Dodla Dairy IPO Details- Dates, Price & Overview3 min read

Dodla Dairy, the milk-based sweets maker’s IPO is all set to hit Dalal street on June 16. The issue amount for this IPO is Rs. 520.18 crore, out of which fresh issue is capped at Rs. 50 crore and offer for sale is capped at Rs. 470.18 crore. The company has fixed the price band for its public offer at Rs. 421 to Rs. 428 per unit.

The Dodla Dairy IPO opens on Wednesday, Jun 16, 2021, and closes on Friday, Jun 18, 2021.

About the Company:

Dodla Dairy is the third highest in terms of milk procurement per day with an average procurement of 1.03 million litres of raw milk per day as of March 31, 2021 and second highest in terms of market presence across all of India amongst private dairy players with a significant presence in the southern region of the country.

The company’s operations in India are primarily across Andhra Pradesh, Telangana, Karnataka, Tamil Nadu and Maharashtra. Its overseas operations are based in Uganda and Kenya.

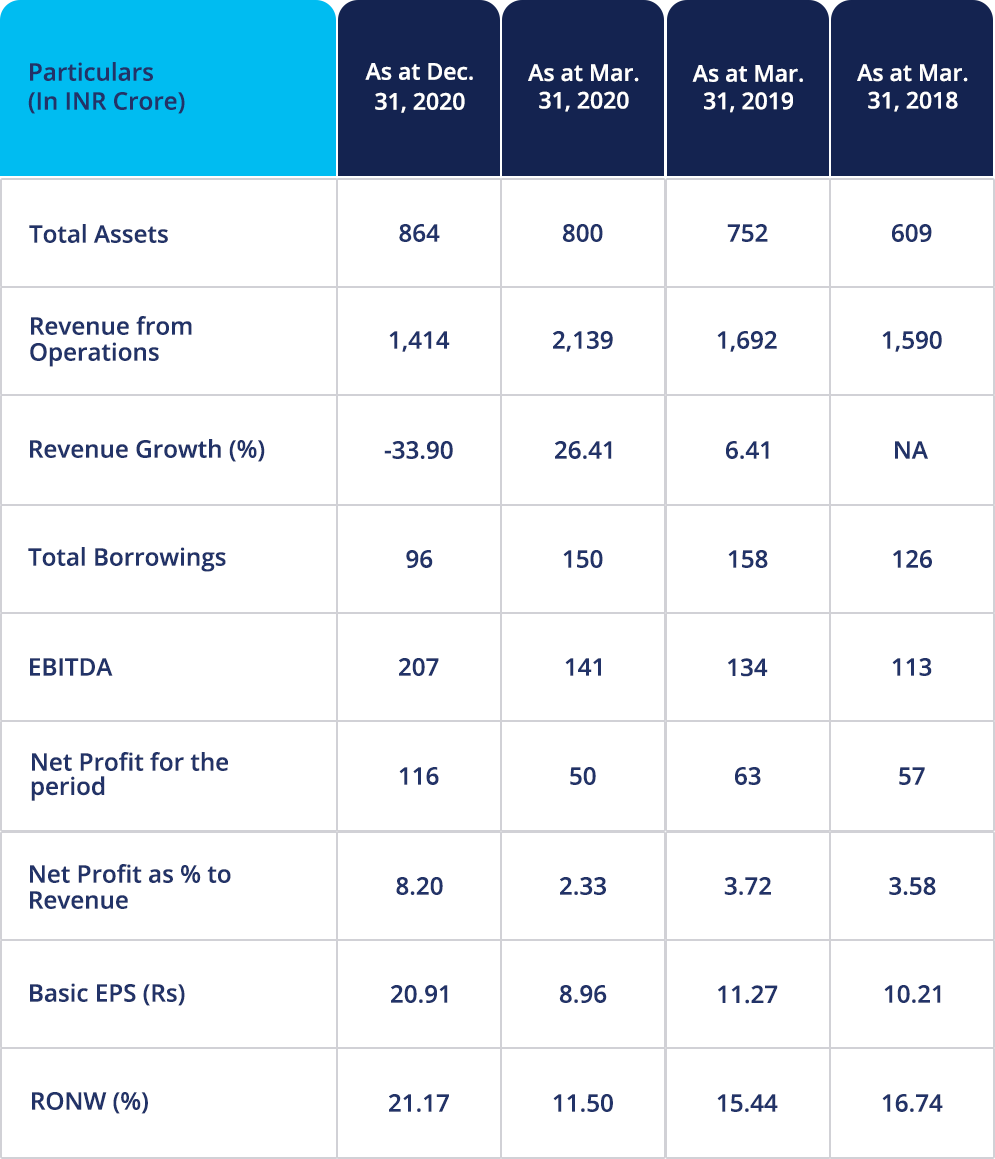

Financial performance:

Let’s take a quick look into a summary of the financial performance of the company to understand its performance of the business and evaluate the growth prospectus:

IPO Details:

- The offer size is pegged at Rs. 520.18 crore, and it comprises fresh issue aggregating up to Rs. 50 crore and an offer for the same of up to Rs. 470.18 crore

- The price band is set at Rs. 421 – 428

- The minimum order quantity is 35 Shares

- The face value of each share is Rs. 10

- Total shares on offer: Up to 12,173,092 Equity Shares at Lower band

IPO Timeline:

Issue opens on: Wednesday, June 16, 2021

Issue closes on: Friday, June 18, 2021

Company promoters:

The selling shareholders include promoters Dodla Sunil Reddy and Dodla Deepa Reddy, along with TPG Dodla Dairy Holdings. ICICI Securities and Axis Capital are the book-running lead managers for the issue.

Objective of the offer:

Proceeds of the issue will be used for Repayment and/ or pre-payment, in full or part, of certain borrowings availed by the company. The company also needs to use the amount for funding capital expenditure requirements of the Company, for general corporate purposes.

In addition to the aforementioned objectives, the Company expects to receive the benefits of listing of the Equity Shares on the Stock Exchanges and enhancement of our it’s brand name and creation of a public market for our Equity Shares in India.

Strengths of the company:

- The company is one of the only dairy related companies to have a large product portfolio.

- It is one of the leading dairy players in the Southern region of India.

- Integrated business model with stringent quality control procedure.

- The company has its presence internationally too.

- The company has an experienced board and managerial team.

Risks involved:

- Company’s operations are dependent on the supply of large amounts of milk at competitive prices

- COVID-19 has had an adverse effect on its business and may continue to do so;

- Inability to accurately forecast demand for its products, may adversely impact business.

- An actual or alleged contamination or deterioration of its products or its raw materials could result in legal liability, reputation loss and adversely affect business

- Primary operations and business activities focussed in south India. Adverse developments in the region can affect business.

- Inability to compete with Dairy cooperatives can impact business.

Sources – RHP, BRLM

Disclaimer – This content is purely for informational purposes and is in no way advice or recommendation.

Investment in the securities market is subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.