Are you investing in Regular or Direct Mutual Funds? Here are 10 ways to Find Out!5 min read

Contents

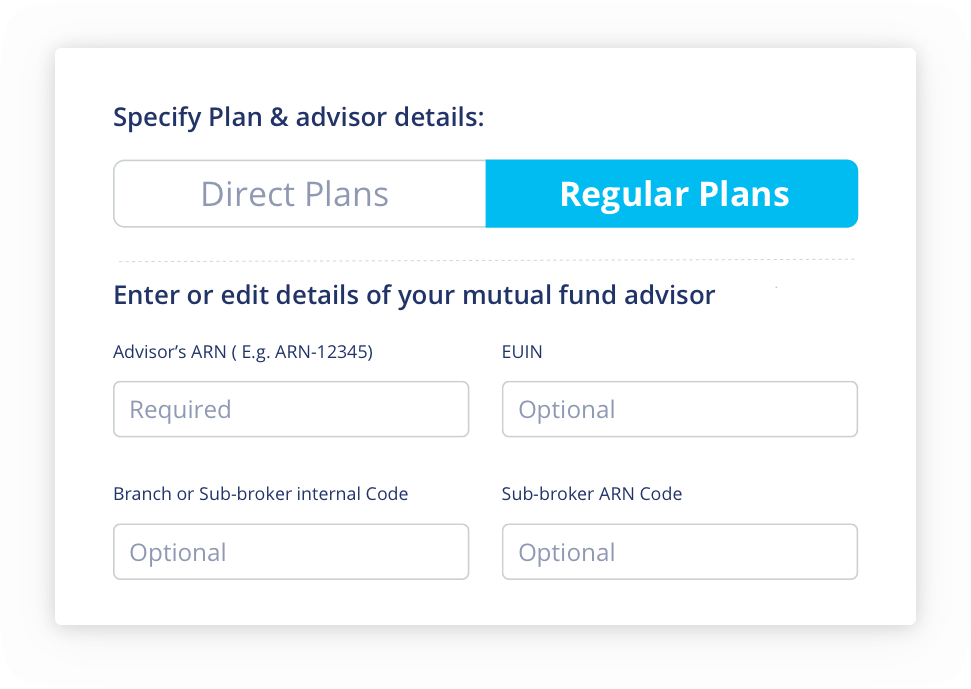

When you look to invest in Mutual funds, you have two options available — Direct or Regular. When you go through a distributor, broker or a bank, it is almost certain that you would have chosen the regular option. As you may or may not be aware, they get paid commissions that are hidden from you, and thus the expense ratio in Regular option is higher than Direct option. As discussed in our earlier blog, you can earn a higher return on your investment by opting for Direct rather than Regular Mutual Funds. Hence, it is very important for you to know if you are investing in direct or regular option.

But first — the biggest myth that we want to clarify — Most people think that if they are investing in Mutual Funds online, or via a bank or via any fintech platform or even on the AMC website/app — they are investing in Direct Plans. No, you are not!

We have listed down 10 simple ways to check if you have invested in a Regular or Direct Mutual Fund:

1. If you have invested in mutual funds through a distributor or a broker or a bank then it is highly likely that you have invested in a Regular Mutual Fund. To be certain, please use the checks given below.

Investing through online portals:

2. We want to bust a common myth that investing online means you are surely investing in a Direct Mutual Fund. There are many online platforms or apps that let you invest only in Regular Mutual Funds.

3. Investing through the AMC website/app does not automatically mean that you are investing in a Direct Mutual Fund. You can invest in Regular mutual funds also through AMC website/app.

Representational image of an AMC website

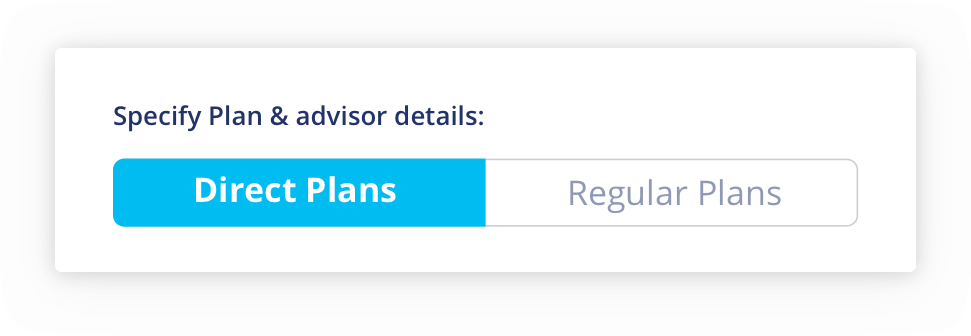

You need to specifically select the Direct option even while investing through AMC website/app.

