Devyani International IPO – Dates, Price & Overview 3 min read

The month of August has started with a glee for the markets with several IPOs hitting the D-street in the first week itself. Devyani International, the company serving the country with a wide range of quick service restaurants will soon be joining the race of IPOs that’ll be launched on 4th August.

The company serving you with pizza, tacos and fried chicken now brings to table an IPO worth Rs.1,838 crores which will hit the market on August 4 and close on August 6.

The IPO size of Rs. 1,838 crore consists of a fresh issue worth Rs. 440 crore and an OFS worth Rs. 1,389 crore with 155,333,330 equity shares.

The share price of each will range around Rs. 86 to Rs. 90 and the face value of each share is Rs.1. The lot size for this IPO is 165 shares and the Registrar for the same is Link Intime India Private Limited.

IPO Details

Know the company:

The company is the largest franchisee of Yum Brands in India and are among the largest operators of chain quick service restaurants in India, on a non-exclusive basis, and operate 655 stores across 155 cities in India, as of March 31, 2021.

Yum! Brands Inc. operates brands such as KFC, Pizza Hut and Taco Bell brands and has presence globally with more than 50,000 restaurants in over 150 countries, as of December 31, 2020.

Their business is broadly classified into three verticals that includes stores of KFC, Pizza Hut and Costa Coffee operated in India.

Besides the pandemic, increasing internet and mobile penetration within India and the advent of food delivery apps are key factors to lead consumers away from traditional dine-in experiences and towards convenience-driven options. It is among the single largest QSR companies in India that is listed on the Swiggy platform, and is among the largest QSR companies in India listed on the Zomato platform in the calendar years 2019 and 2020.

Objective of the offer:

Through this IPO, this company intends to make repayment/prepayment of all or certain of our borrowings. Going further it also plans to use the funds for general corporate purposes.

In addition, the Company expects to receive the benefits of listing of Equity Shares on the Stock Exchanges including enhancing its visibility and its brand image among its existing and potential customers and creating a public market for its Equity Shares in India.

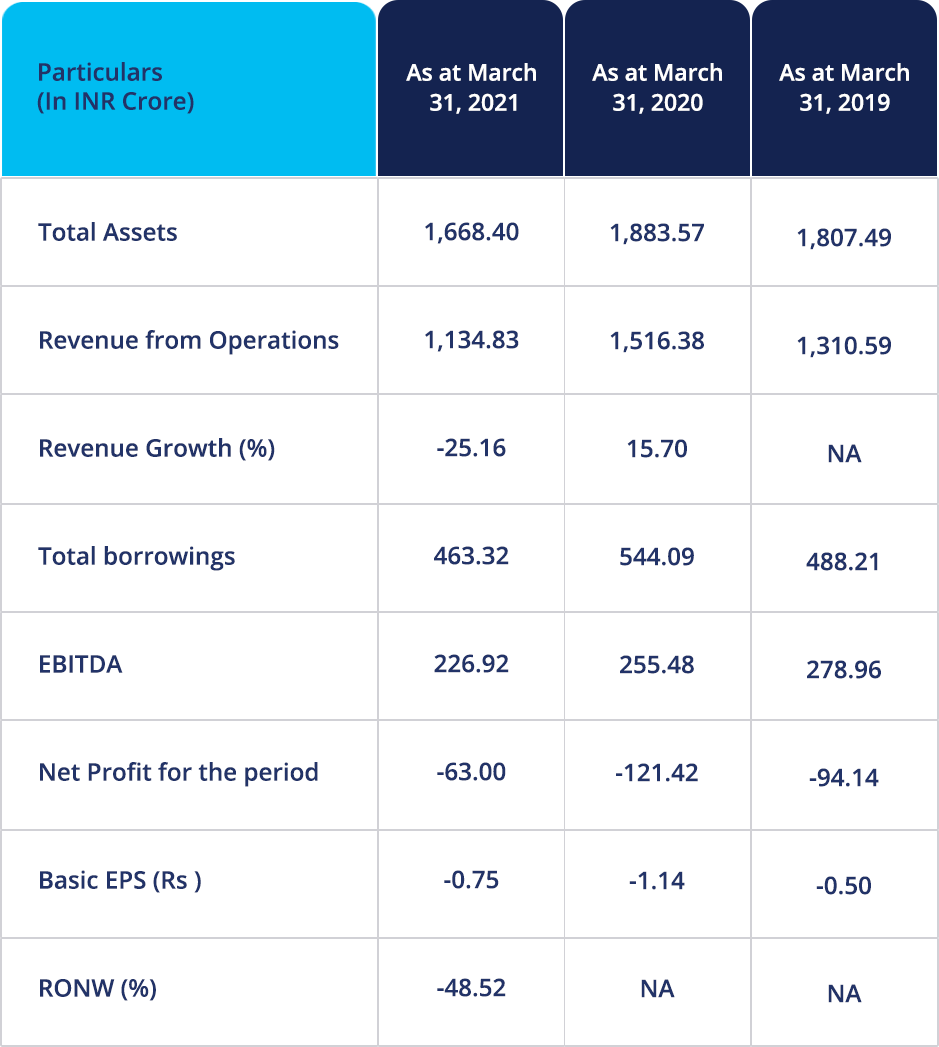

Important Financial data:

Strengths of the company:

- Portfolio of highly recognized global brands catering to a range of customer preferences;

- It is a multi-dimensional comprehensive QSR player.

- The company has a presence across key consumption markets with a cluster-based approach;

- There is brand synergies with operating leverage;

- Disciplined financial approach with focus on cash flows and returns; and

- Distinguished Board and experienced senior management team.

Risks involved:

- There is an uncertainty of the continuing impact of the ongoing COVID-19 pandemic.

- Termination of or inability to renew the arrangements with Yum for its KFC and Pizza Hut stores that comprise a significant majority of its business.

- Termination of or material modification to the existing terms of the Costa IDA affecting the ability to continue its Costa business.

- Losses incurred in Fiscal 2019, 2020 and 2021 which resulted in erosion of its net worth;

- Adverse remarks/ qualifications/matters of emphasis in the Audited Consolidated Financial Statements.

- Business heavily dependant on success of core Brands

Sources – RHP, BLRM

This content is purely for informational purpose and in no way an advice or recommendation. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.