Should you postpone your EMIs?4 min read

Contents

Has the COVID-19 crisis disrupted your immediate cash flows? Are you finding it tough to service your EMI/loan repayments? Well, recently Reserve Bank of India (RBI) announced a slew of measures to relax the financial burden on individuals and corporates amid the ongoing crisis. The biggest relief to individuals was the announcement of a 3-month moratorium on all term loans outstanding as of 1st March, 2020. You must be wondering whether you should actually avail this benefit or continue with your monthly payments. Let us understand the relief in detail and clarify your queries.

What is the 3-Month Moratorium?

To put it simply, RBI has allowed you to defer your payments on your home, personal, education, auto loans as well as your credit card dues for a period of 3 months starting from 1st March, 2020 to 31st May, 2020. So, if you avail this benefit then you can defer your monthly payment due on Mar 1st to June 1st and similarly the one due on 1st May to 1st August as shown below.

What are the implications?

What you have to understand clearly is that this provision merely allows deferment of your monthly financial liabilities and but in no way can be treated as an interest waiver. Keep in mind that your outstanding amount will keep on incurring interest during these months and thus making your repayments costlier. The quantum of extra interest amount to be paid if you defer your loan payments depend on your principal outstanding and the interest rate on the loan.

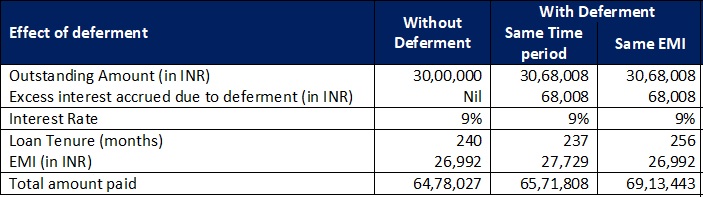

Consider the following example. Your outstanding loan amount is INR 30 Lakh and interest rate is 9%. Without any deferment you will be paying an EMI of INR 26,992 for a period of 20 years. But if you opt for deferment, the interest accrued on this loan for 3 months will be close to INR 68,008. Now, if you plan to complete your repayment according to your earlier plan, you have to pay an EMI of INR 27,729 for the remaining 237 months (240 minus 3 months). Or if you plan to keep the EMI amount constant at INR 26,992, you will have to pay the EMIs for 256 months to completely repay the loan.

In both the cases, you will have to pay more than what you paid in your earlier repayment plan.

In case of credit card loans, the interest rate are very high around 36 – 42% p.a. So deferring credit card payments could burn a big hole in your pocket. If you had an outstanding credit card bill of INR 50,000 as of 1st Mar and you deferred it by 3 months, then you might have to shell out INR 54,636 ( 50,000 principal + 4,636 interest @3% per month) on June 1st! You would also pay an additional GST @18% on interest and other charges! What’s worse is that if you don’t repay the whole outstanding amount on June 1st, then all your subsequent credit card transactions end up accruing interest from day 1 and you might get caught in the vicious cycle of credit card debt!

Should you avail?

It is clear that you will end up paying more if you avail this facility. But, there are some benefits like you get a cash flow relief of 3 months and your non-payment in these 3 months won’t be treated as a default by the bank. Thus it won’t affect your credit score in any manner.

So, you can avail this benefit if and only if you are in any the following conditions:

• If you do not have enough money in your emergency fund

• You are facing a financial burden due to a pay cut, delayed salary, leave without pay, job loss, etc

But if you’re capable of servicing your monthly debt obligations during the crisis, then please continue to do so. In case you are deferring credit card payments as well, then it would be wise to replace the credit card debt with a much cheaper personal loan which would cost you around 10-12% p.a.

Eligibility

This is applicable for all term loans irrespective of the segment or tenor of the loan. But as per the RBI circular offering the moratorium is as per bank’s discretion. So your bank can define certain parameters of eligibility, if any. For availing the moratorium, please get in touch with your bank or check their website for the process to be followed.

Conclusion

So if you are financially capable during to the crisis, then continue repaying your loans. Opt for the moratorium only if you think that your emergency funds are not sufficient or you are under financial stress. To know more about how to build your emergency fund, read our earlier article.