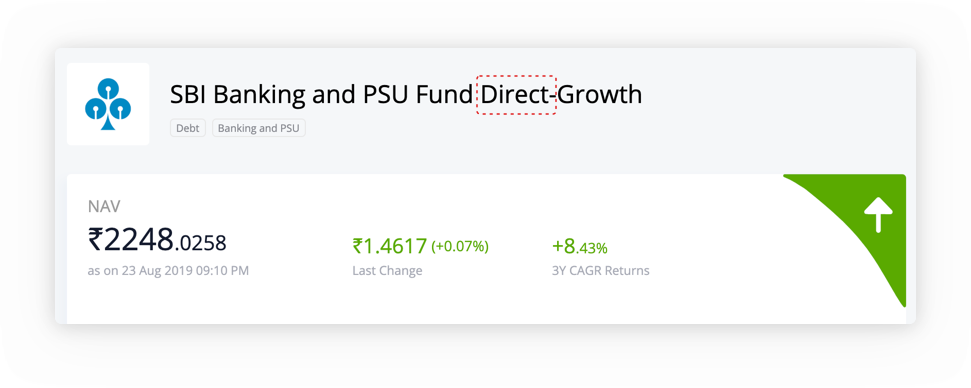

4. Direct funds have the word “Direct” in the scheme name. If you are investing through an online platform, you can easily check this. Some portals can use the abbreviation “Dir” to denote Direct Mutual Funds. If there is no mention of these words or instead there are words like “Regular” or “Reg” then you are probably investing in a Regular Mutual Fund.

Paytm Money offers only Direct mutual funds and this is how a fund page looks like on the platform.

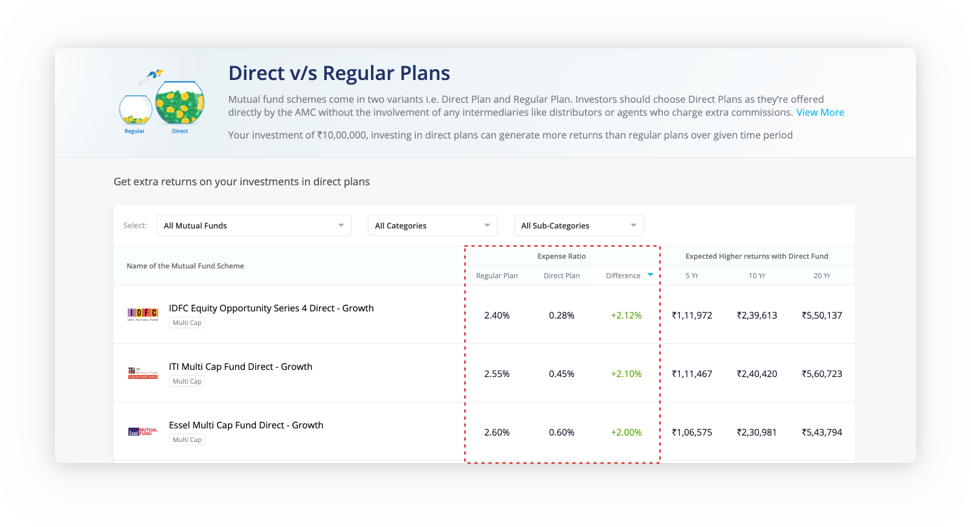

5. Expense ratio of Regular Mutual Funds is always greater than Direct Mutual Funds. Before investing you can check the expense ratio and make sure that you are investing in the Direct option.

Paytm Money has made it easy for you to check this. On our website you can compare the latest Expense Ratio of Direct and Regular plans of any Mutual Fund. Also, you can find out how much more wealth you can create by investing in Direct plans.

Expense ratio comparison tool on Paytm Money

Consolidated Account Statement (CAS):

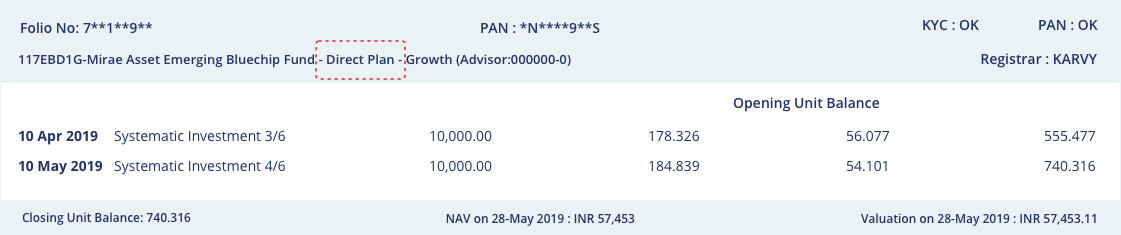

Consolidated Account Statement gives you a complete summary of mutual funds that you invested in till date. You can download your CAS and carry out the following checks to find out if you invested in a Direct or Regular Mutual Fund.

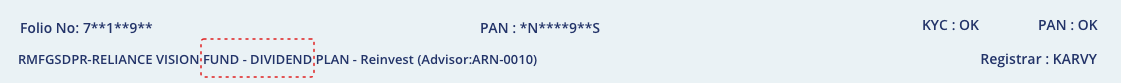

6. If there is the word “Direct” in the name of the fund as highlighted below, then you have invested in a Direct Mutual Fund.

