Investing in ETFs or Exchange Traded Funds is way more simpler and convenient on the Paytm Money app.

ETFs are passive funds that are listed on NSE /BSE and traded like regular equity shares. These funds provide you the merits of mutual funds along with the return potential of stocks.

The best part about ETFs lies in it being a relatively low-cost option wherein on account of passive fund management, the fund has a lower expense ratio as opposed to actively managed mutual funds.

When users would invest via smaller amounts, the benefit of compounding coupled with low fund management costs would enable them to boost the portfolio returns.

Read more about ETFs in the articles we have previously published

Let’s Look At Some ETFs Features Paytm Money Offers

Discover Different ETFs

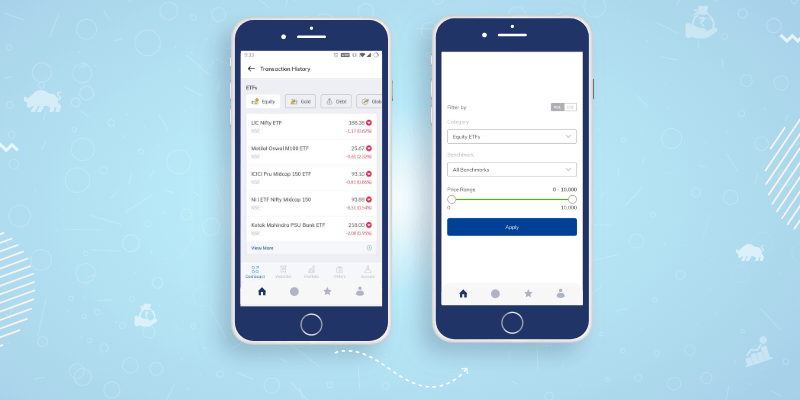

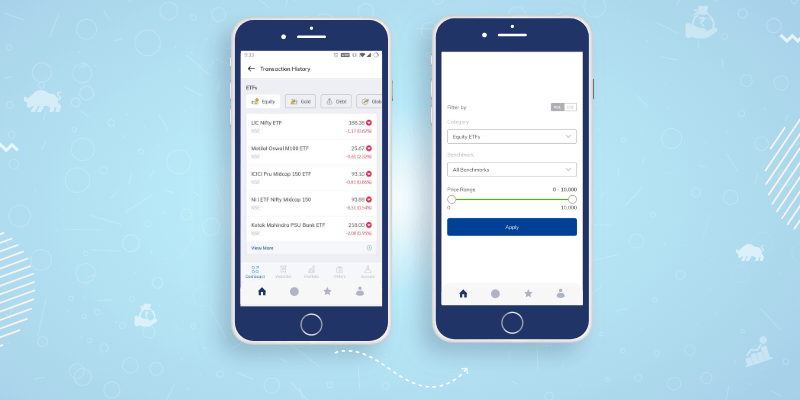

Investors can explore a range of ETFs on the Paytm Money app like Equity ETFs, Debt ETFs, Gold ETFs and International ETFs. Each of the categories has an underlying index, bonds or gold.

What is Underlying?

This denotes the index / price that ETF tracks. When the value of the index changes, ETF tracks the index and changes in-line with that. Few of the underlyings – Nifty 50, Nifty Bank, Sexsex, Nifty IT, Nifty Private Bank, Physical Gold, corporate Bonds, and so on.

You can invest in different categories of ETFs by searching for relevant underlying or categories in the app. ETFs offer diversification of portfolio by offering different ETFs across categories.

Easy Tracking

Tracking ETFs on Paytm Money is simple. Just add ETFs to your watchlist and track the prices on a daily basis.

Setting price alerts for ETFs is easy on Paytm Money app, this way investors will not have to track actively. All you need to do is set a price alert on the app for your favourite ETFs and you would be notified when the target price is reached.

View ETF Fundamentals

You can view important information of the ETF like AUM, Expense Ratio, Tracking Error in the ETF details page along with the historical performance.

