The start of the COVID 19 pandemic has led to multiple developments taking place in all sectors of the country. Universities and prominent companies are striving to discover vaccines to put an end to this pandemic at the earliest.

Within the pharma stocks, Dr. Reddy’s Labs has witnessed the biggest gains to the tune of over 40% over the past six months. In fact, in the Nifty 50 index, it became the only stock along with RIL to experience a sharp run-up of more than 90% in the past 365 days.

Let’s get a deeper understanding of the company and see the chain of positive updates that led to the recent spree in the stock’s price.

Dr. Reddy’s…Naam To Suna Hoga???

Dr. Reddy’s Laboratories, a leader in the pharma sector, started off with a noble objective to deliver not just medicines but a cost-effective way that helps patients to regain their health. Its motto “Good Health Can’t Wait” rightly underpins this passion that inspires over 20,000 of its employees to come to work every day without fail.

In India where individuals got to spend over 60-80% from their own pockets on health care, providing greater access to generic drugs (that are affordable) becomes an important factor to ensure good health among the masses.

From this aspect, the company is staying true to its promise. Besides fulfilling the unmet needs of patients via offering generic drugs, it enables them to handle diseases in a better way and also partners with relevant organizations to make medicines within the reach of those in need.

Hmm…Lekin Dr. Reddy’s Karta Kya Hai?

Interestingly, Dr Reddy’s offers over 200 high-quality generic formulations of patented medicines in over 80 countries across the globe. Generic drugs are those that are not covered by patents and are permitted to be manufactured and sold by any company at a fraction of the cost.

Tablets, capsules, injectables, and topical creams form the largest part of the company’s generic formulations’ business that covers therapeutic areas like gastrointestinal ailments, cardiovascular disease, pain management, oncology, anti-infective, pediatrics, and dermatology.

The USP of Dr. Reddy’s lies in its ability to take care of the entire value chain i.e. from manufacturing active ingredients, making formulations to disseminating them through a robust supply chain. The economies of scale gained via mass production are transferred to the end-user through cheaper medicines. Additionally, the company leverages on its regulatory knowledge to come up with high-quality medicines that are regulatory-compliant.

Some of its leading brands in the emerging markets include the following:

- Nise tablet (Nimesulide 100 mg)

- Omez capsule (Omeprazole 20 mg)

- Clamp 625 tablet is a combination of Amoxycillin (500 mg) and Potassium Clavulanate (125 mg).

- Razo 10/20 tablets (Rabeprazole sodium 10/20)

- Ketorol DT (Ketorolac Tromethamine 10 mg)

On top of that, the company is also working relentlessly to evolve methods that help the patient to stick to his dosage schedule for a speedy recovery. In one such instance, Dr. Reddy’s developed a patient-friendly dosage of Metformin, a drug used to maintain the good health of diabetics. This enabled the patient to easily swallow the medicine making him stay compliant to his prescribed treatment regime.

The company also has a significant share in manufacturing generic drugs for US and European markets. Usually, if a pharma company has invented a medicine or vaccine, as per patent and drug regulator laws the company can sell it exclusively until the patent expires which may take around 20 years in the USA and they are the price setters. After that, any other company can reverse engineer it and make a similar medicine with the same ingredients which are then termed as generic.

Most Indian drug makers apply for USFDA approvals for several drugs and biosimilars because selling it in US and European markets fetches higher revenues.