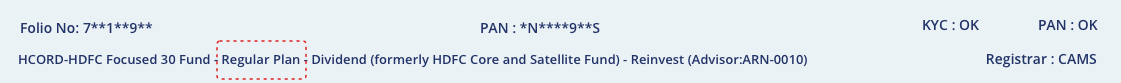

7. If there is the word “Regular” in the name of the scheme, then you have most probably invested in a Regular Mutual Fund.

8. If the fund name does not contain the words “Direct” or “Regular”, then once again you have invested in a Regular Mutual Fund.

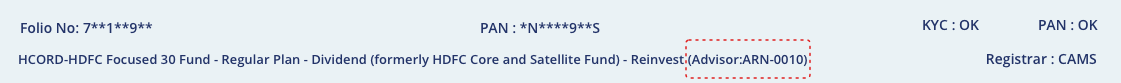

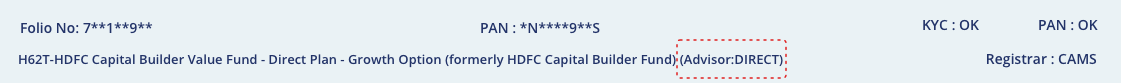

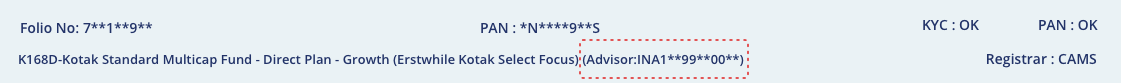

9. In your CAS, there is a field called Advisor as highlighted below. If that field is filled with “ARN” followed by a number code, then it is definitely a Regular Mutual Fund.

In the same Advisor field if you find values like: Direct / 0000000000 / INA100009859, then it is a Direct Mutual Fund.

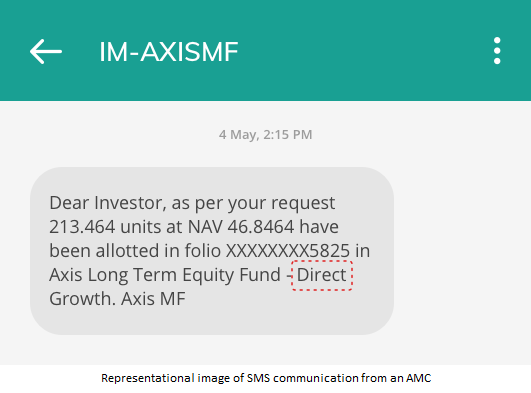

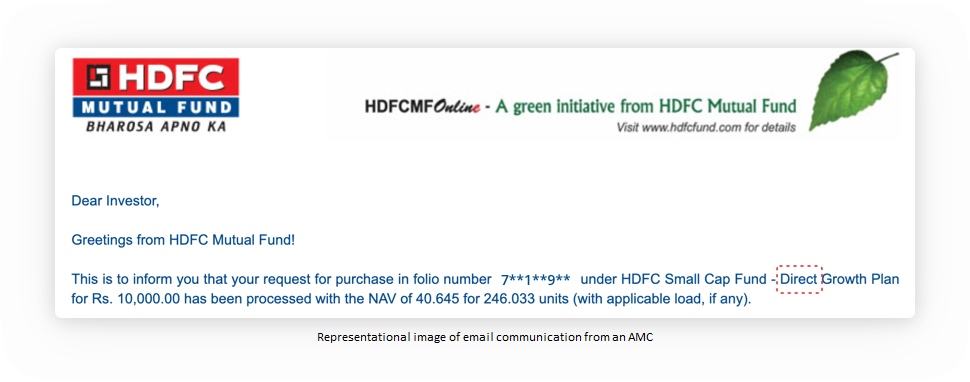

Communication from AMC:

10. One more way you can verify this is from the communication that the AMC sends you via email or SMS. Most of the AMCs mention the variant of the scheme that you invested in. If you cannot find the word “Direct” in either of these communications, then most probably you are investing in a Regular Mutual Fund.

You can switch to Direct!

After going through these checks, if you realize that your investments are through Regular Mutual Funds, don’t worry! There is a misconception that if you have invested in Regular Funds, you cannot change that decision. There is an option called switch and using this function, you can shift your investments from Regular Funds to Direct Funds and thus earn higher returns on your investments.

As switch transaction involves redeeming units from the regular plan and making a fresh investment in a direct plan, exit load (if any) and capital gains tax would apply.

In the case of equity funds, if you switch within 1 year from the date of investment, the Short Term Capital Gains (STCG) will be taxed at 15% plus an applicable surcharge. However, if you switch after 1 year from the date of investment, then the Long Term Capital Gains (LTCG), exceeding the threshold of Rs 1lakh, will be taxed at 10% plus an applicable surcharge. In the case of debt funds, if you switch within 3 years from the date of investment, then the STCG will be taxed as per your applicable slab rates. However, if you switch after 3 years from the date of investment, then the LTCG will be taxed at 20% after indexation benefit.

Paytm Money is now offering the switch feature on its app. This will help you track all your mutual fund investments at one place and also help you earn higher returns on your investments by letting you switch from Regular Plans to Direct Plans in few simple steps. Download your CAS and upload it on our app to switch your investments. Thinking of investing in Mutual Funds? Go the Direct way and invest through Paytm Money!