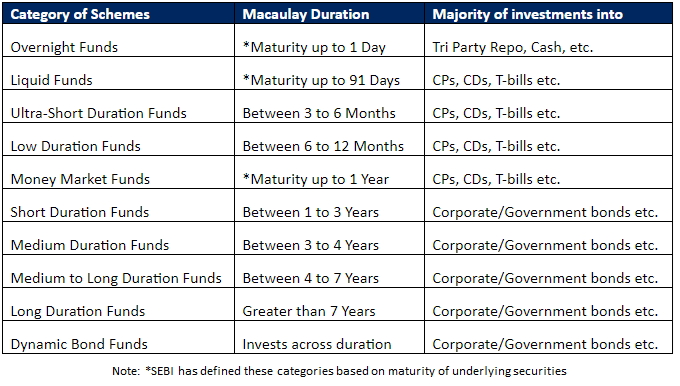

- Maturity/Duration based: SEBI has defined categories of mutual funds based on maturity or Macaulay duration of the fund. Put very simply, Macaulay Duration is the time taken for a bond to repay its own purchase price in present value terms. Generally, the longer the maturity of the instruments that the mutual fund holds, higher the Macaulay duration of the fund. Typically the longer the maturity/duration of the fund, the higher the expected returns. But higher duration also leads to higher volatility in returns with change in interest rates.

Maturity/ Duration based classification

There are ten such categories according to SEBI’s definition, and each of them are explained below:

Credit Ratings

Before we go to the next type of debt funds, let us first have a quick recap of what are credit ratings. These are ratings issued by credit rating agencies like CRISIL, ICRA, etc. to debt instruments on the basis of the borrower’s creditworthiness. Simply put, these ratings represent the risk of default by the borrower. There are generally two ratings for a borrower: short term and long term.

Short term debt ratings are assigned to instruments with an original maturity period of up to one year. These ratings range from A1+ to D. A1+ stands for the highest rating (least risk of default) and D stands for default/expected-to-default rating. Similarly, long term debt ratings are assigned to instruments with original maturity above one year. These ratings range from AAA to D, where AAA stands for the highest rating (least risk of default) and D stands for default/expected-to-default rating. As per SEBI, securities with AAA and AA+ ratings are considered to be the highest rated.

Typically, the lower the credit rating of the underlying instruments of a mutual fund, higher is the expected return from the fund due to higher risk of default (credit risk) it carries.

Theme based classification

There are six theme-based debt categories according to SEBI’s definition:

- Corporate Bond Funds: These funds invest at least 80% in corporate bonds having highest credit rating i.e. AAA and AA+

- Credit Risk Funds: These funds invest at least 65% in relatively riskier corporate bonds i.e. having lower credit rating (other than AAA and AA+)

- Banking & PSU Funds: At least 80% of their funds is invested in debt instruments issued by banks, public sector undertakings and public financial institutions

- Gilt Funds: This category invests at least 80% in Government Securities having different maturities

- Gilt Funds with 10 Year constant maturity: These invest at least 80% in Government securities such that Macaulay duration (explained here) of the portfolio is maintained at 10 years

- Floater Funds: These funds invest at least 65% of the total assets in floating rate debt instruments. Floating rate instruments are debt instruments whose interest rate is not fixed but keeps changing (for example, linked to treasury bills)

By now, you will have a hang of the various debt categories. Hence the next obvious thought in your mind would be “How to choose a fund most relevant for you?” In our upcoming article we will help you with the same and explain this in a step by step process.