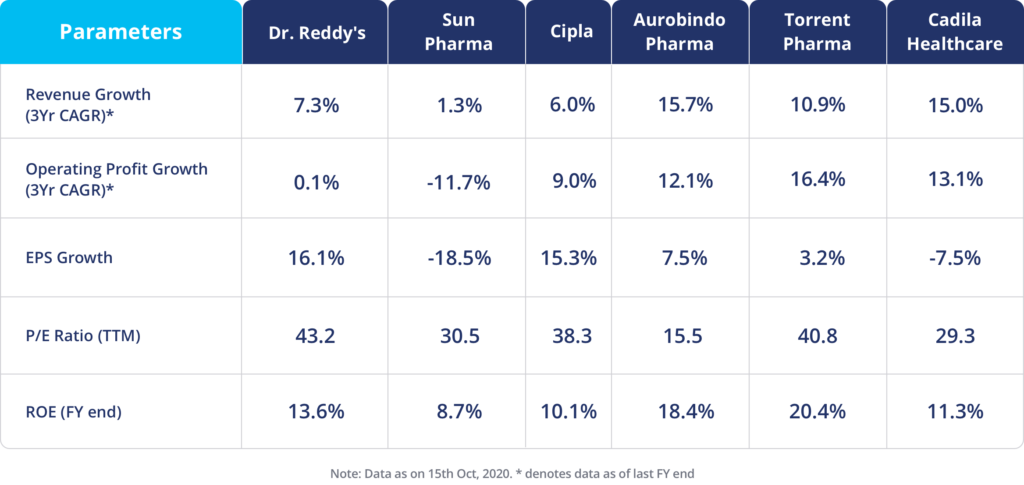

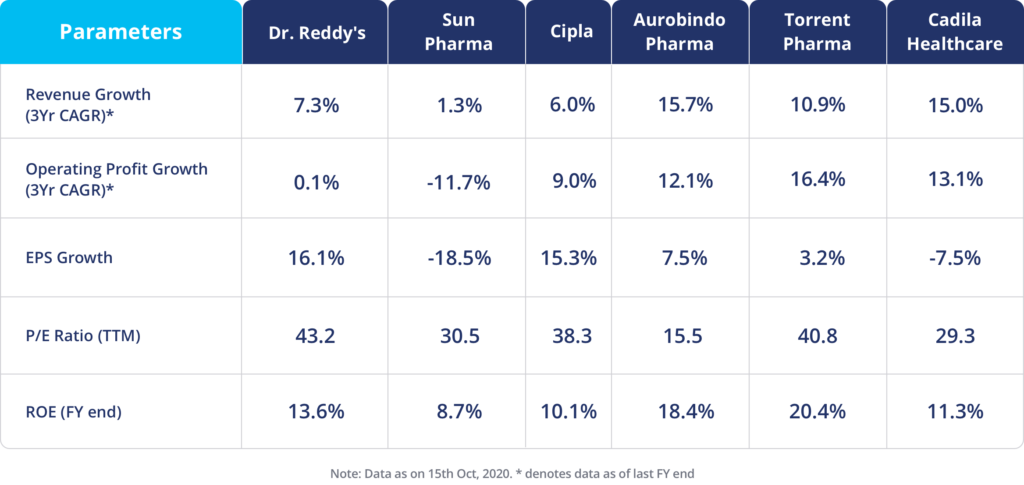

Kitne Competitors The…?

Nifty Pharma index has around 10 companies including Cipla, Biocon, Cadila Healthcare, Lupin, Sun Pharma and so on that are direct competitors of Dr. Reddy’s Laboratories. Most pharma companies in India are after generic businesses in the US and European markets.

In comparison to its competitors, Dr. Reddy’s has clocked-in better performance both in terms of profitability and solvency. As of 31 March 2020, its net profit margin stood at 11.56% which is way above that of its competitors who were hovering in negatives. Also, it has successfully lowered the debt portion on its balance sheet, making it a relatively less risky investment than its peers.

But Risks Bhi To Honge To Business Mein!!!

Indian Pharmaceutical sector is mostly dependent on generic drugs that they sell to US and European markets because production is cheaper in India and revenues are higher. But there is immense competition among drug-makers especially after 2017 when the US started to push for lower-cost generic drugs.

However, there is a constant risk of the drug regulators and their scrutiny, they often conduct frequent checks of production facilities. Regulators can stop the production or ban any generic if they feel that the required precautions are not being taken.

Another risk to the global pharmaceutical industry is counterfeit drugs, which costs $75 billion a year as per World Health Organisation estimates.

