Contents

Why did SEBI cut mutual fund TERs?

The Mutual Fund Industry in India has evolved rapidly over time, with the Asset under Management (AUM) growing from INR 90,587 crore in March 31, 2001 to INR 48.74 lakh crore as on November 30, 2023 (over 20% CAGR). But even as the size grew to massive proportions, the industry was not passing on the benefits of scale to the investors. In the interest of retail investors, SEBI intervened in October, 2018, by rationalizing Total Expense Ratio (TER) of mutual funds.

SEBI had observed that, TER reduction was not happening in the equity oriented mutual fund space, where majority of the AUM is held by retail investors (over 80%). In contrast, the non-equity categories witnessed TER cuts with increasing fund size as majority ownership was with institutional clients.

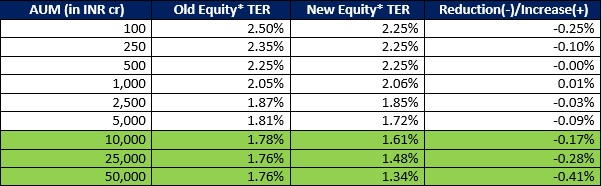

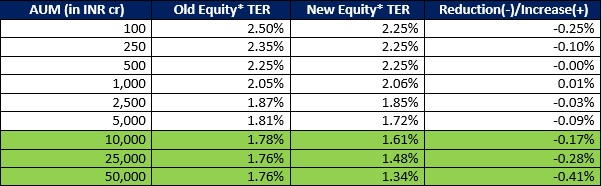

Comparison between Old and New TER structure

Most of you would know how investing in direct mutual funds can lead to higher returns due to lower TER compared to regular mutual funds. In this article we take a closer look at expense cuts in direct funds itself due to SEBI regulation and how it will benefit you in the long run.

In the following table we show the effective TERs of equity oriented schemes as per the old structure and the new structure (which came into effect from April 1, 2019) and highlight the difference in expenses.

Note: * denotes all equity oriented mutual funds i.e. schemes that have more than 65% exposure to equities.

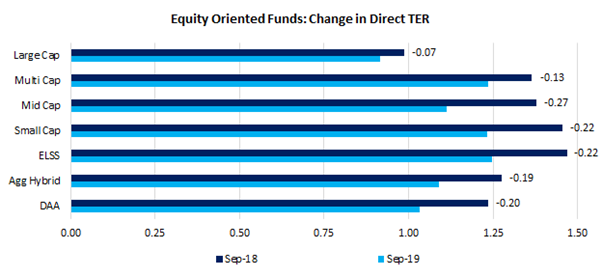

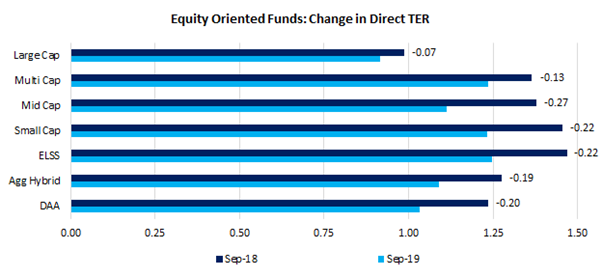

Popular categories & their TER change

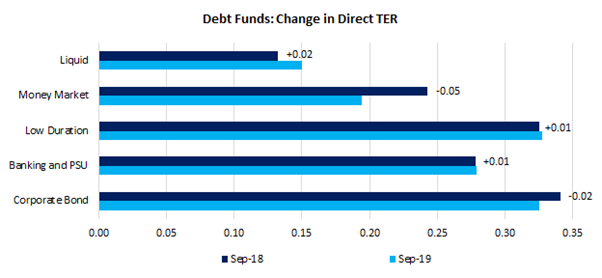

A look at the direct plan TER change over the last 1 year (Sep’19 vs Sep’18) among popular equity oriented categories indicates that in the Large cap and Multi cap, TERs have fallen by 7-13 bps while in others it has fallen by ~20 bps or higher.

Note: All TER changes are in %. Agg Hybrid denotes Aggressive Hybrid category & DAA denotes Dynamic Asset Allocation category

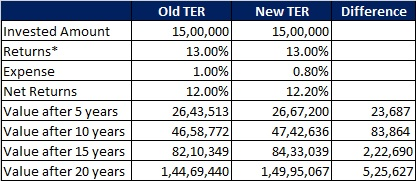

Among popular debt categories, the changes have been miniscule. Liquid, Low Duration and Banking & PSU Debt categories have seen small increase in direct TERs while there has been a small fall in Money Market and Corporate Bond categories.

Note: All TER changes are in %

How it benefits you?

As expenses are charged from the returns that you earn, a reduction in TER will translate into higher returns for you! Although the slash in TERs by few basis points may seem insignificant to you now, but over time with the benefit of compounding, it will make a huge difference to your portfolio.

Let’s take an illustration to understand this better.

Note: Amounts are in INR. * denotes 20 year average annualized returns for Large cap funds

A mere 20 basis point change in TER can earn you over INR 5 lakh more over a period of 20 years!

The expense ratio of Direct Plan is always lesser than Regular Plan for the same mutual fund scheme. By switching from Regular Plans to Direct Plan of mutual fund schemes you can make sure that you keep earning more on your investment!

As switch transaction involves redeeming units from the regular plan and making a fresh investment in a direct plan, exit load (if any) and capital gains tax would apply.

In the case of equity funds, if you switch within 1 year from the date of investment, the Short Term Capital Gains (STCG) will be taxed at 15% plus an applicable surcharge. However, if you switch after 1 year from the date of investment, then the Long Term Capital Gains (LTCG), exceeding the threshold of Rs 1lakh, will be taxed at 10% plus an applicable surcharge.

In the case of debt funds, if you switch within 3 years from the date of investment, then the STCG will be taxed as per your applicable slab rates. However, if you switch after 3 years from the date of investment, then the LTCG will be taxed at 20% after indexation benefit. Starting from 1st April 2023, all the investment done after 1st Apr 2023 tax will be as per tax slab irrespective of how long the unit is held.

Think Mutual Funds, Think Direct, Think Paytm Money!