Simple Transaction Process

Here’s how you invest in ETFs through Paytm Money app

– Login to your Paytm Money app or website and tap on stocks icon on the home screen

– In the search option, you can search for ETFs with their names

– Once you click on the desired ETF, you can choose the buy or sell option & intraday or delivery option to trade and invest in ETFs.

That’s it! You can buy ETFs like a stock and trade it as well in these three simple steps, for further details you can read commonly asked questions on the app and website.

Invest in ETF via SIP mode

The feature of stock SIP is powered by a choice of weekly or monthly SIP in stocks. On the Paytm Money app if you want to automate buying of a particular ETF or stock you can either choose monthly by picking the date or weekly, where you can select the day. This way you can start SIP by filling in the quantity and day or date for any ETF or stock to automate buying of the stock.

You can start a weekly or monthly SIP given that they are traded on the stock exchanges just like any other stock.

How to setup ETFs SIP on Paytm Money

Search for theETF you want to start SIP with, open the scrip page

In the ETF page, you can see a SIP option below the chart or via in the more menu

Add the number of Quantity and dates or days on which you want the stocks or ETFs to be bought

Click on “Start SIP” and automate your investments in ETFs

Note: Maintain sufficient balance in your trading account so that SIP orders triggered get executed.

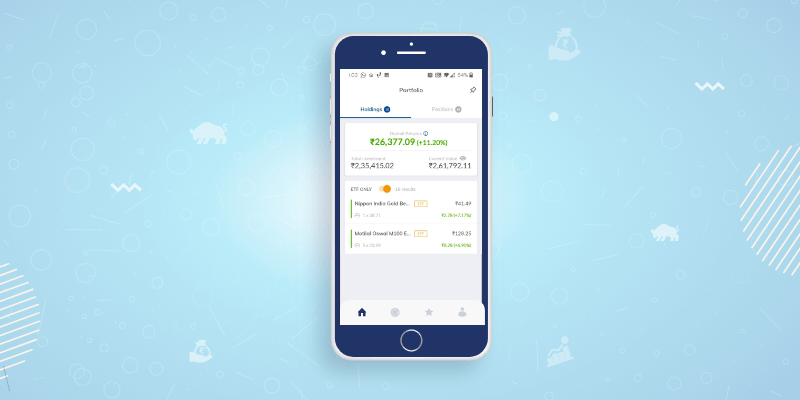

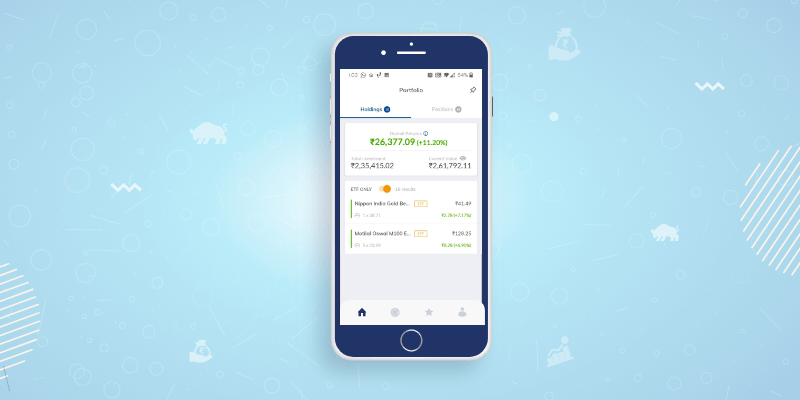

Track your ETF Holdings in Portfolio with Ease

You can track your ETF Holdings within your portfolio with ease. View your ETF holdings by applying the ETF filter available. See the performance of each ETF Holdings and also sort them by Value, Returns etc.

Conclusion

All these unique and ETF custom features make Paytm money one of the best and go-to platforms for ETFs. Paytm Money tech team is relentlessly working to make the Paytm Money app a go-to platform for every Indian when it comes to wealth management.

Disclaimer – “Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Such representations are not indicative of future results.

Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. For complete Terms & Conditions and Disclaimers visit www.paytmmoney.com.”