Kuch Russian Tie-ups Ka Case Bhi Hai…

Dr. Reddy’s gains are being attributed to its tie-up with Russia’s sovereign wealth fund concerning the production and marketing of the latter’s potential vaccine Sputnik V for COVID-19 in India.

As per the deal, Russia would provide 100 million doses of Sputnik V to Dr. Reddy’s. This would be taken up post the success of Phase 3 of clinical trials whose data is expected to be released by November.

The said vaccine has been found to be promising and safer over other alternatives with no potential long term negative effects. Things would get clearer once the trials are over. However, this deal is expected to significantly improve Dr. Reddy’s earnings prospects.

Tarikh Pe Tarikh!

The drug manufacturer, Dr. Reddy’s Labs, recently settled a patent violation case with Celgene, its parent company being Bristol Myers Squibb, that pertained to the manufacturing of Revlimid (lenalidomide) capsules.

This cancer drug, Revlimid, is used to treat multiple myeloma and myelodysplastic syndromes. Post the settlement, Celgene would offer a license to Dr. Reddy’s thereby allowing the Indian company to launch generics of anti-cancer drug Revlimid in limited amounts after March 2022 and without volume limitations after January 2026 in the US.

By when would the drug be launched is yet to be seen and would be subject to regulatory approvals. Still, we may call this as one of the reasons behind the windfall gains that the stock is set to notice.

Besides the generic Revlimid drug, a favorable court ruling on the blood thinner generic of Vascepa and its launch could add more certainty to earnings beyond 2022-23 for Dr. Reddy’s.

Abb Tera Kya Hoga… Dr. Reddy’s?

In one of the interviews, GV Prasad, Co-Chairman & MD, Dr. Reddy’s Laboratories said that ‘In the next 3-5 years, there will be significant growth in our India business, our active ingredients, and the services business’.

Now there are certain factors that would determine whether or not the stock is able to sustain the growth momentum in its prices, one of them relates to the launch date.

Analysts foresee downside risks in the form of delays that the company may face in releasing the key offering as per the planned schedule in the US. Competitors like Natco Pharma, who is closer in the race to get approvals from US regulator, may probably launch the drug sooner causing Dr. Reddy’s to lose the first-mover advantage.

Also, there would be challenges by way of regulatory hurdles that the company would have to overcome successfully. The drug trials for Revlimid are yet to begin in India and the final nod would ultimately depend on whether or not the drug proves to be safe. Besides, stringent control over drug pricing may act as a growth impeding element.

Overall, the pharma sector is poised to grow given the opportunities that a company may witness and quickly harness in the current scenario.

Fundamental Analysis

Dr Reddy’s Laboratories has a Market Cap of INR 86,274 crore and is a large-cap stock.

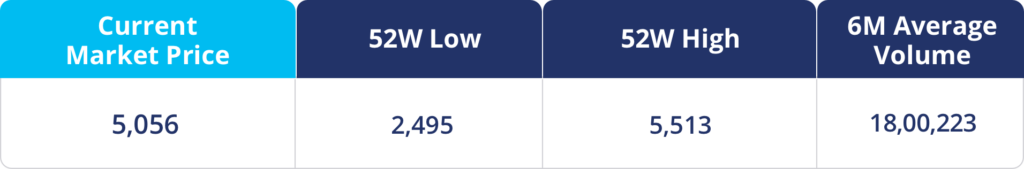

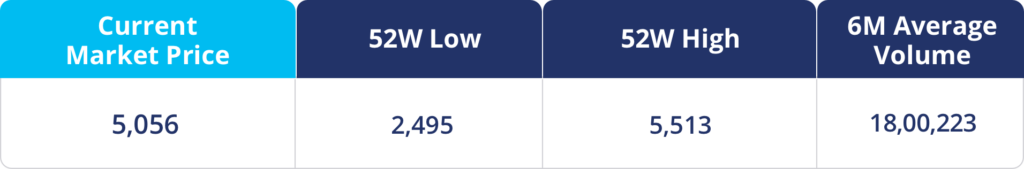

Technical Analysis

Note: Data as on 15th Oct, 2020